A realtor friend was telling me this morning, that they attended an industry conference yesterday where the speakers were explaining why tighter mortgage rules in January (that are set to reduce buying power by about 20%), are unlikely to hurt sales or prices. Hmmmm. Of course, price declines are always ‘unexpected’ in markets populated by sales experts and gullible, greedy ‘investors’. And so it goes…

A Richmond Hill woman is among a segment of Canadian homeowners hit hard by a decline in the residential market. As Sean O’Shea reports, the problem occurs when someone buys one home before selling the one they’re in. Here is a direct video link.

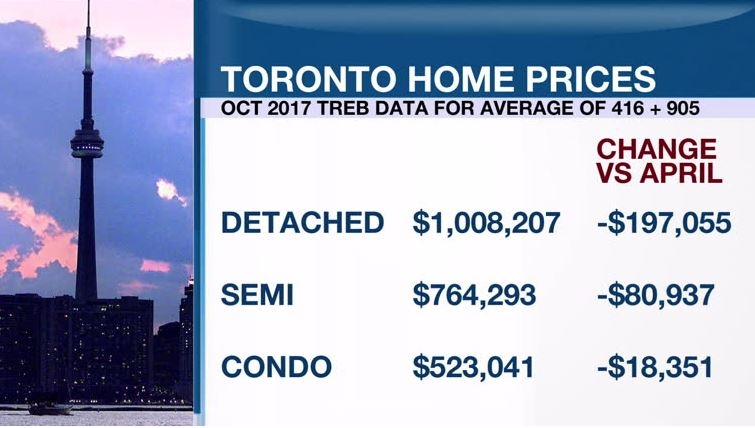

This morning we learn that in October Greater Toronto Area sales volumes were down 26% year over year, with new listings up 78% and detached prices off 15-20% across most of the GTA since last March. Here is a direct video link. Who could’ve seen this coming, right?

Sales were down across all segments of the market, with the biggest decline (29.8 per cent) registered among detached homes.

The overall average selling price last month in Canada’s largest housing market was $780,104. That was a modest increase year-over-year, but still 15 per cent below the April peak of $920,791.