Those saying that the recent rise in interest rates is still inconsequential because relative rates remain below historic averages, are ignoring that debt service costs are a function of rate and the amount of debt outstanding. With record debt at every level in pretty much every country today–consumers, corporations and governments–every rise in rates equates to a significant increase in debt service costs and less discretionary cash flows for other spending, saving and investment.

and the amount of debt outstanding. With record debt at every level in pretty much every country today–consumers, corporations and governments–every rise in rates equates to a significant increase in debt service costs and less discretionary cash flows for other spending, saving and investment.

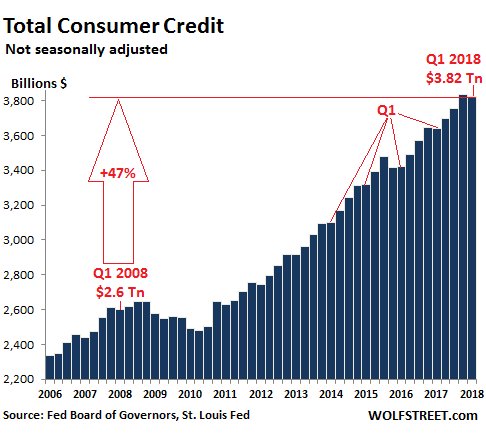

Pretending otherwise is whistling past economic graveyards. The chart beside shows the 47% increase in just US consumer credit over the last decade. Doug Kass explains this math below.

Doug Kass, president and founder of Seabreeze Partners, discusses a “new regime of market volatility” and the impact of the rising 10-year yield. Here is a direct video link.