We have encountered several people in the past year who have been gutting the equity in their homes via mortgages and ‘Home Equity Lines of Credit’ to speculate on other properties and security portfolios. Often they are doing so on the ‘advice’ of their bankers, mortgage brokers, realtors and stockbrokers, financial planners’and even accountants. Others have taken How to get rich seminars with HGTV celebrities like Scott McGillivray (similar to the Trump ‘University’ courses that people were paying thousands to take a few years back). Sales puff designed to profit off the gullible.

All of this great for enriching those collecting fees and commissions on the transactions, and most likely to be financially devastating for those doing the buying and so called investing. It has also set up for the next liquidation sale coming, where present holders become stressed sellers and those with cash can pick up assets for pennies on the dollar. This has been an extra long up cycle, so we should expect the correction phase to be equal and opposite in the other direction. Lots of good insights in this clip.

Scott Terrio, estate administrator at Cooper and Company, joins House Money to discuss the dangers people can get themselves into when usnig HELOCs.Here is a direct video link.

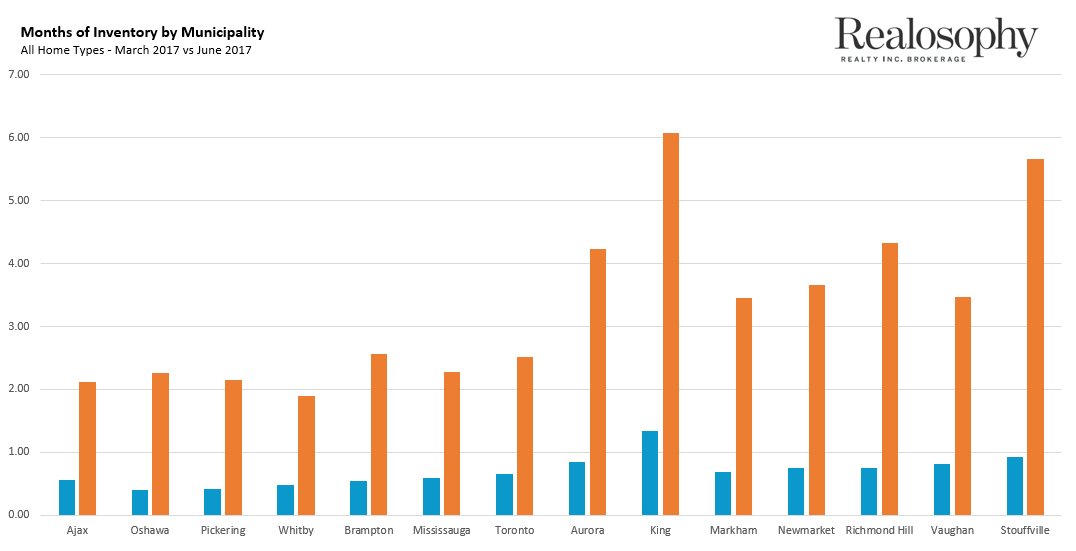

Meanwhile, the policies aimed at curbing rampant speculation in realty markets seem to be taking a hold in Ontario. This chart of months of inventory at the current rate of sales in Greater Toronto Area cities in June (orange) versus March 2017 (blue), offers a glimpse of rapidly changing supply dynamics. What goes up on excessive credit, tends to mean revert just as aggressively. Much more to come.