Torrents of foreign capital seeking land banks in the west, misguided government policies that encourage real estate speculation, the lowest interest rates in centuries, excessive credit abuse enabled by central banks, debt securitization and yield-desperate, price indiscriminate funds buying everything in sight–all these factors served to temporarily hyper-inflate realty and security prices into 2017. Now these same forces are moving in the other direction–all together, even while many realtors and builders are working to keep up bullish appearances. See Recycled listings around Vancouver obscure a major market correction.

While it is a common fantasy that affluent people always buy and never need to sell their properties, history does not agree. This is especially the case in today’s highly interconnected, debt-soaked economies and markets.

CNBC’s Robert Frank (who reports in the clip below) is the author of the must-read book The High-Beta Rich (2011) which brilliantly illuminates on the global interconnections at work here.

CNBC’s Robert Frank reports on how New York City real estate fared in the second quarter of 2018. Here is a direct video link.

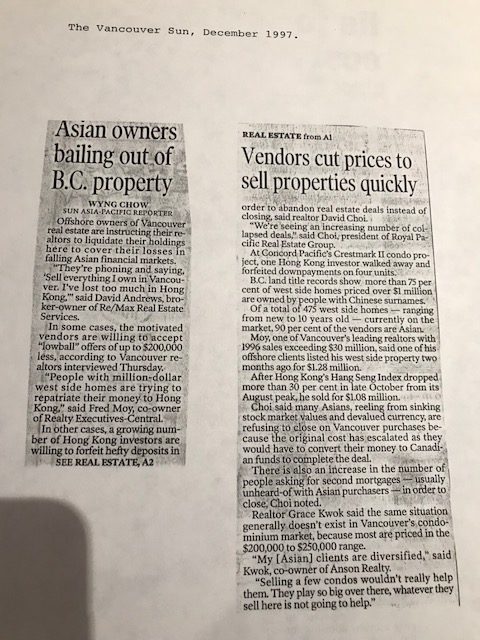

Thanks to a reader who, this week, sent me the below snapshot of a December 1997, Vancouver Sun article, reminding of the forced selling wave that hit Vancouver realty during the Asian liquidity crunch of 1997-98. This was the same butterfly flapping its wings in Asia, that brought down the ‘genius’ Long Term Capital Management funds and shook Wall Street in 1998. A synchronous liquidity crunch across many highly levered economies and asset markets in the months ahead, is likely to hit harder and last longer than previous cycles in memory. We’ve been amply warned about how these cycles go.