Thanks to liquidity-pumping central banks, the globe-driving US economy is now in the 109th month of expansion without recession–second in history only to the unprecedented 120 months of expansion between March 1991 and March 2001.

Surely after this unbelievable period of emergency support, and unusual luck, the world has saved up enough rainy day funds to help buffer the next downturn or crisis, now overdue?

Nope, savings deficits have reached record highs as real wage growth has continued to fall (below since 2015) and the world is servicing the highest debt levels in human history. What financial progress?

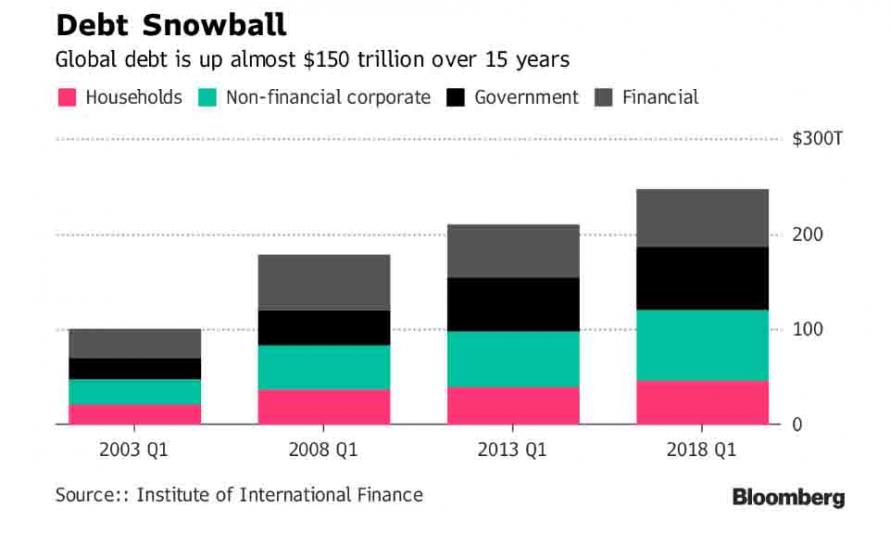

The Institute of International Finance published its latest quarterly update (link here) on the amount of global debt. As at March 31 st, the total climbed $8 trillion to a new all-time high of $247 trillion (1/4 of a quadrillion!) and up $30 trillion from the end of 2016. Non-financial corporate and household debt have reached record highs in Canada, France and Switzerland.

Now at 318% of global GDP, debt has risen globally in every sector: non-financial corporate debt: $74 trillion, up from $58 trillion in 5 years; government debt: $67 trillion, up from $56 trillion; financial debt: $61 trillion, up from $56 trillion; household debt: $47 trillion, up from $40 trillion. Here is there chart, courtesy of Bloomberg.

Spending obligations for an aged but long-living population have continued to mount even as tax revenues has been falling for the past couple of years already. This is no way to prepare for an inevitable downturn. If the plan is hoping that no downturn or bear market comes, a new plan is needed. See Many states are likely unprepared for next downturn:

State revenues have been held back by sluggish wage growth and by changes in people’s consumption patterns. Households are shifting spending away from brick-and-mortar stores, which collect state sales taxes, to shopping online, which until recently largely escaped those taxes…And some states, such as Kansas or Oklahoma cut taxes during the expansion, slowing revenue growth.

An aging population is also putting pressure on state Medicaid budgets and pension funds. State pension contributions were 78% higher in 2017 than in 2010, according to census data. And state Medicaid payments were 59% higher in 2016 than in 2010, according to the Centers for Medicare and Medicaid Services.