Ok, time for a refresher on financial basics 101: The vast majority of finance and advice/management firms are designed to collect the highest fees on capital allocated to the highest-risk asset classes and products; hence the business model is to keep people long the highest-fee asset classes at all times. This is the case even when risk-reward prospects are bleak. The most they will offer is to suggest a ‘rotation’ out of one risky asset to another or an ‘underweight’ in one to ‘overweight’ another.

Also, because nearly all business and market news media are sponsored by these same companies, their representatives are the ubiquitous source of nearly all financial commentary the world over; it’s not insight or advice, it’s their sales pitch. Hence, why it is so rare to witness honest comments on meaningful risk management anywhere.

An exception slipped through yesterday in the person of Investec Asset Management Ltd.’s Philip Saunders, who is quoted on Bloomberg as follows:

“If U.S. equities have a tough time, do you honestly believe that you should be switching out of U.S. equities and go into other markets because they are going to have different experiences? They are in the same boat.”

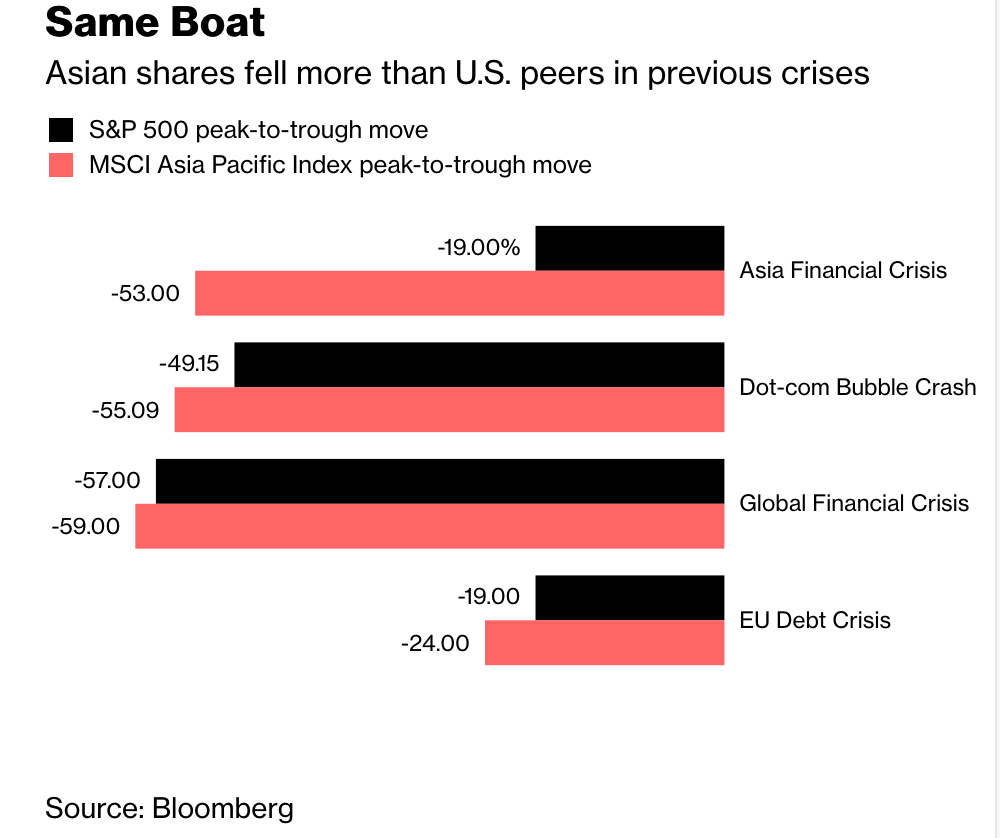

The article goes on to include the chart below which compares the last three major loss cycles in 1998, 2000 and 2008 as between US (in black) and Asia Pacific equity markets (in pink). Does this look like global diversification is a benefit?

Today’s highly-interlinked, highly-levered financial markets of corporate securities-debt and equity as well as commodities generally, and all the myriad of long funds, portfolios and ETFs derived from these constituents–tend to move up and down together-worldwide.

Today’s highly-interlinked, highly-levered financial markets of corporate securities-debt and equity as well as commodities generally, and all the myriad of long funds, portfolios and ETFs derived from these constituents–tend to move up and down together-worldwide.

The bottom line is simple: risk assets come in different colors, but they are all jellybeans. If jellybeans are falling and priced to be bad for your health, consuming one color over another is not going to help!

Only non-jellybean, low-fee assets, like cash, North American treasuries and some safe-haven currencies have typically offered capital shelter and some nourishment in these conditions. Word to the wise.