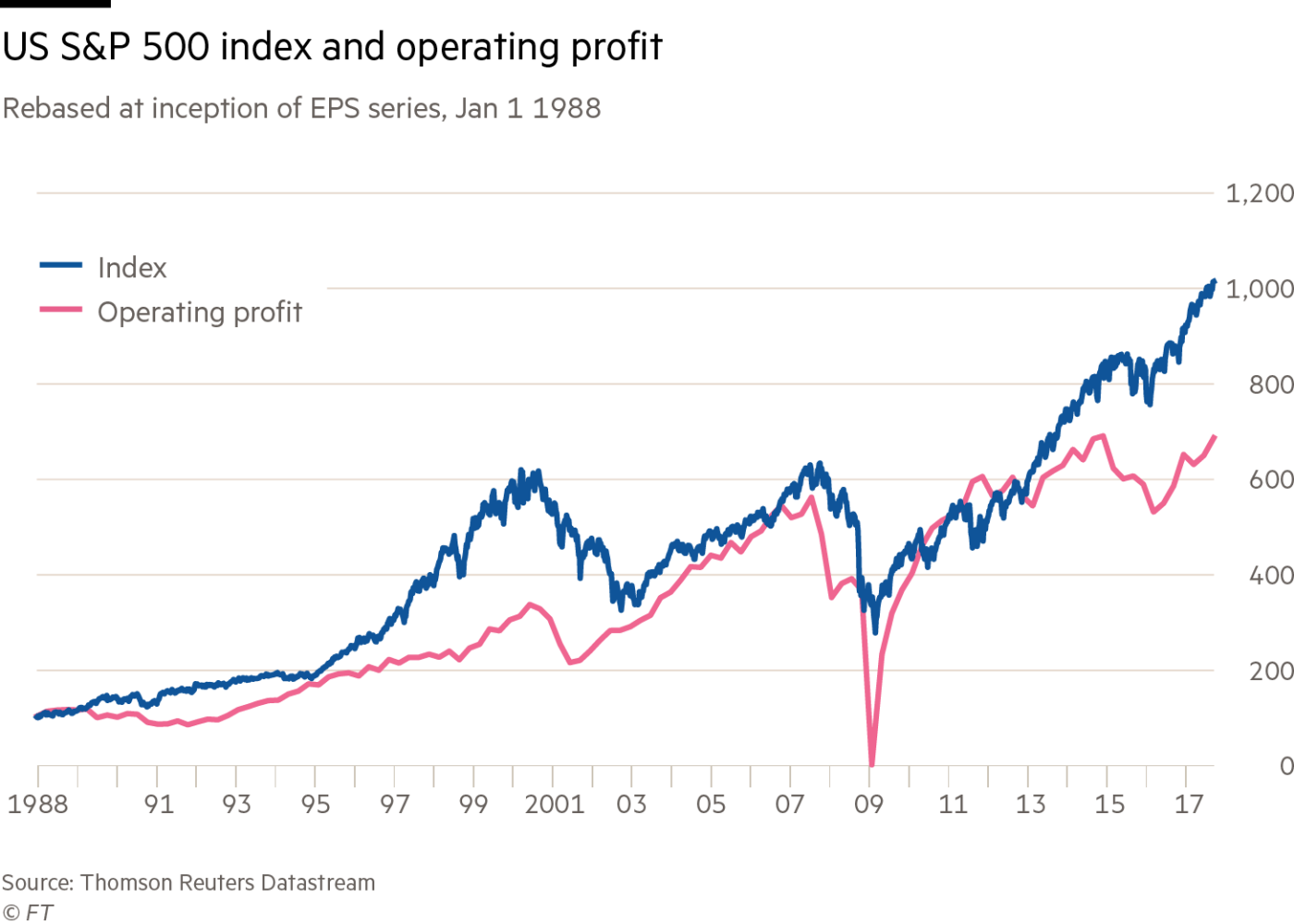

As some dream that lower US corporate taxes will magically save the business/credit cycle from its normal and overdue correction phase and justify stock prices today trading at obscene valuations, the truth, as charted below, is that taxes paid by U.S. companies as a share of their operating profits, is already the lowest since 1947, next to the depths of the 2008 financial crisis. See Blissful Delusion:

“Put simply, it seems misguided to imagine that “tax reform” will somehow make the most obscene speculative bubble in U.S. history something other than the most obscene speculative bubble in U.S. history. Corporations are already enjoying strikingly light tax burdens from a historical perspective, and investors are already paying extreme valuation multiples on elevated earnings.

“Put simply, it seems misguided to imagine that “tax reform” will somehow make the most obscene speculative bubble in U.S. history something other than the most obscene speculative bubble in U.S. history. Corporations are already enjoying strikingly light tax burdens from a historical perspective, and investors are already paying extreme valuation multiples on elevated earnings.

We are observing an episode that will make future investors wince. Just like the two closest analogs, the 1929 high and the tech bubble, I expect that future investors will shake their heads in wonder at the stark raving madness of it all, and ask what Wall Street could possibly have been thinking.”

Comparing S&P 500 stock prices (in blue) with operating profits (before tax of any level–in pink below since 1988), we can see clearly that the third and greatest irrational exuberance episode of the past 20 years, has so overshot any logical connection to operating cash flows here, that only a mean reversion in stock prices can restore rational investment prospects. No, paying even lower taxes won’t make this madness sane. But it will make government deficits even larger. All the less to bail out this mess once the debt bubble bursts again.