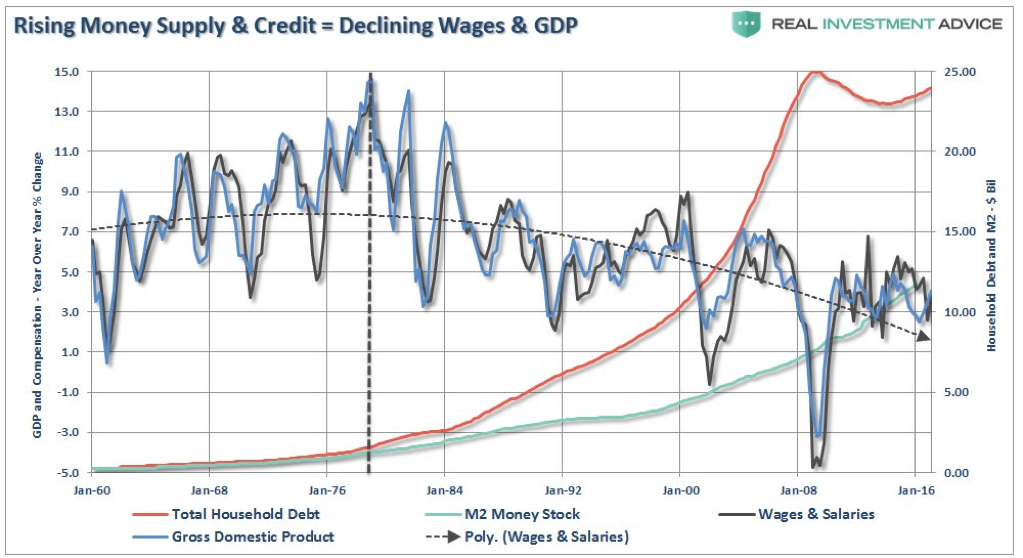

As central banks have pumped trillions of QE liquidity into the financial system since 2008, money supply (green) increased along with household debt (in red), but economic output (blue) has maintained its downward trend along with wages and salaries (black).

