The financial business lives to churn out products for mass consumption, and they are excellent at selling them to us. The trouble for buyers is that they tend to be different-wrapped packages of the same highly correlated securities, and so the appearance of diversity is one of form over content.

While rising capital inflows tend to inflate corporate securities all together, when risk-appetite turns they also drop en masse. This truth was revealed in 2008-09, and for short-lived episodes since in 2011, 2015, 2017 and 2018. It will be revealed in the next bear market as well–to the shock and horror of today’s hope-filled holders.

The Wall Street Journal highlights the issue today in When diversification doesn’t spread your risk, reviewing how colateralized loan obligations that blew up the economy in 2008 have become widely packaged and sold to risk-blind buyers again this cycle, to wit:

There is a simple lesson here for CLO investors: Never assume that investing with multiple managers diversifies your risk, as there is a fair chance you are buying many of the same underlying loans.

But there is a potential pitfall here that everyone should note. Today’s loan market has a much greater concentration of deals with low ratings, single-B and below, which are more prone to downgrades and defaults. More low-quality loans everywhere likely means more widespread losses when a downturn comes—no matter what kind of diversification you think you have.

The ramifications are much broader than for just CLO buyers however, because the contagion among corporate debt, derrivatives and equity prices is baked in the leverage linkages and behaviors that drive them each cycle.

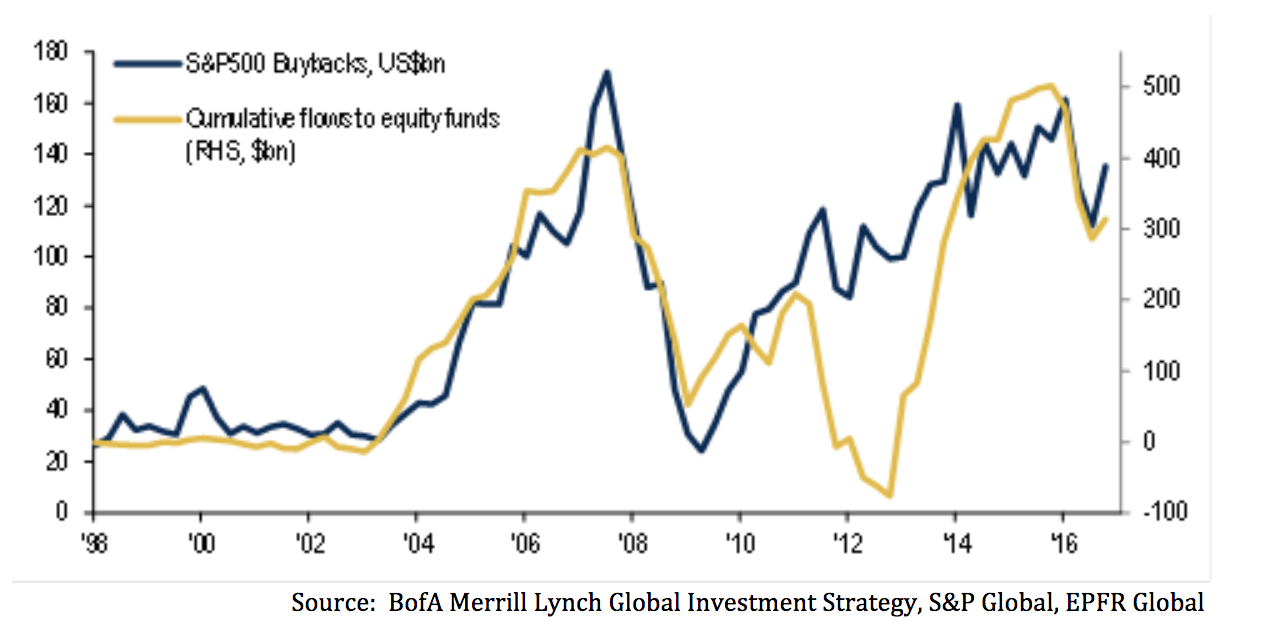

In equities, fund flows confirm that large corporations buying back their own shares–to boost prices and increase reported earnings per share–has been, by far, the largest net buyer of shares since at least 2009, as shown in the chart below.

Turns out this is especially the case, in low volume months like August, where executives use the pump of buyback announcements to liquidate their own personal holdings into policy-contrived strength.

All of this should be banned of course, and it may be again soon, as agregious insider-selling abuses have been recently noted in analysis by Robert J. Jackson, Jr. at the US Securities and Exchange Commission, and targeted by proposed new bills from Elizabeth Warren (D) and others.

Equity managers and products have lots of enticing different names, but they pretty much all track the same indices and each other. So in reality, there is zero benefit in picking a bunch of different ones thinking you are adding diversity. As the WSJ article admits: “You are just buying the same stocks via different channels”.

The only meaningful capital-defense one can actually have is to adopt financial management rules and an investment discipline that moves inverse to the indiscriminate buying and selling of crowds. The rest is all sales puff.