One of the most damaging presumptions of mainstream portfolio theory posits that there is downside protection against market sell-offs in holding an assortment of different stock and corporate bond issuers, products, sectors and countries. There is not. This week’s decline reinforces the point again.

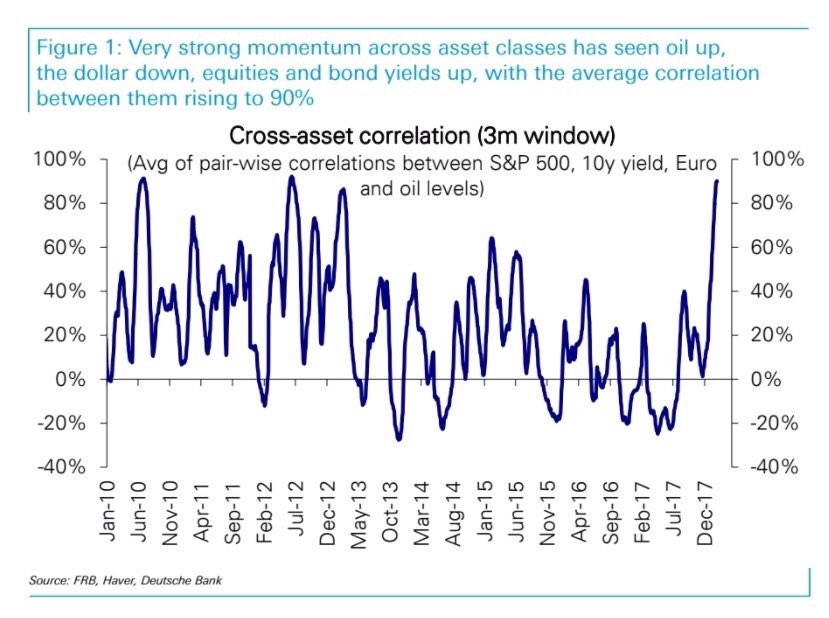

In a world of highly interconnected intermediaries, derivatives, credit flows and group think, cross-asset correlations were a positive 90% in the 2017 rally (see chart below). This made the riskiest assets look genius and the safest most liquid ones look dumb.

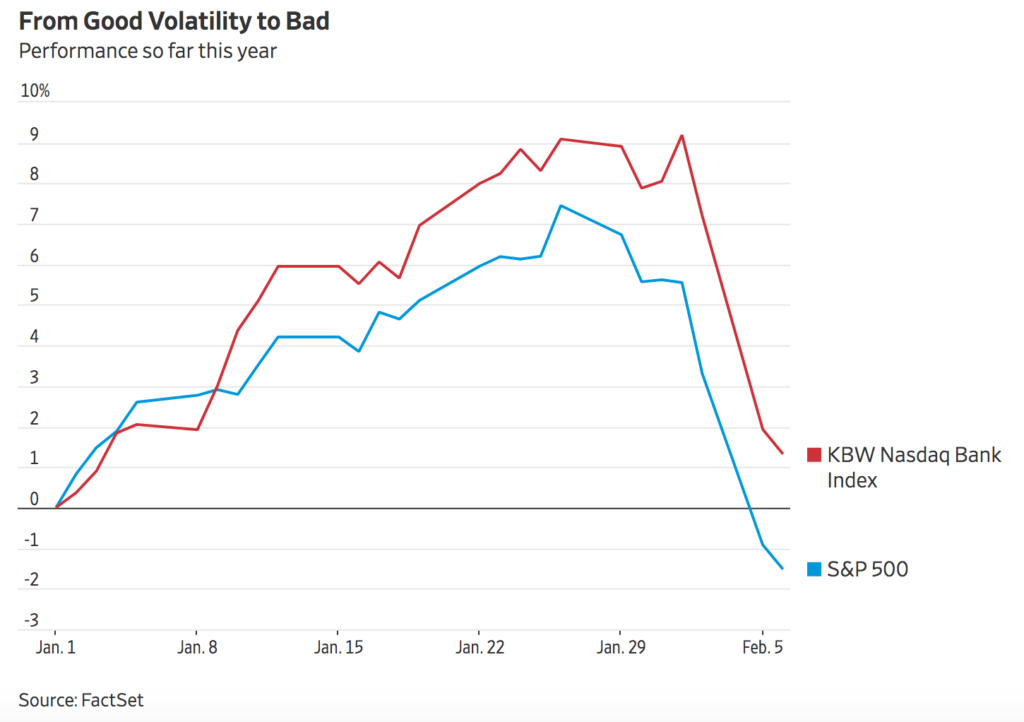

But now in the past few days, we are seeing the reverse–treasuries and the greenback are bid, while other assets and currencies are falling, worldwide. Moreover, dividend paying stocks like utilities and banks are dumping along for the ride. No, they are not capital ‘defensive’ in any meaningful way–never have been. This chart of the KBW bank index (red) and S&P 500 (blue) makes the point crystal clear. Have a look at their charts in 2000-02 and 2007-09 for further clarity.

Make no mistake, a bear market, where a world of over-valued risk assets lose more than 20% of their value all at once, is long overdue. And markets that escalated quickly on leverage take elevators down, none of this should be surprising anyone.

Whether the last few days are finally the start of the next lengthy mean reversion period or just another interim head fake, is too early to tell. But either way, now is another excellent opportunity to review the way in which your present holdings are responding in the sell-off, are any maintaining their value or going up, while the rest are going down? If not, how will you feel when all of these holdings are down 20% + all at the same time and then take years to recover?

It’s not too late to reduce your capital loss exposure. Being proactive and doing so before much bigger losses hit is wise, whether markets rebound for a while longer here or not.