For financial markets and the economy, the most relevant outcome of last night’s reweighting in the US Congress may be that further tax cuts and unfettered deficit spending are less likely over the next two years.

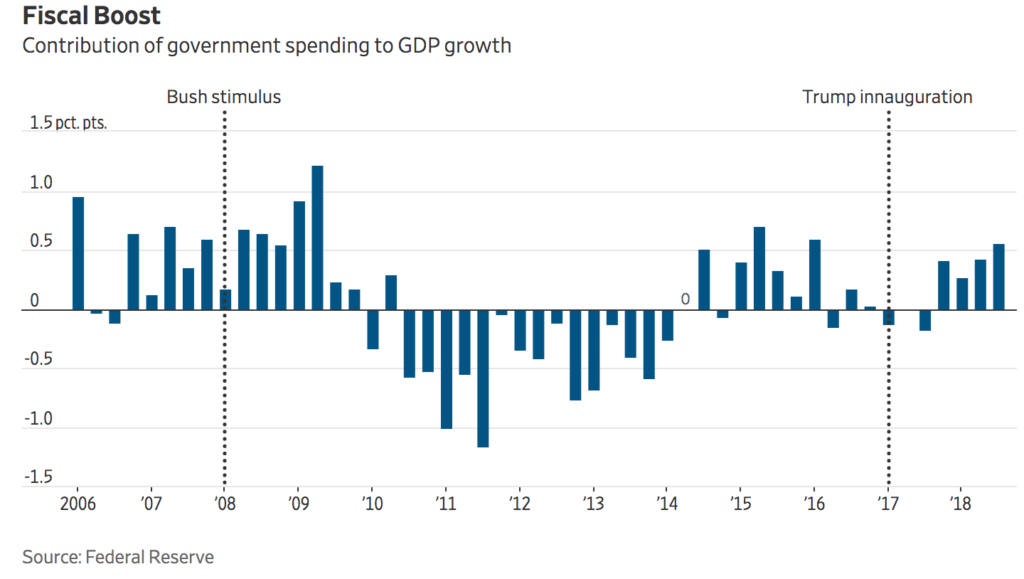

While this should mean lower US debt accumulation going forward (a good thing), it also suggests less near-term fiscal stimulus from government spending. This is noteworthy because as shown below, the contribution to US GDP growth from the federal government over the last year under Trump has been significant. See more here courtesy of the Wall Street Journal.

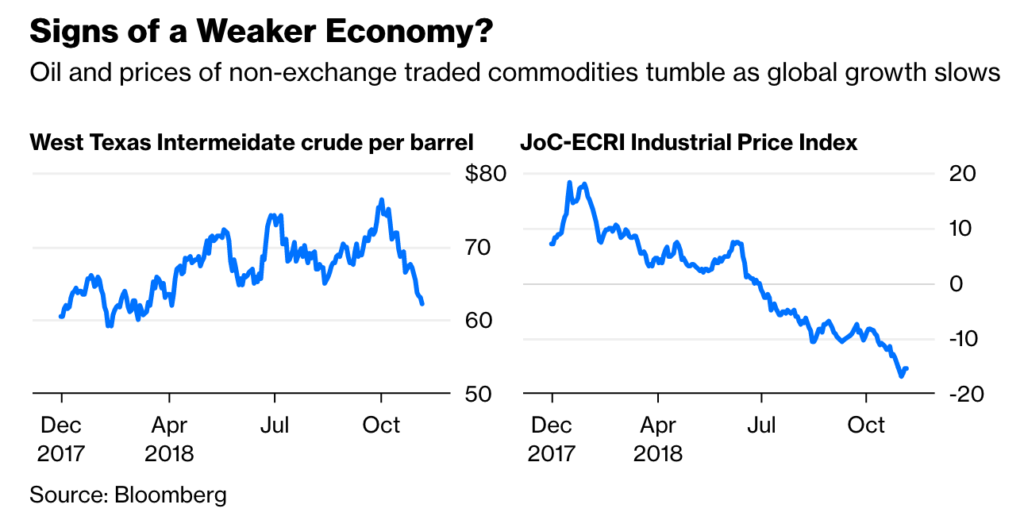

Even amid significant fiscal and monetary stimulus, oil and other non-exchange traded commodity prices have fallen over the past year with world demand as shown below courtesy of Bloomberg. Most are lower this morning as well, along with higher government treasury prices in North America–another signal of lower growth and less Fed rate hikes probable.

The bottom line is that the global economy was already in the midst of a cyclical downturn before the US mid-terms and before any further rate hikes or quantitative tapering (QT) from the US Fed. Last night’s election outcome is likely to magnify that slowing trend.

Economic Cycle Research Institute’s Lakshman Achuthan discussed the global cyclical slowdown in process a couple of weeks ago on Bloomberg:

Bloomberg Daybreak Asia speaks with ECRI’s Achuthan about ECRI’s U.S. slowdown call, including housing and inflation downturn calls, and some China related details. Achuthan also explains that a global cyclical slowdown was already underway before trade sanctions arrived delivering a one-two punch. Here is a direct video link to the full 6 minute segment.