Economist Steve Keen writes yesterday in Australia’s Housing Bubble Pops, that the rate of change in mortgage credit (in red below) leads the level of house prices (blue), as shown here in America since 1990, with the 2006-09 collapse in both readily apparent.

While Australia and Canada boasted a record surge in home prices over the decade since the Great Recession, this also came with the commensurate surge in mortgage credit, and as shown below for Australia, both credit and prices are now following their natural path lower over the past year.

While Australia and Canada boasted a record surge in home prices over the decade since the Great Recession, this also came with the commensurate surge in mortgage credit, and as shown below for Australia, both credit and prices are now following their natural path lower over the past year.

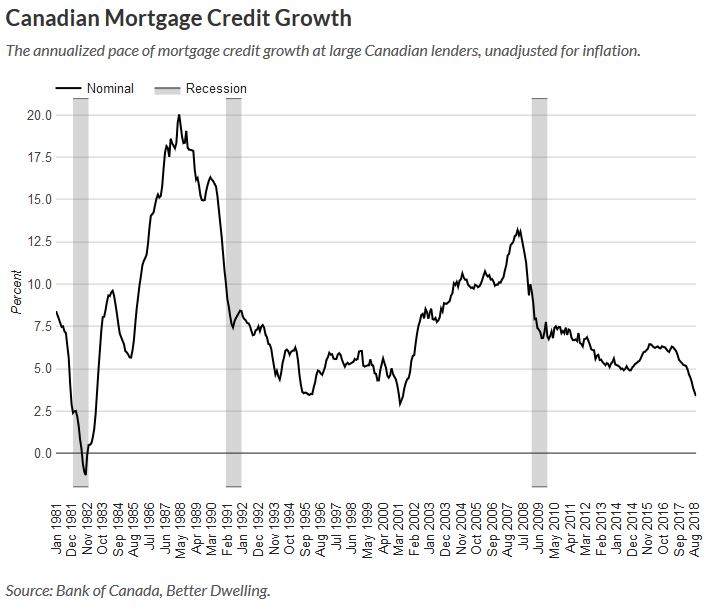

This is forboding for Canada as well, where property prices have also been softening and credit growth has turned sharply negative over the past 18 months, shown below since 1990. (Adjusted for inflation, this credit contraction has been much sharper). Similar drops marked the onset of the last 3 Canadian rescessions (grey bands), as well as a halving of the Canadian stock market in 2000-03, even though no official Canadian recession was recorded.