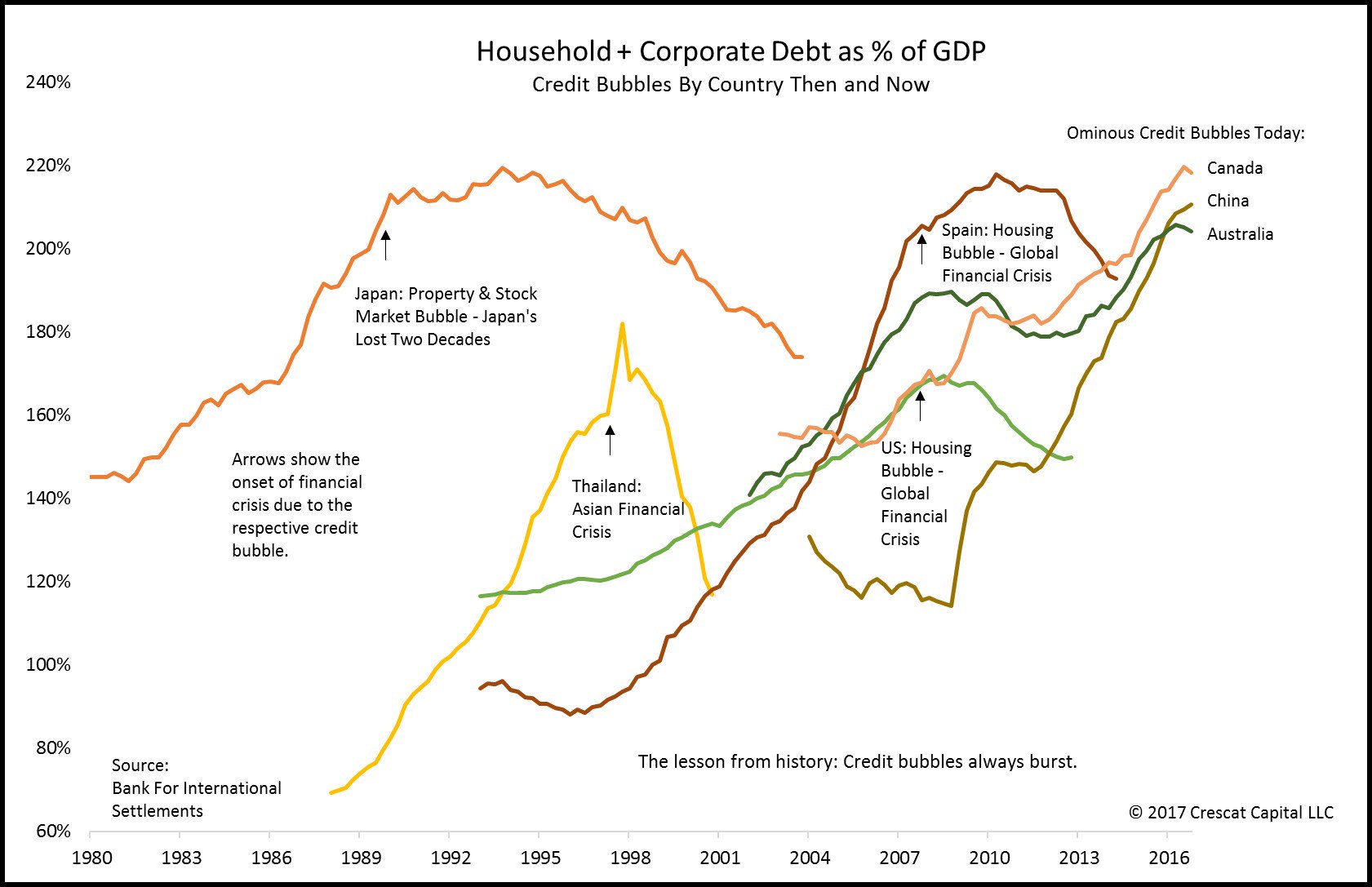

This is a big problem, because credit bubbles have always burst–every one (see chart below)–evaporating the appearance of wealth as asset prices collapse and debts remain.

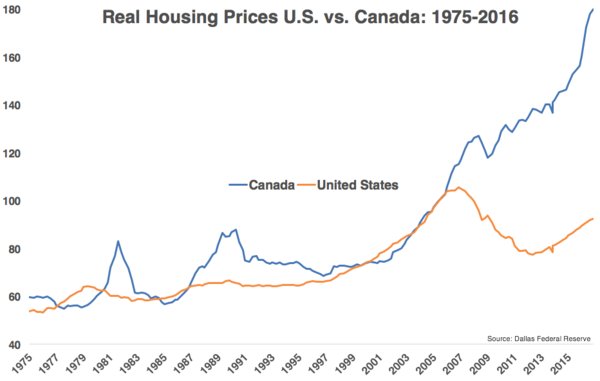

When the Canadian debt bubble is finished mean reverting, this chart showing the relative overshoot in Canadian home prices versus the US since 2008 gives a sense of how far prices are likely to retrace.

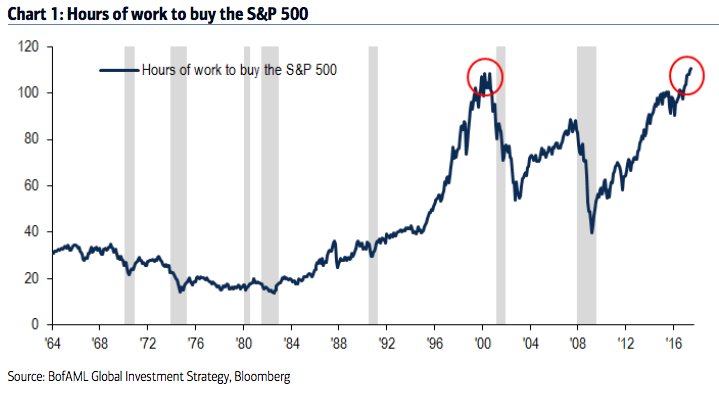

A similar story is told in this chart of the amount of hours of work required at current average wage rates to purchase one share of the US S&P 500 stock index. Today we are at peak price madness, as we were last in 2000.

This is a financial mess of biblical proportions, led and enabled by a reckless, ungoverned financial sector and risk-blind central bankers. The coming repricing cycle will reveal once more the extent of the hubris and harm which has cost humanity so dearly.

Societe Generale’s Albert Edwards has expressed this well in Theft redux: the citizens will soon turn their rage toward central bankers:

Evidence of the impact of monetary madness on assets prices is all around if we care to look…Is it just me or can I hear echoes of the mechanics of the CDO crisis? But no one cares when the party is still raging and investors, drunk with the liquor of loose money, are blind to the inevitable catastrophe that lies ahead.

There is a lot of anger out on the streets, as demonstrated most visibly in recent elections…I am not completely alone in thinking it is the unelected and virtually unaccountable central bankers who are primarily responsible for the poverty of working people and who will be ultimately held to account in the next crisis.