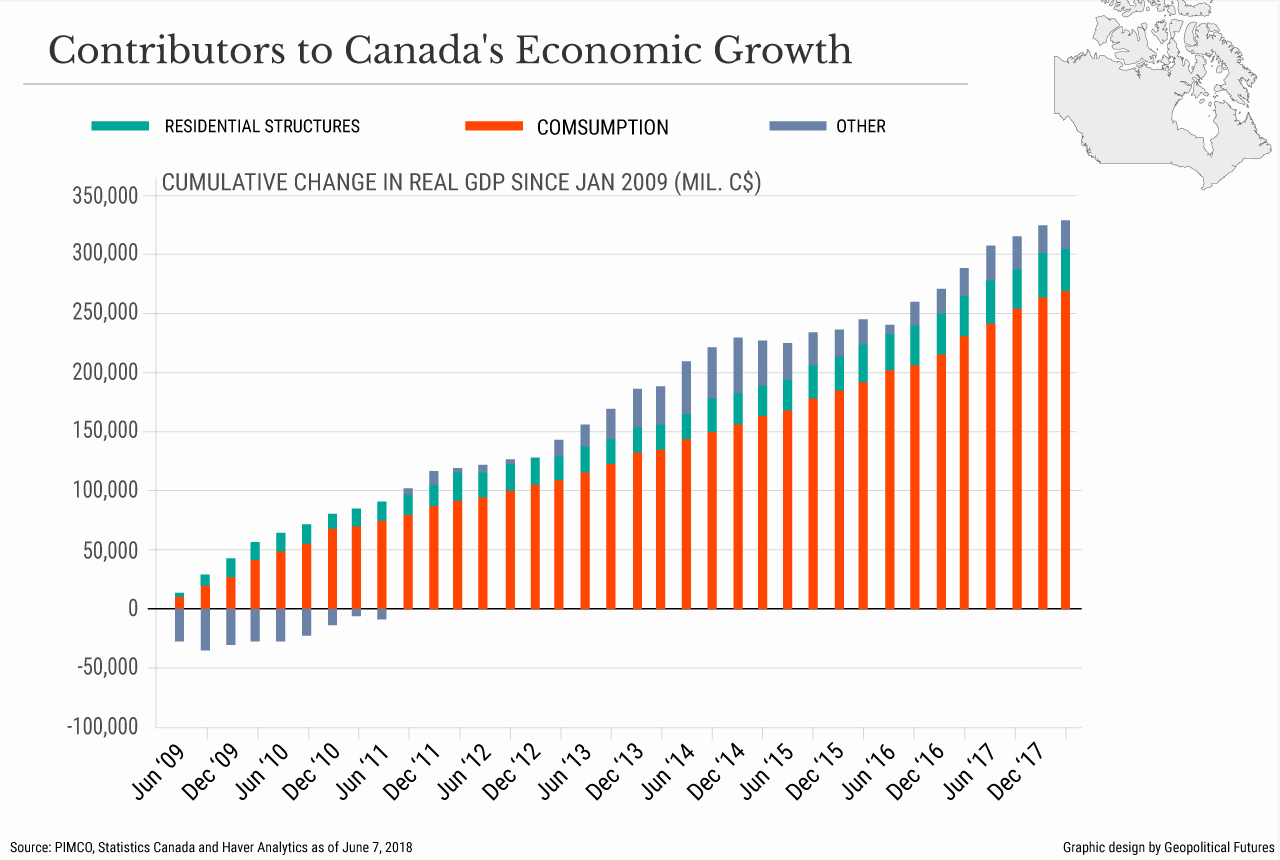

Some 90% of Canada’s economic growth since the last recession has come from household consumption and spending in the realty sector (see chart below), enabled by unsustainable growth in debt at every level of the economy.

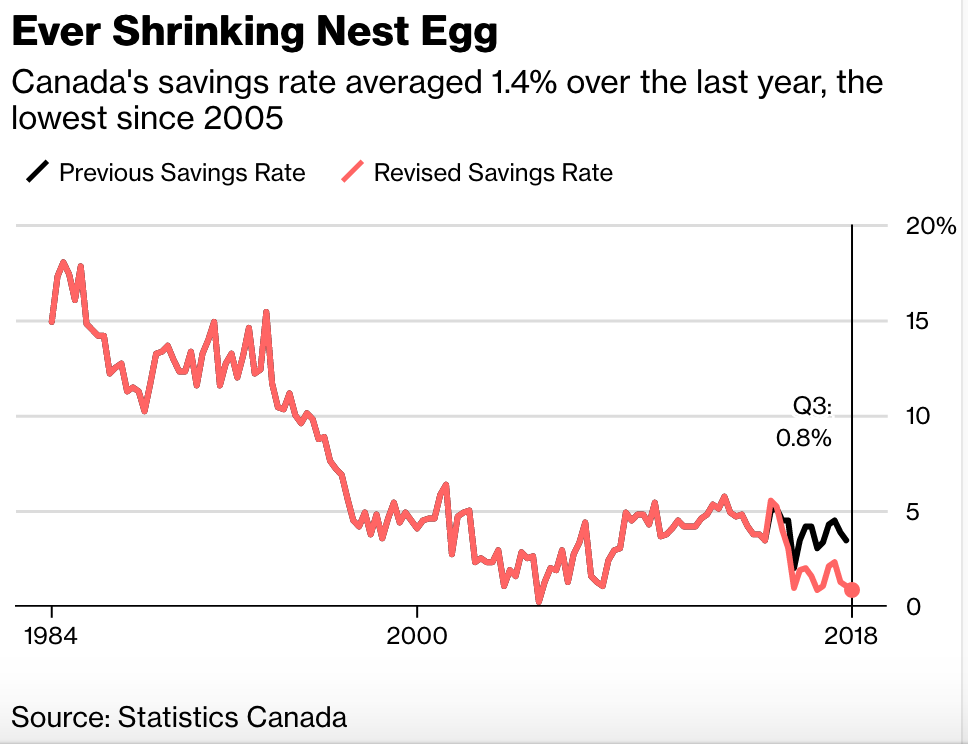

In the process, Canadians dramatically reduced their savings for rainy days and future needs like retirement and their children’s education, moving from 10 to 15% of disposable income before 1995, to less than 5% over the past 20 years, and a pitiful 1.4% in the latest 12 month period (as shown below). See: Canadians aren’t saving much of their paychecks for a rainy day.

One might expect that the second longest economic expansion since World War II would have bolstered financial strength over the last decade. Unfortunately, because it was enabled by ‘easy credit’ and malinvestment–it has had the opposite effect, making households and the nation now extra vulnerable to retracing realty prices and a slowing global economy.

All of this proving once again that smooth waters do not build the best sailors. It has been wisely said that a crisis is a terrible thing to waste. We should hope to learn better financial management skills from adversity in the next phase.