The Bank of International Settlements (BIS) is a board made up of 60 different central bank heads, that meets bi-monthly in Basel, Switzerland and bizarrely issues reports where they talk about central bankers (ie., themselves) in the third person. Rather like a Monty Python skit where the clerk at one counter pretends they are not the same guy you spoke with at the other. Their latest missive is classic. After two decades of aiding and abetting devastating financial bubbles, they are once more warning see Central banks raise alarm about new crash after steep rise in lending.

Here they are: “keeping interest rates too low for long could raise financial stability and macroeconomic risks further down the road, as debt continues to pile up and risk-taking in financial markets gathers steam.”

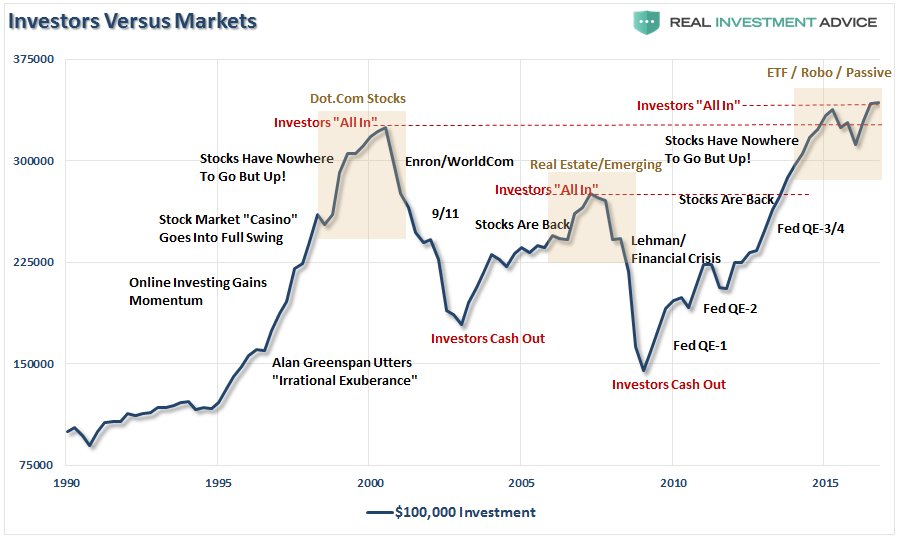

As “risk-taking in financial markets gathers steam”? Hmm. As shown in this chart from Lance Roberts, having just grown back their losses for the second time since 2000, buy and holders are once more ‘fully in’ at a secular peak in valuations with average cash levels less than 5% for most managers, ETFs, mutual funds and Do-it-yourselfers. Convinced once more that this time is different, they will be selling for the exits at the next cycle bottom as they did in the last two. Central banks are the architects of this nightmare on Main Street, and investor lemmings play a leading role in their own demise. Sad story!