Continuing to take risk measurements and pay attention to what’s under investment marketing wrappers is key to protecting and growing capital over full market cycles. But it takes discipline and constant attention, so most people don’t do it. Therein lies the downfall of the masses, and the opportunity inherent for the few who do. This extreme cycle is one for the history books.

Amazon is a top holding in over 140 exchange-traded funds. A liquidity event for Amazon shares — perhaps triggered by issues related to the Trump administration’s ordered review of the company’s impact on the U.S. Postal Service — would create uncontrollable selling, in our view.

Zooming in further, around 40 ETFs hold Amazon within the top 5 percent. Look out below: This is a colossal failure of common sense.

Investors have been stuffing themselves on a Thanksgiving feast full of technology stocks. Today, tech sector equities comprise nearly 30 percent of all large-cap mutual fund portfolios; this is an accident waiting to happen.

See: Why Amazon could be the next black swan for the market.

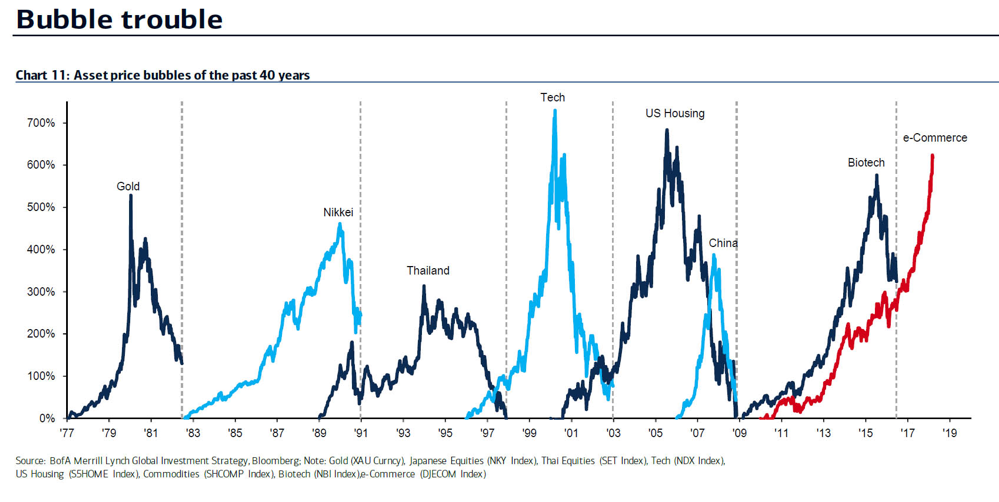

The most recent ‘e-commerce bubble’ ranks with technology shares in 2000 and US homes in 2006 as the three largest asset bubbles in the last century. As charted below since 1977, all such previous bubbles were followed by bust cycles that saw prices fall an average of 60 to 80% and take many years thereafter to recover.