GMO’s James Mortimer and Matt Kadnar have written a great piece breaking down and comparing ‘relative’ value opportunities in risk assets today. Well worth the time for anyone with savings to shepherd through the world’s presently precarious financial markets. See: The S&P 500: Just Say NO.

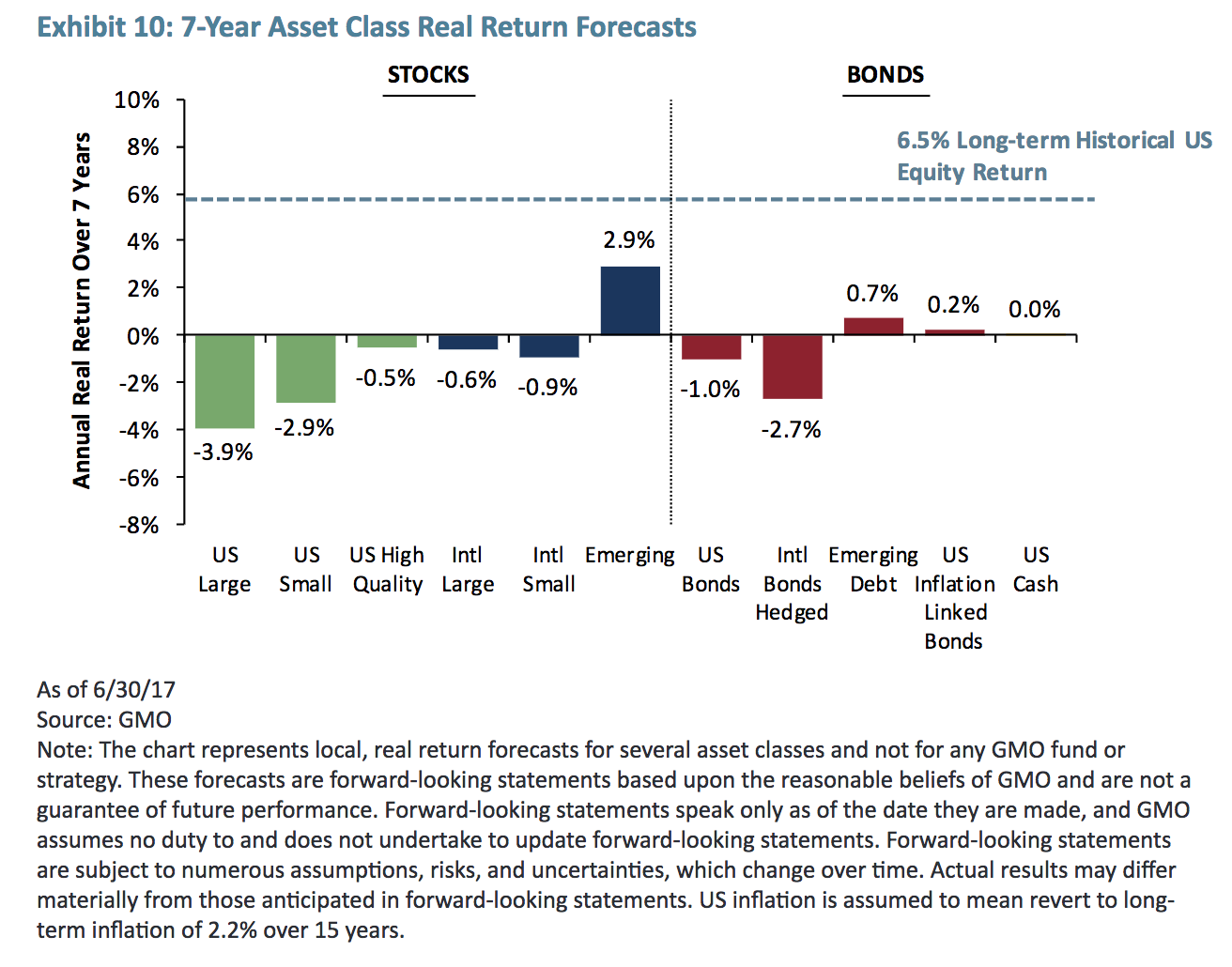

If you’re a manager that must be long risk assets, or an individual with some financially suicidal obsession, their table below shows today’s relative return choice set for different risk assets from current levels over the next 7 years. Math must be faced. No strong picks yet, to say the least.

However for those that have the flexibility and self-discipline to not choose from poison fruit, future returns offer much promise (precisely because this price cycle is so over-extended today) once the next bear market arrives to ‘Make Value Great Again’. Here’s their suggestion:

In absolute terms, the opportunity set is extremely challenging. However, when assets are priced for perfection as they currently are, it takes very little disappointment to lead to significant shifts in the pricing of assets. Hence our advice (and positioning) is to hold significant amounts of dry powder, recalling the immortal advice of Winnie-the-Pooh, “Never underestimate the value of doing nothing”or, if you prefer, remember – when there is nothing to do, do nothing.