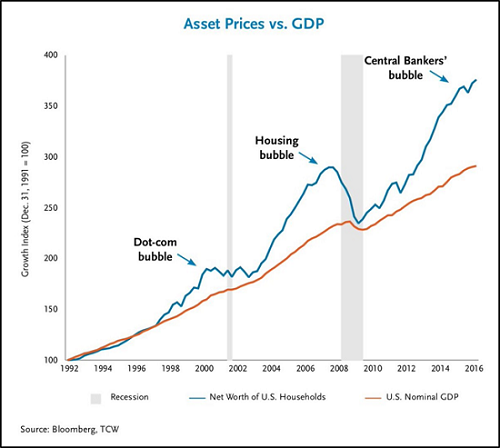

Nine long years of continual monetary injections and we have risk markets and their cheerleaders with a perspective-blurring addiction of unprecedented scope and scale.

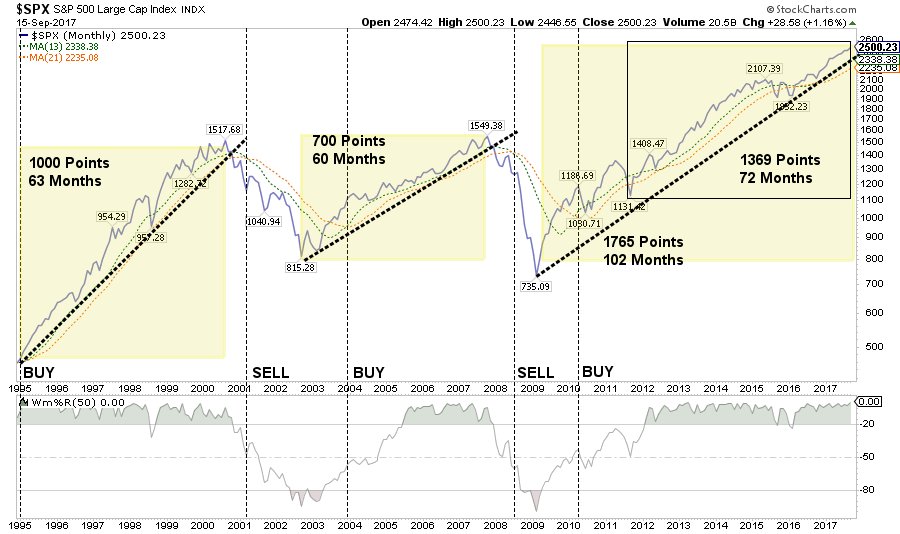

This chart from Lance Roberts captures a relative glimpse of the length and size of the overshoot in the S&P 500 this up cycle (since 2009) as compared with the last two (1995-2000) and (2003-2007). And it says a lot, since the last two up cycles were considered text book financial bubbles for all the ages. Clearly, we have a new winner on our hands this time.

The same participants that were capsized in the last two correction cycles are finally back lovin’ the wave once more, and completely unprepared for what comes next. But that’s the trouble with risk and leverage addictions, the longer they go on, the harder and farther they fall and typically just as the undisciplined masses have gone ‘all in’ once again.

This time, it’s not just stocks, or corporate bonds, or derivatives or real estate that’s precariously valued. It’s everything all at once, all over the world. How awesome is that? You do have to hand it to the expansionary monetary theorists today, they really do know how to pump up the destructive behavior in humans. Congrats indeed.

If only the party could last forever. Alas, it never does. Peter Boockvar reminds today that the times are changing at long last, and the monetary tightening phase (which triggered 10 of the last 13 recessions) is about to embark on a whole new experiment in ‘Quantitative Tightening’. See Fed’s QT is about to start:

If only the party could last forever. Alas, it never does. Peter Boockvar reminds today that the times are changing at long last, and the monetary tightening phase (which triggered 10 of the last 13 recessions) is about to embark on a whole new experiment in ‘Quantitative Tightening’. See Fed’s QT is about to start:

We’re finally here. About nine years after quantitative easing (QE) began, quantitative tightening (QT) is about to start. On Wednesday, after the Federal Open Market Committee releases its statement, Janet Yellen will follow with a press conference that she will do her best to make as boring as possible.

Every Fed member I suppose is praying for boring because of the epic bubbles that QE and seven years of zero interest rate policy (ZIRP) has created in just about everything. They want this to unfold as orderly and as quietly as possible. Wishful thinking I believe…

He offers the modified prose of Paul McCarney for a little humor…

“Yesterday, buying the dip was such an easy game to play. Now I need a place to hide away. Oh, I believe in yesterday.”

Unfortunately, rather than worrying about protecting the capital recovery gifts that have been bestowed during QE, most are now busy cashing out of any remaining safe deposits they may have left and doubling down on the assets that have gone up the most already.

After the third longest economic expansion and biggest global asset boom in world history, now would be a smart time for participants to ask themselves or their long-always broker or advisor: hey, so, what’s the plan now? You do have one right?

(Spoiler alert: the plan is to keep you holding and keep you buying the highest valued, riskiest assets until you lose your shirt and run screaming out of crashing markets once more). One more round trip for the memoirs.