This year marks the ninth year of the expansion cycle that began in 2009, the second longest in recorded history, and an ominous 31-year high in investor confidence. Free-to-cheat-and-steal-financial intermediaries, greased by ludicrous liquidity gifts from central banks, have had a hell-of-a run–the past 5 years, in particular. Monetary conditions have never been more easy, volatility never lower; and genius never easier to feign.

Right on cue, a survey released by PricewaterhouseCoopers at the world economic forum in Davos, Switzerland this week, notes that booming stock markets and the best global economic growth in seven years are also fueling record levels of optimism among corporate executives today.

For mere mortals, rightly focused on self-preservation first, there are some hints to be had here: the consensus (including Davos-attending gurus) are more bullish today than at the 2007 cycle peak, right before financial markets last collapsed and the global economy followed.

Still, listening among the talking points, there are some useful insights to glean from Davos speakers. In the below interview, Canada Pension Plan CEO Mark Machin offers some worthwhile nuggets.

Mark Machin, president and chief executive officer of Canada Pension Plan Investment Board, discusses asset-price returns, inflation and emerging markets. He speaks with Bloomberg’s Erik Schatzker at the World Economic Forum’s annual meeting in Davos, Switzerland. Here is a direct video link.

The following are some key points Machin makes in this interview that should not be overlooked (along with my comments in brackets):

-

- (Unlike individuals with finite life spans), the $263 billion CPP fund (other pensions and conventional managers) assume a “super-long term, literally over a 75-year time frame… a quarter for us is considered 25 years not 3 months.“

- CPPIB selects their global equity exposure not in terms of expected returns over the next 5 years, but on a constantly allocated basis that is 74% to equities, roughly in proportion to a region or country’s contribution to global GDP, ie, the US is 40% of global GDP and their largest exposure, Emerging Market is 15% presently, 5% in China.

- The fund holds 25% in government bonds (he does not explain here that to make payouts, pension funds–and investment accounts–need to match future withdrawal needs with guaranteed funds coming due over the next 10+ years. There are prudent reasons to hold an allocation to least risky instruments, even where yields are low).

- If interest rates were to rise steadily, government bonds would sell off on an interim basis (interim, because the bonds still mature at face value, unlike equity-based securities which have no maturity date or legally prescribed income payments whatsoever).

- Moreover Machin mentions that, if government bonds sell off on rising rates, other interest sensitive sectors (like real estate, infrastructure, utilities, financial and preferred shares), will sell off even more (their dividends make them interest sensitive and they have no guaranteed payments or maturity dates. You can see my partner Cory Venable’s chart of financial darling TD Bank shares here for some reference. Equity-based securities and corporate bonds also typically sell-off when the economy weakens and defaults spike, whereas government bonds tend to rise on safe haven inflows during financial market stress.)

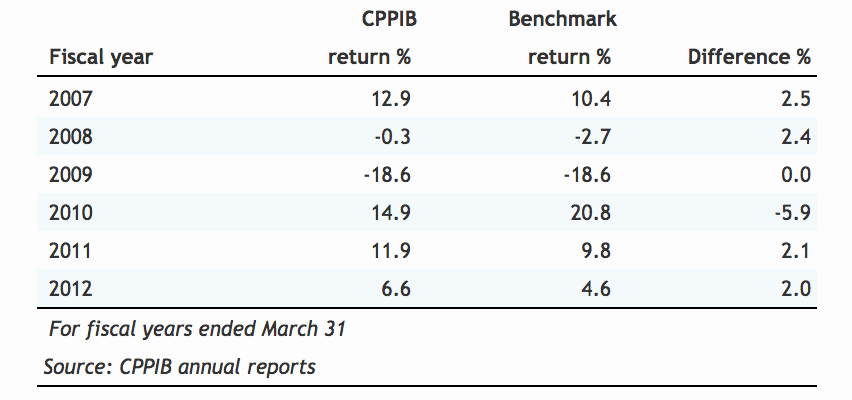

As shown in the below table of CPPIB year end results between 2007 and 2013 which are considered excellent by institutional standards, after increasing 12.9% in 2007, the fund lost about 19% of its value during the 2008-09 downturn before rebounding again 2010.

What is not clear without doing net return calculations, is that the 2008-09 loss rendered the fund’s 3-year return between the end of 2006 and the end of 2009 to -2.88% a year, their 4-year return rate to the end of 2010 to 1.28% a year and their 5-year return to the end of 2011 to 3.33% a year. Most individual investors would have bailed after the 2008-09 losses, or after the poor three and four year results, and not been there to benefit from the rebound since. That’s reality.

Unlike individual investors, the fund also enjoys monthly inflows equivalent to 9.8% annual contributions in good markets and bad, and no risk of panicked redemption demands after market declines–regular payouts are prescribed and capital withdrawals are not. In other words, the CPP fund operates in a dreamworld, while most mutual funds, ETFs and money managers live in a reality where investors jump in and out of their portfolios at the most inopportune and capital-damaging times. Thus, in real-life, useful managers cannot afford to be passive, and have to be focused on minimizing capital losses above all else if they are to get clients through a full market cycle (trough to trough) with net benefit.

While the CPP fund, and others who are long-always equity markets, have enjoyed some double digit returns again over the last 5-years, Machin admits that we are now late cycle once more (like 2007). This means there is little diversity benefit to be found in holding different overvalued risk assets; and another period of give back is due. He offers this key observation:

“Markets are getting quite stretched…given where asset prices have run to now…asset returns are likely to be quite depressed over the next few years… if you look at performance in late cycle, most things don’t perform that well in late cycle”.