A useful piece with some illuminating charts from Jesse Colombo this week, read US stocks are in a bubble. This comment on passive investing is the critical point that long-always advocates recklessly ignore:

The proponents of passive investing point out that the passive approach is much cheaper than the active approach in terms of management fees, brokerage commissions, and other costs.

They also posit that few active investment managers consistently beat the major stock indices over the long run, so investors are better off holding index funds or ETFs. While the proponents of passive investing make some valid points, they are ignoring a glaring risk of their approach:they never sell out of the market, even when it is extremely overvalued as it is currently.

This issue should not be taken lightly because…it takes an average of twenty-two years for investors just to break even if they start investing at high valuations like we have today. Twenty-two years is a very high percentage of the time most investors have to build up a retirement fund, which is usually a few decades at most. Investing in stocks at the wrong time can completely ruin one’s retirement plans.

Extreme asset over-valuations and years of self-destructive policies and behaviors have assured that the next bear market will be of historic proportion and financial harm.

Whether it starts next month, or next year will be irrelevant in the end, because those exposed will see years of apparent net worth gains vaporized in months, and lack of preparedness, liquidity crunch and terror will force selling near cycle lows for many.

The vast majority of market participants today will end up far worse off than if they had kept their savings in cash and guaranteed deposits for the last 20 years, and all the recent boasting about ‘performance’ will be moot. Centuries of history are ours for the noting.

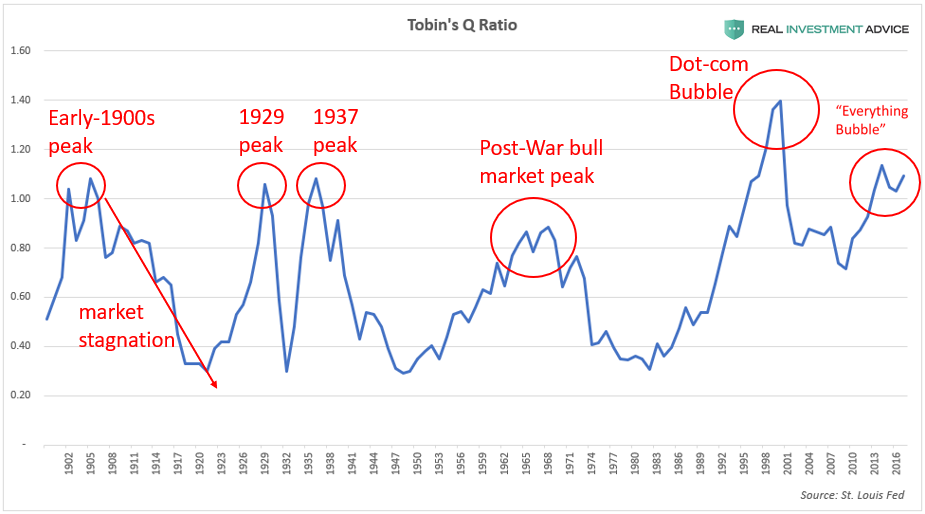

This chart from Jesse’s article showing the Tobin Q valuation ratio (total stock market value divided by the total replacement cost of assets) for US stocks since 1900 is a beauty.

Bottom line: Financial markets have never been more manic than in the last 20 years, and never more capital dangerous than they are today. Given these are the facts at hand, the question must be what is our plan to survive and thrive these conditions within our own finite time horizons? Wilful blindness and ignorance will not help. Eyes wide open.