On the way back to academic pastures this week, outgoing FOMC Chair Janet Yellen got nearly candid to reporters about the asset prices which she and her colleagues have maniacally contrived to inflate over the past 8 years:

“Well, I don’t want to say too high. But I do want to say high. Price-earnings ratios are near the high end of their historical ranges. Commercial real estate prices are now quite high relative to rents. Now, is that a bubble or is it too high? And there it’s very hard to tell. But it is a source of some concern that asset valuations are so high.” —CBS interview, February 4, 2018

‘Damn it Janet’, you well know that overvaluing assets and enabling reckless and illegal activities to enrich banks, has been the number one goal of central banks, all around the world, for years now. That was the whole point. Good job; except that now we have the longer term costs to deal with, and no one, least of all central bankers, are about to admit responsibility for what’s coming next.

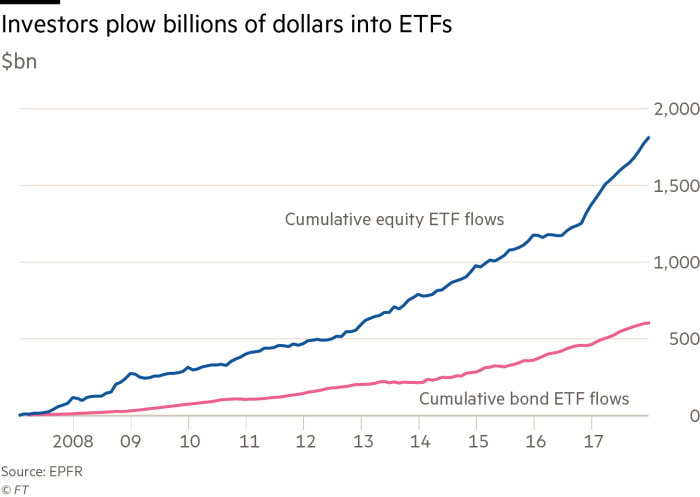

Trillions in liquidity from central bank fire hoses has pooled into long-always products like mutual funds and Exchange Traded Funds (as charted beside)–all on a one way impossible bet for endlessly lower volatility and ever higher prices.

Trillions in liquidity from central bank fire hoses has pooled into long-always products like mutual funds and Exchange Traded Funds (as charted beside)–all on a one way impossible bet for endlessly lower volatility and ever higher prices.

Mindlessly benchmarked to these same long-always indexes, pensions and so called ‘active managers’ have followed suit, indiscriminately funneling capital into risky assets hand over fist. No one has been doing (or admitting?) math on longer-term risk-adjusted investment return prospects, that have been increasingly dismal, since 2012.

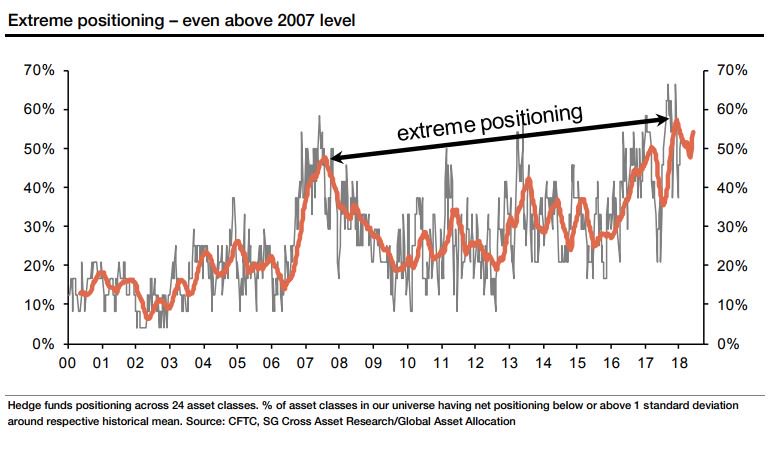

So called ‘hedge funds’ have been racing to keep up, terrified to miss out on any upside risk, for fear of losing clients and their fees. Hedge funds? What are you hedging when you’re 100% levered long? Today these ‘hubris’ funds are even more risk-exposed than heading into the 2007 financial implosion (as shown here).

Smooth sailing doesn’t build good sailors and years of easy money has made inept financial managers. Just like central bankers, the ‘high frequency traders’, beta takers and algorithm runners who have made off like bandits in recent years, have fallen in love with their genius and asleep at the switch. While they, like politicians, take credit for gains on a rising tide, they blame the machines when liquidity inevitably evaporates and losses hit. See this week: A down day on the markets? Analysts say blame the machines.

Financial memories are suicidally short at the best of times. But in a financial sector dominated by salespeople and commentators under the age of 40, who are paid to funnel money into markets–and have so far amassed little net worth of their own to lose–loss cycles are not an inkling. They will say they had no idea this could happen, after the fall. Is Wall Street’s untested millennial majority a risk? You bet:

“…most millennial investors have only worked in an era where central banks printed trillions of dollars to prop up their economies and markets. Since starting their careers, average interest rates in the developed world have barely nudged above 1 percent, inflation all but vanished, the S&P 500 Index more than doubled and bonds rallied so high that more than $7 trillion of debt is negative yielding.”

Followers and believers beware, protecting your life savings is all on you.