Secular bears are born from extended periods of indiscriminate buying and speculation that drive prices paid for securities to irrational multiples of real world items like revenues, cyclically adjusted earnings, tangible assets and wages. And then they mean revert.

Bulls say buying and holding at any price is smart investing, because ‘over the long-run’ market cycles spend more time and points going up than down. This misses the math of the matter utterly.

It is not the duration of the upcycle that is definitive of net returns, but rather exposure to the intermittent loss cycles.

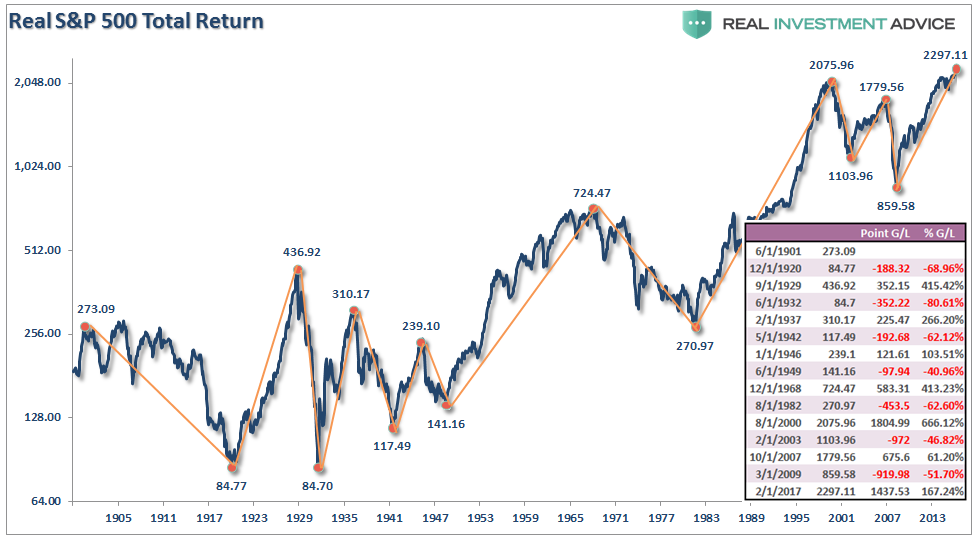

The inset table on the far right of the below chart from Lance Roberts shows the bull and bear periods for the S&P 500 since 1900–both in terms of index points and the percentage gained and lost each time. As shown in the chart itself, the shorter recurring bear cycles take back most and sometimes all of the real gains clocked during the longer bull upcycle.

In addition, and most importantly, since bull markets increase confidence and risk-taking as they go, capital tends to get pushed in most near tops and least near bottoms, making the cyclical mean reversion periods much more capital destructive than even this chart would suggest.

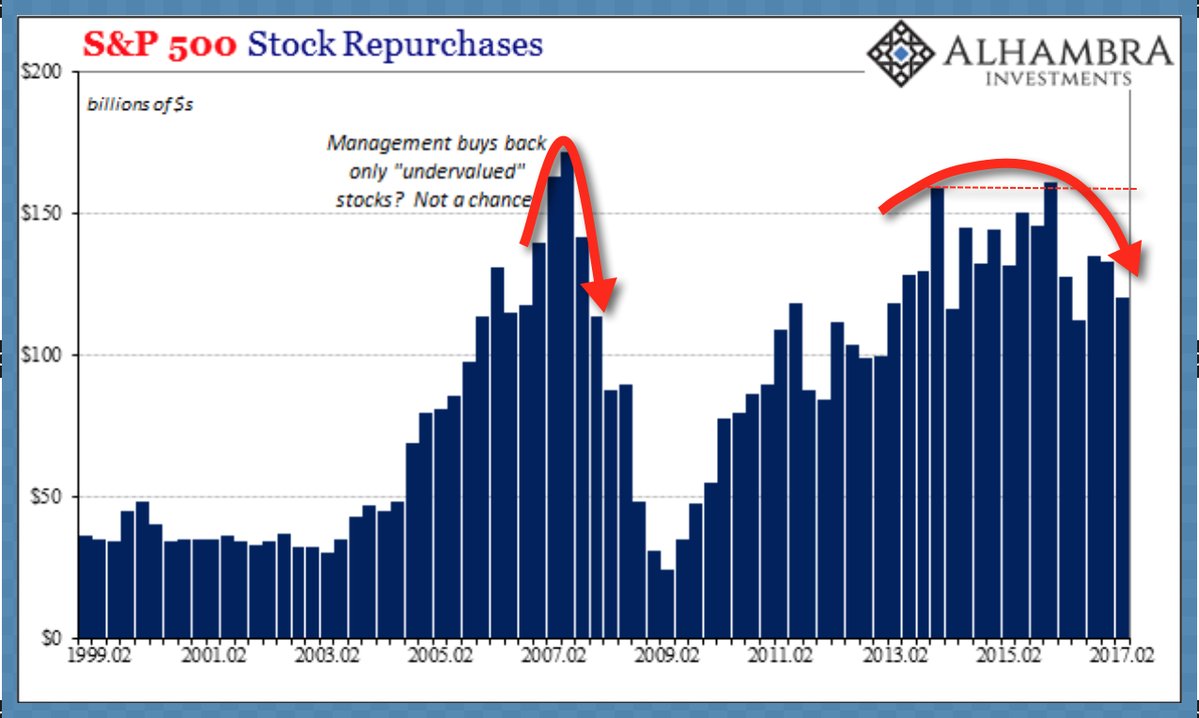

The same goes for corporate management teams and their so called “active” shareholders, that infamously waste good money buying back badly over-valued stocks each market peak, as shown here since 1999.

As people amass more and more of their life savings, and have less and less time to grow back losses, the extent to which they are protected from the downcycles becomes the most defining element of real life investment outcomes. This is especially the case during secular bear periods, where the recurring cyclical declines tend to be twice as deep and long as during periods starting from low valuations (ie., secular bulls like 1982-2000).

Yes, the current upcycle is one of the 3rd longest in market history in terms of years, but a decline of 50% from here would still wipe out all the apparent capital gains since about 1996. And given the extremity of present valuations, holders will be lucky if they ‘just lose half’ this time.

The long-always crowd can mock risk-conscious managers all they like, but mean-reversion and the math of loss rule secular bears, and hubristic hares and those following their advice, don’t win over full market cycles.

“Reality is that which, when you stop believing in it, doesn’t go away.” ― Philip K. Dick, author