The Canadian dollar has fallen nearly 5% against the US dollar year-to-date and compared to emerging market (EM) currencies that decline is small. Of the 24 most traded EM currencies, only the Mexican Peso has managed to eke out a small gain against the greenback year to date, while several others are down 10% and (some much) more.

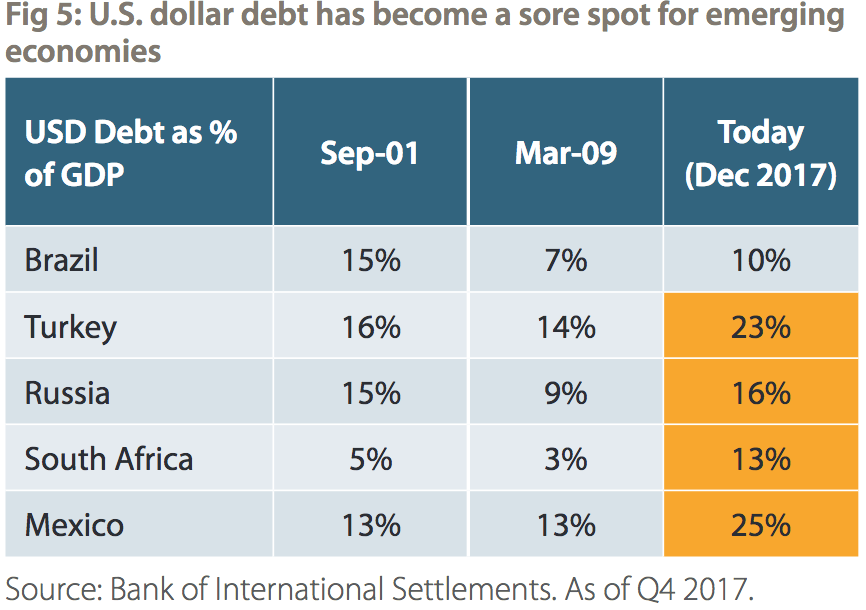

As many people and countries have learned, many times before, currency depreciation is painful when your expenses are in the rising currency and/or you have investments priced in the falling currency.  As shown in this table on left (from Picton Mahoney), over the past decade several EM countries have doubled their US denominated debt relative to their revenue (GDP), overdosing on U$ liquidity flowing from QE and the US Fed. As a result, now sharply rising debt costs leave fewer funds for everything else, along with higher default and bankruptcy rates, and a need to sell assets and raise cash.

As shown in this table on left (from Picton Mahoney), over the past decade several EM countries have doubled their US denominated debt relative to their revenue (GDP), overdosing on U$ liquidity flowing from QE and the US Fed. As a result, now sharply rising debt costs leave fewer funds for everything else, along with higher default and bankruptcy rates, and a need to sell assets and raise cash.

Foreign investors also have a history of selling when the currency their assets are priced in plummets against that of their home base. So it’s no surprise then, that EM stock, debt and realty markets, have been following their currencies down, with the MSCI Emerging Markets Stock Index already nearly 20% below its January peak. A good start, but deeper price declines will be needed before risk-discerning capital is enticed to come in from the stability and optionality of cash-equivalents.

As usual, in highly levered and interconnected global financial markets, selling waves are unlikely to be contained in EM. With infamously misplaced consumer and investor confidence once more back near past cycle highs, the cash crunch and selling tsunami is likely to hit globally this time too. After buying and holding at some of the highest (least rational) valuations in market history, many will be washed off course once more. See No relief in sight as emerging markets tumble toward Bear Market:

It’s “no longer just about EM fundamentals,” Sameer Goel, the head of macro strategy for Asia at Deutsche Bank AG in Singapore, said in a Bloomberg TV interview with David Ingles. It’s “increasingly about contagion, which largely happens because of cross-holdings and the pressure of redemptions.”

