Deutsche Bank strategists are out with a new report stating the obvious: “We’re in a period of very elevated global asset prices – possibly the most elevated in aggregate through history” and there are “a number of areas of the global financial system that look at extreme levels.”

Unless one is in complete denial, and/or paid to keep selling risky, low yielding assets to others at every price–there is simply no denying the clear and present dangers at hand:

“This includes valuations in many asset classes, the incredibly unique size of central bank balance sheets, debt levels, multi-century all-time lows in interest rates and even the level of potentially game changing populist political support around the globe. If there is a crisis relatively soon (within the next 2-3 years), it would be hard to look at these variables and say that there was no way of spotting them.”

The test for every individual at the moment–whether in the financial management and advice business, a client of one, or a do-it-yourselfer–is given the facts before us, what is your response?

For most in the financial business, the answer is keep buying and holding and hope for the best. Very few ever take active steps to seek meaning capital defense, because first it requires proactive, independent thinking, and second it means having the courage to step out of rising markets and look dumb while you wait for lower prices to return, however long that takes.

Even the few who express a bearish view or talk about massive global risks, tend to keep their clients and followers fully invested in the most vulnerable securities as they tumble into bear markets (Seriously, check their performance in 2008 for some insight). The business is set up to collect the highest fees and commissions on the most risky assets and funds, so reducing exposure means a pay cut, and who wants that?

Others have learned that trying to be defensive will get you fired when your ‘performance’ lags others on the upside, even though indiscriminately buying and tracking indices up, means you also track them down. When prices finally do mean revert, clients are most likely to sell at the bottom, fire and look to sue you, their long-always leader.

We each pick our poison. The truth is that investing in publicly traded securities is a devil’s bargain of sorts. No one gets through a full market cycle without regret or periods of frustration. But it’s not a race, it’s a contest of our own personal discipline.

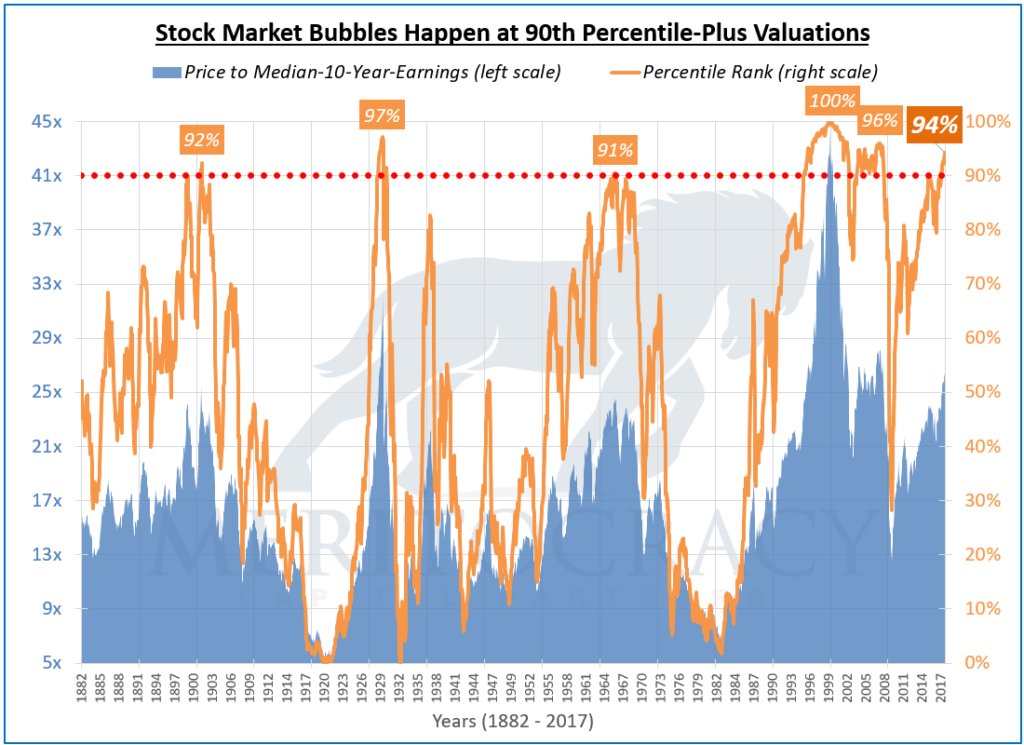

In the end, it’s not what markets do, but what we do in response to each part of the cycle that defines our longer term financial success or failure. Today more than ever in our lives, we should choose very carefully. Also see: Stock Market Bubbles in Perspective.