Another new study confirms what has been abundantly clear for years now: stock price manipulation via rampant share buybacks is weakening worker compensation, capital investment, innovation, productivity, corporate balance sheets, and future economic resilience. See The Atlantic’s Are buybacks starving the economy? for a worthwhile update:

In recent years, with corporate profits high, American firms have bought their own stocks with extraordinary zeal. Federal Reserve data show that buybacks are now equivalent to 4 percent of annual economic output, up from zero percent in the 1990s. Companies spent roughly $7 trillion on their own shares from 2004 to 2014, and have spent hundreds of billions of dollars on buybacks in the past six months alone.

…The growth of buybacks and growing research on the perils they pose has increased interest in regulatory or legal action to bar or limit them. Tung and Milani argue that companies should be required, as they were before the 1982 rule change, to provide dividends rather than purchase shares with their cash. “Issuing cash dividends (regular or special) has a less predictable and manipulative impact on a company’s stock price—and thus is less prone to gaming by executives or activist investors for their own gain,” they write. “Dividends also do not have the same potential as buybacks to mask the market and balance sheet impacts of increasing executives’ stock-based compensation.”

Meanwhile it is critical to comprehend a connection here: the recent Trump corporate tax cuts are ballooning the national debt to enable this madness, as companies are using their windfall for even more buybacks in 2018. Shoveling cash into obscenely over-valued financial assets is like shoveling it into a wood stove. It burns bright for a bit before going up in smoke and leaving zero lasting benefit. This is dumb and dumber-style resource management.

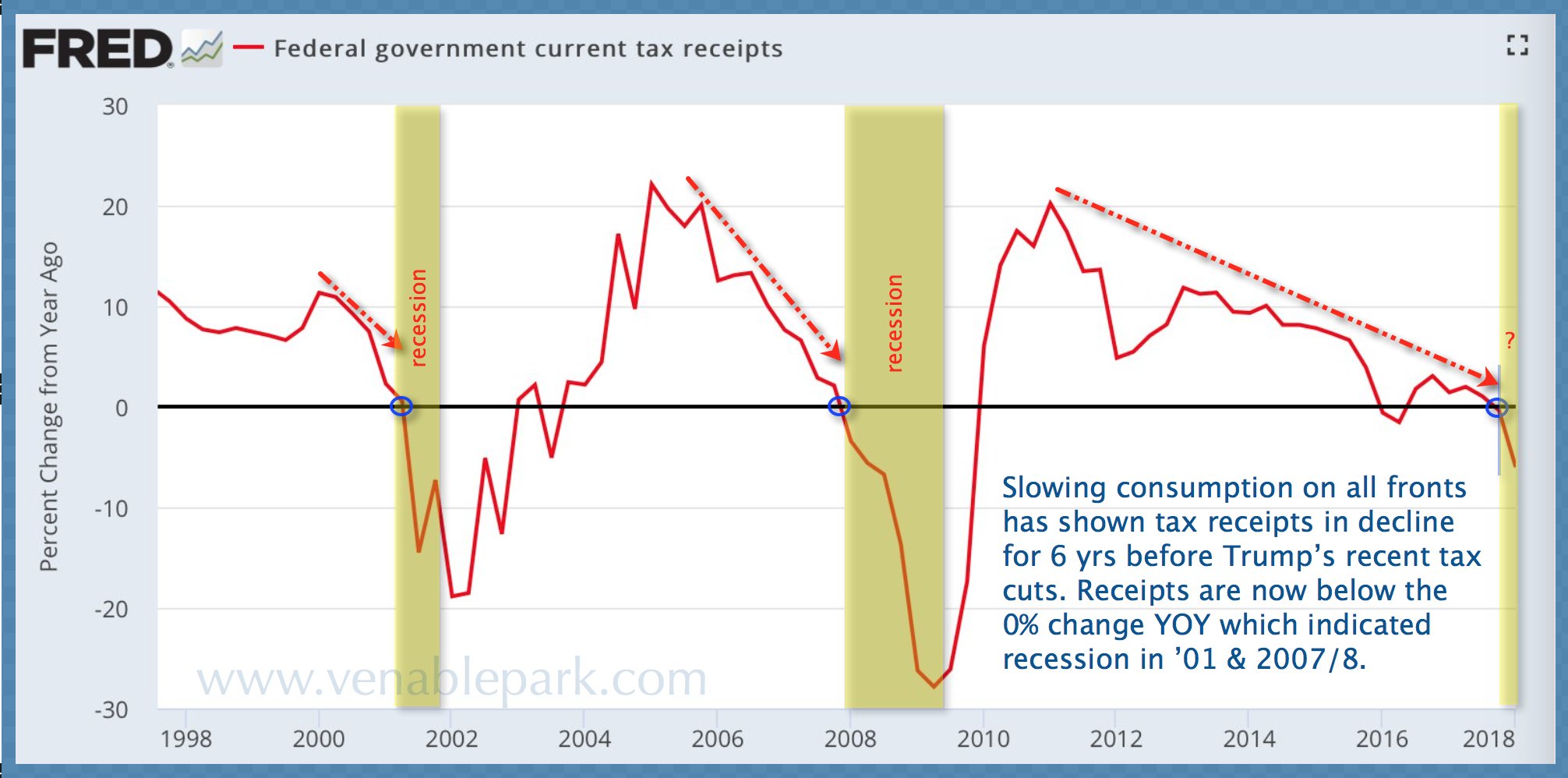

As shown below, even before recent cuts, US tax receipts had fallen near the lows that marked the start of previous recessions.

It is essential to get smarter and more efficient with limited resources. Progress cannot afford reckless waste to continue. A reinstatement of laws banning buybacks as market manipulation is inevitable because its necessary. In March democratic senators proposed a bill to do just that, it now needs political power to pass. Ongoing economic strife is likely to bring it. See Dems offering bill aimed at stemming share buybacks:

The bill would repeal a Securities and Exchange Commission rule that makes it easier for companies to do stock buybacks, and it would also end corporations’ ability to repurchase stocks on the open market. Companies would still be able to buy back shares through tender offers, which are subject to more disclosure requirements than open-market purchases, according to the release from Baldwin’s office.

Additionally, the measure would require one-third of a public company’s board to be chosen by its workers.

Groups such as the AFL-CIO, Take On Wall Street and Americans for Financial Reform are supporting the bill.