There’s now just a .13 yield bump to buy a 30-year over a 10-year treasury bond, and short term treasuries 3 months and out are yielding more than S&P 500 stocks with their 30-year+ duration and huge principal risk. Capital is finally being paid to come in the risk curve, look out below.

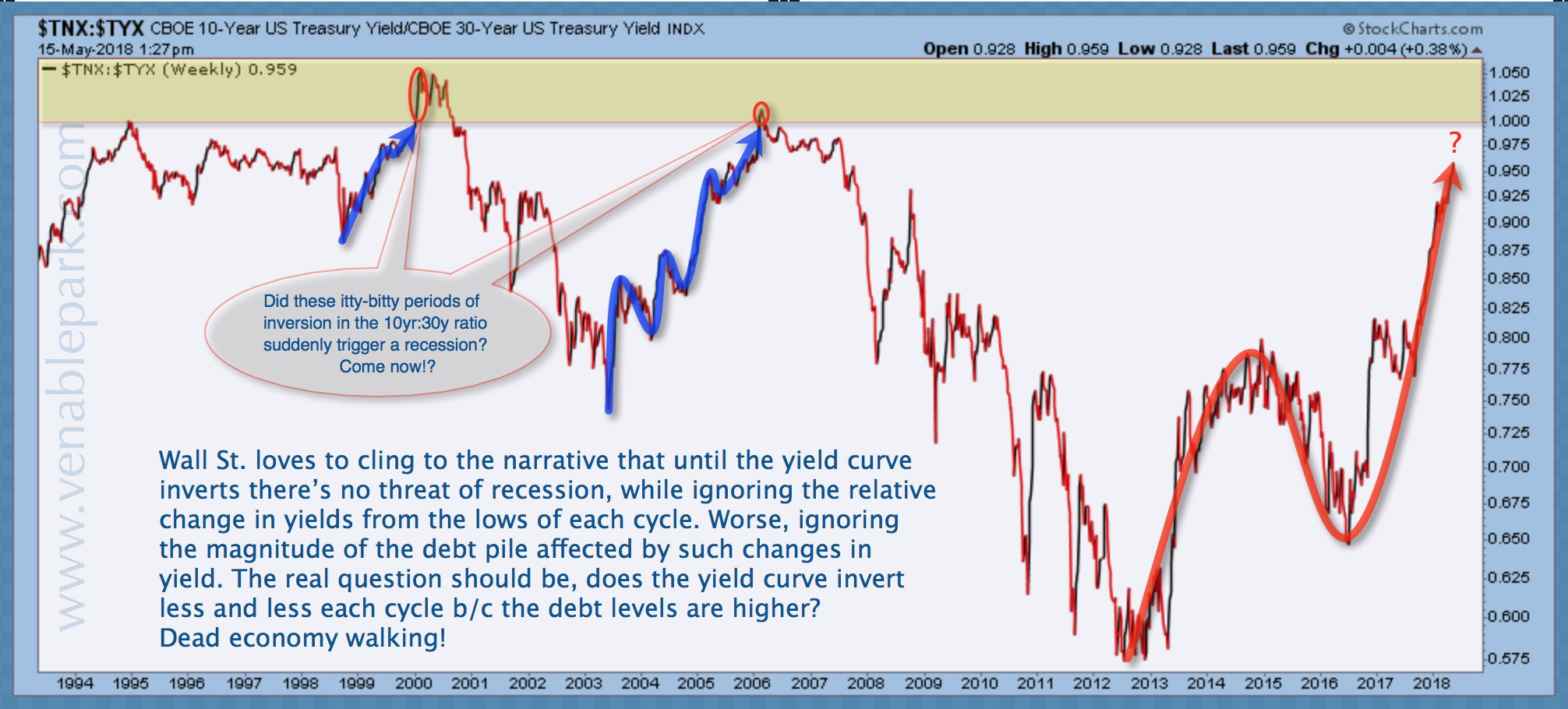

Here is my partner Cory Venable’s spread chart showing the much smaller relative tightening that triggered asset bubble bursts and the 2001 and 2008 recessions.