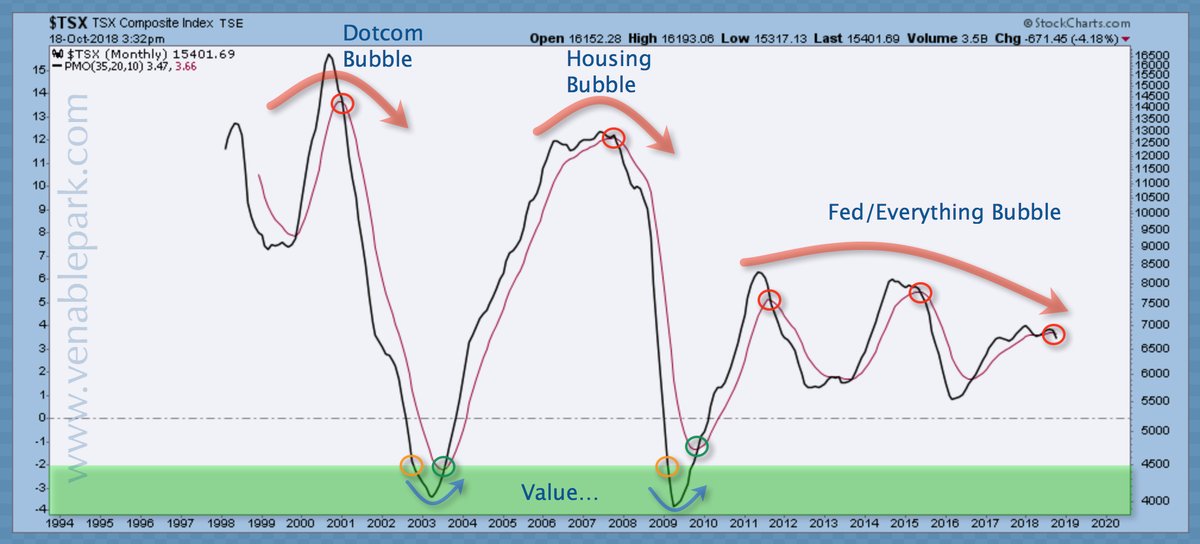

As markets plunge around the world this week, we should not lose big picture perspective on how relatively little they have mean reverted to date. And also on how much further stocks are likely to fall before they complete their third, and potentially final, bear cycle of this secular bear that began in 2000.

This chart of the Canadian stock index (TSX) from my partner Cory Venable offers a glimpse of where we are today and where cyclical value is likely to present (green band). A great opportunity is coming, but only to those who have been defensive in reckless times and prepared their liquidity in advance. Sitting ducks tend to get shot, and no one should be surprised by any of this.