U.S. auto sales peaked in 2016 and fell for a fourth consecutive month in June, while sales in Canada hit a fresh record in the the first half of 2017 on an 8.8% increase in light truck sales thanks to (misplaced?) business confidence in construction and oil. Passenger car sales on the other hand, declined 2%. It’s worth noting that passenger sales have been contracting despite unprecedented incentives and give-a ways from dealers.

Consider the below car add from the Financial Post this week. You can lease a brand new 2017 Mazda 3GX in Canada with $1795 down (0n your credit card) and ‘bi-weekly payments’ of $89 for 5 years. What is the actual cost of the vehicle? No one asks.

You can tell dealers are stretching for marginal buyers when they quote bi-weekly payments in case $178 a month sounds too expensive. And therein lies the rub. Everyone who would like to qualify for a car loan/lease has done so, even a couple of times, over the past few years. Now even if auto financing rates could stay at zero forever, there are only so many payments a person can maintain. With more than $2 trillion in outstanding Canadian consumer debt today and flat wages, even using ‘creative’ financing, discretionary consumption had to hit the end of the cash flow tether.

You can tell dealers are stretching for marginal buyers when they quote bi-weekly payments in case $178 a month sounds too expensive. And therein lies the rub. Everyone who would like to qualify for a car loan/lease has done so, even a couple of times, over the past few years. Now even if auto financing rates could stay at zero forever, there are only so many payments a person can maintain. With more than $2 trillion in outstanding Canadian consumer debt today and flat wages, even using ‘creative’ financing, discretionary consumption had to hit the end of the cash flow tether.

Meanwhile internal combustion engine (ICE) auto production is booming. Automotive is now Canada’s largest manufacturing sector, just surpassing fossil fuels. Together these descending products comprise 33% of present Canadian exports (as shown in this table).

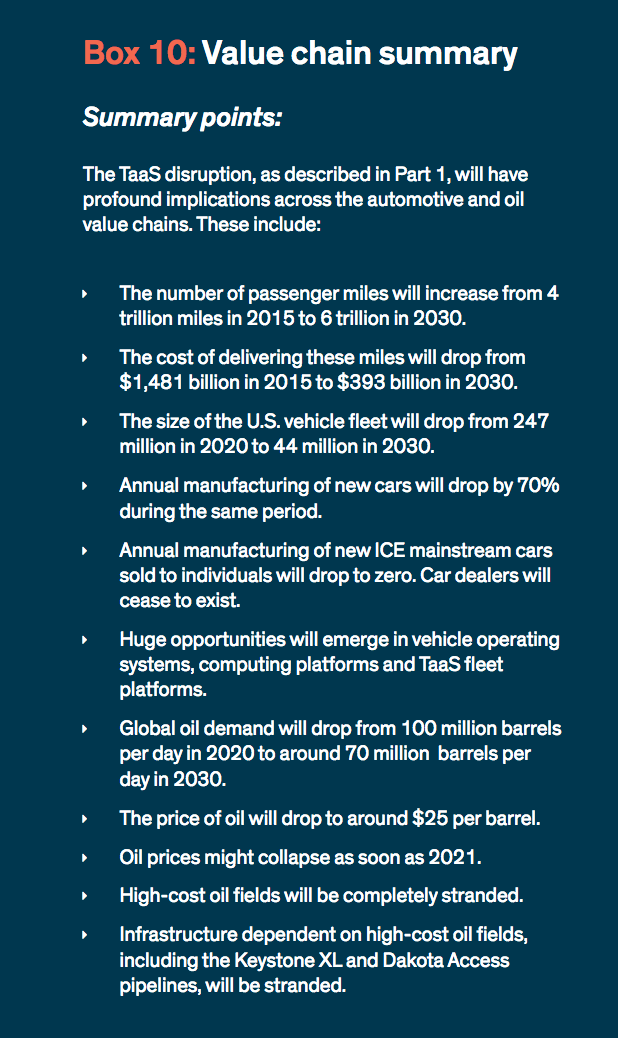

And both are running straight into a wall of massive disruption that will decimate demand, revenue and profits, along with Canada’s GDP and government tax collection. This table on the left from the Rethinking Transportation 2020-2030 report penned by James Arbib and Tony Saba, offers a summary of the accelerating transformation of shared, electric, increasingly autonomous, transportation as a service (Taas) now underway.

And both are running straight into a wall of massive disruption that will decimate demand, revenue and profits, along with Canada’s GDP and government tax collection. This table on the left from the Rethinking Transportation 2020-2030 report penned by James Arbib and Tony Saba, offers a summary of the accelerating transformation of shared, electric, increasingly autonomous, transportation as a service (Taas) now underway.

This is all a critical part of rebooting the world economy toward greater efficiency, less waste, and lower costs to restore financial viability for cash-strapped consumers and governments. There is much good growth, new jobs, and new revenue streams that will come from all of this. But getting from here to there, will be hard on all the countries and economies who are unprepared. Short-sighted planning has made Canada in particular, a poster child for incoming shock and pain.

Everyone should read the whole important report here, see RethinX: Disruption, implications and choices. Perfect summer reading. The quicker we can understand and adapt the better. The more we pretend it isn’t happening, the harder it will be.

This month as Tesla hands over its first 30 all electric Model 3’s (starting at $U 35k), and all the other car companies race to catch up, the truth is they are all running head long into the massive rationalization of shared, electric transportation that will reduce North American vehicle demand by an estimated 80% within the next 13 years and reduce the market price of old tech vehicles, fossil fuel infrastructure and many of today’s related businesses, towards just scrap value.

There is no more time to waste. These massively disrupting trends have to inform everything we chose to do from here.