Financial sales firms will never ‘get’ the sacrosanct importance of holding professional advisors to a fiduciary standard because masquerading sales as advising is such a lucrative business model for them.

The crash of 1929, the decade of loss and suffering thereafter and the revelations of the Pecora Senate hearings of 1932-34, made this vividly clear to our grandparents and led to the landmark Glass-Steagall Act of 1933 and its hard divisions between banking, product underwriting and advising services, as well as the Securities Act of 1933 setting penalties for filing false information about stock offerings, and the Securities Exchange Act of 1934, to regulate stock exchanges. This was all watered down to nothing over the past 20 years, and the consequences are our present reality of record debt, destabilizing financial risks and gaping capital shortfalls in most of the world’s pension, trust funds, families and institutions.

A recent article underlines the classic conflicts of interest so endemic today in Some Merrill Brokers say plan urges more consumer debt:

Some brokers at Merrill Lynch are pushing back against a compensation plan they claim rewards them for increasing debt their clients take on and in some cases can punish them for reducing it.

…The skirmish is occurring as brokers digest pay policies that include what amounts to a broad pay reduction as well as changed targets for attracting new business and cross-selling certain products. Those who miss growth targets earn less than in the past; those who jump certain hurdles stand to get a bonus.

One of those targets focuses on growing clients’ net new assets and liabilities, including things like securities-backed loans and mortgages, by at least 2.5% annually…

Loans that are backed by a client’s investment portfolio are a particular favorite of brokerage firms, said Jeffrey Harte, brokerage analyst at Sandler O’Neill + Partners. “It’s taking money that’s already there and making more money on it, versus the much harder job of going out and growing assets,” he added.”

Merrill Lynch Wealth Management ‘Manglement’ head Andy Sieg is so corrupted that when asked about the scheme, he didn’t even know to be embarrassed about it, acknowledging some complaints from brokers he added the “pay program has motivated many financial advisers and helped boost growth at Merrill.”

Well, if it’s helping boost growth for the brokers and your bonus Andy, by all means, abuse away, right?

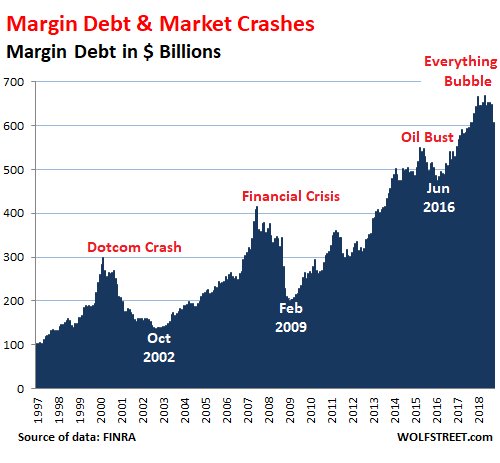

The add more debt and stir model has been legendary this cycle. Below is the latest margin debt chart showing funds borrowed against security portfolios from 1997 through the end of October. Much forced selling is coming to markets everywhere as these levered accounts unwind amid falling prices. And that won’t just hurt levered participants, but un-levered ones who think they are being ‘conservative’ as well.