It’s hard to be hyperbolic about the present level of equity valuations. Suffice to acknowledge: the overpricing today is more extreme and pervasive than at the tech fueled market top in 2000. This suggests the correction phase coming should also be wider and deeper, just as many holders are 18 years older, and savings and pension deficits much larger than in 2000–and that’s even before the next wave of capital losses hit.

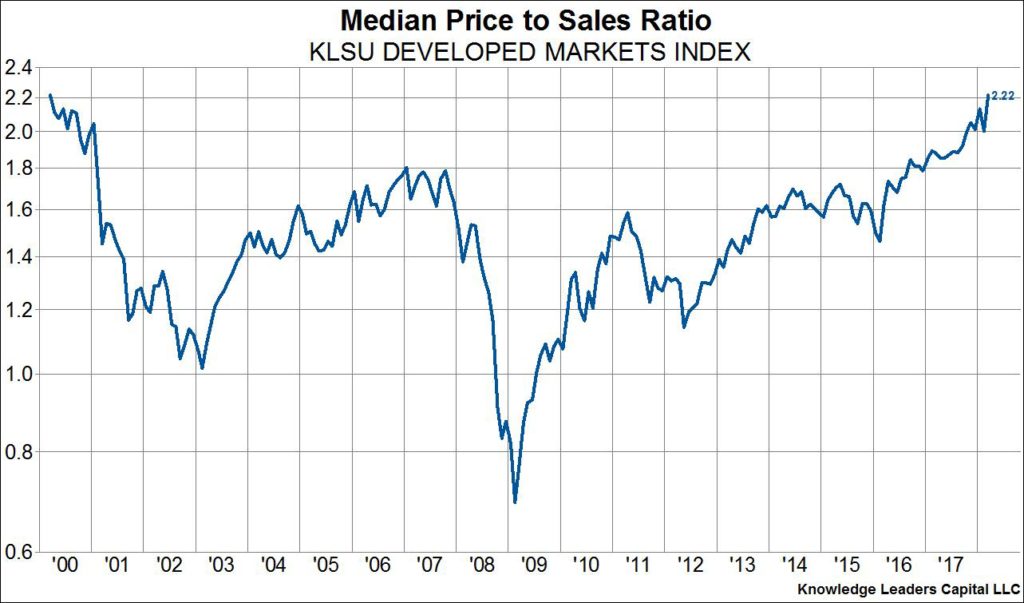

We are wise to face facts and govern our finances accordingly, while making ready for the asset liquidation sale coming. See: Unchartered territory for stock valuations:

“…The median company in our developed world index (which covers the top 85% of companies in each country) just achieved a price to sales ratio that eclipsed the 2000 peak…What’s more, unlike in 2000 when the median valuation was driven higher primarily by tech stocks, leaving plenty of “value” areas to flock to, valuations today are extended across the board, from staples, to industrials to tech to materials.”