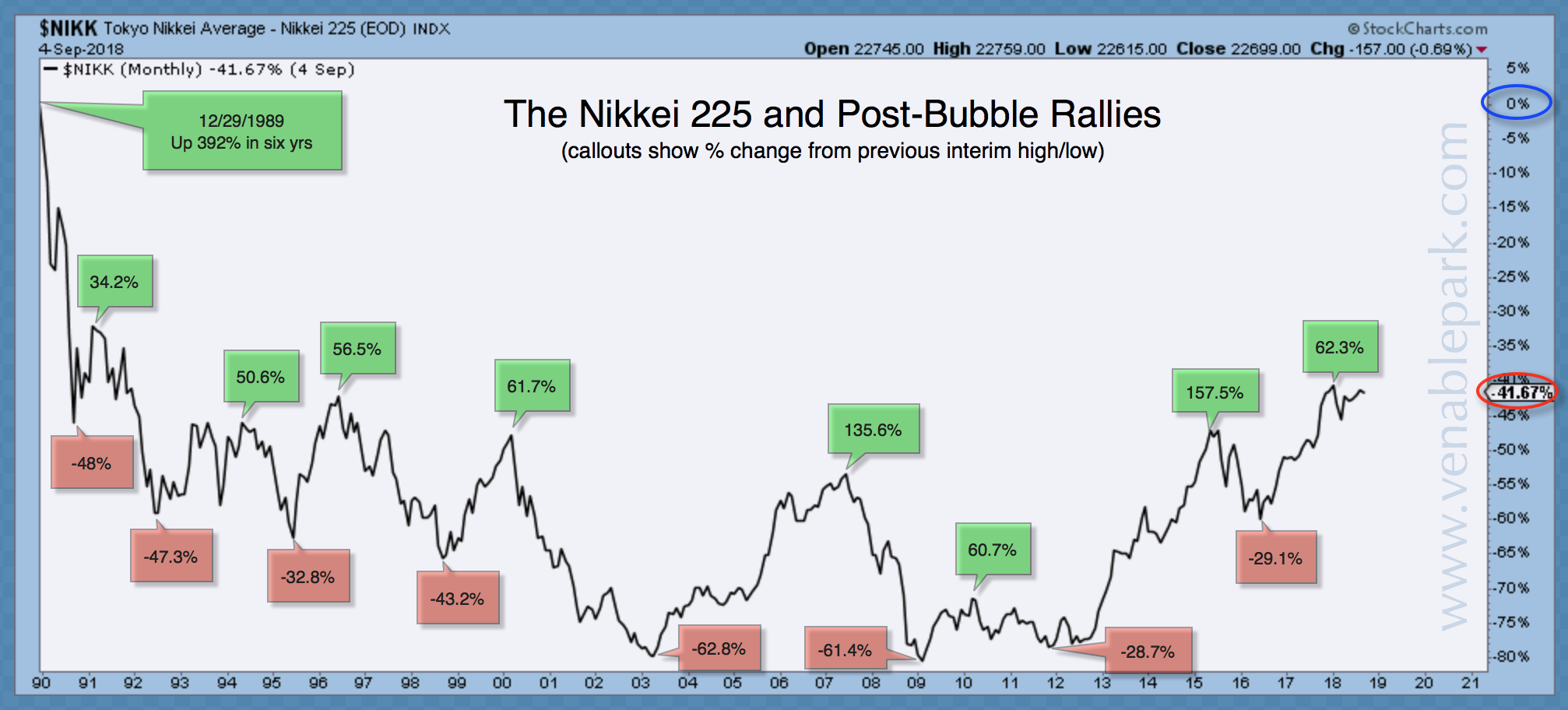

For those looking for a sense of how massively over-leveraged financial cycles have historically resolved, we reference this chart of the Japanese Nikkei 225 stock index and note eight cyclical rallies (green boxes) over the last 28 years with the Japanese market still 40% below its December 1989 secular peak.

One can argue this is an extreme example–sure, Japan has an old population, low birth rates and little immigration, but most developed economies have at least the first two of these today, and anti-immigration policies/sentiments are on the rise all over–still, the precedent of taking at least two decades for financial assets to work off prior secular excesses is very typical. Witness the 25 years it took the US Dow 30 Index to reclaim its 1929 peak, the more than 16 years (and trillions in QE push and buybacks) it took the NASDAQ to (temporarily?) reclaim its March 2000 peak (by August 2016), the 12 years and counting that many US realty markets remain below their 2006 top, and the decade and counting that Chinese stocks, commodity companies, and commodity prices have been laboring, still today 40-70% below their 2007-2008 euphoric peaks. Stay tuned.

History never repeats exactly, but given that similarly destructive financial policies and credit abuse have driven asset prices to similarly irrational peaks and behaviors, over the last 20 years, in most asset classes, in most of the world, we should now be expecting a larger than average (historically typical) correction period (offering a better than average buying opportunity) followed by a long, slow, price recovery period from there. Who’s ready?