In the 1960’s and 70’s my depression-era grandparents helped raise me. Because of their life experiences in the 1920’s and 30’s they had developed a healthy distrust and aversion to the “God damn bankers” as my grandpa used to say. In my own adult and professional experience over the past 30 years, I came to understand this assessment wholeheartedly.

A positive outcome from the mayhem of the 2008 financial crisis and ongoing aftermath, is that young people today seem to have also learned this aversion, and as with the earlier ‘Silent Generation’, the sentiment is likely to stay with them for the rest of their lives. No doubt this will be further ingrained by the next wave of the ongoing global credit crisis, recession and financial bear market. See: Millennial’s distrust of banks is spawning a new breed of start-ups.

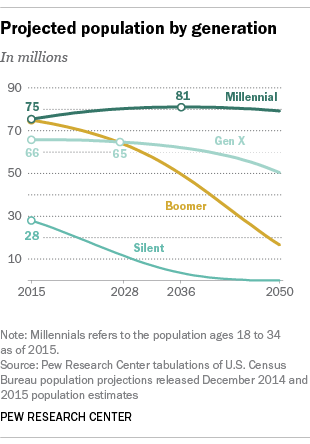

Millennials are those born between 1982 and 1997 (now aged 20 to 35), and according to the latest U.S. Census Bureau, they are now the largest living generation numbering 75.4 million compared with the 74.9 million Baby Boomers born between 1946-64 (now aged 53-70).

Millennials are those born between 1982 and 1997 (now aged 20 to 35), and according to the latest U.S. Census Bureau, they are now the largest living generation numbering 75.4 million compared with the 74.9 million Baby Boomers born between 1946-64 (now aged 53-70).

Right now, most Millennials are struggling with a weak job market, student debts and unaffordable housing costs, but this group is coming into power nonetheless. Their size, sentiment and influence as they come of age will be instrumental in shaping public policy over the next three decades.

As in the 1930’s, a healthy revulsion for financial crimes and offenders will help exert the political pressure necessary to break up the banking conglomerates, ban stock buybacks and other financial gimmicks as illegal market manipulation, and hold individual directing minds accountable for crimes of their institutions. All much needed.