Sydney has been an epicenter for speculative fervor in the Australian property market over the past decade, much like the greater Toronto and Vancouver areas in Canada.

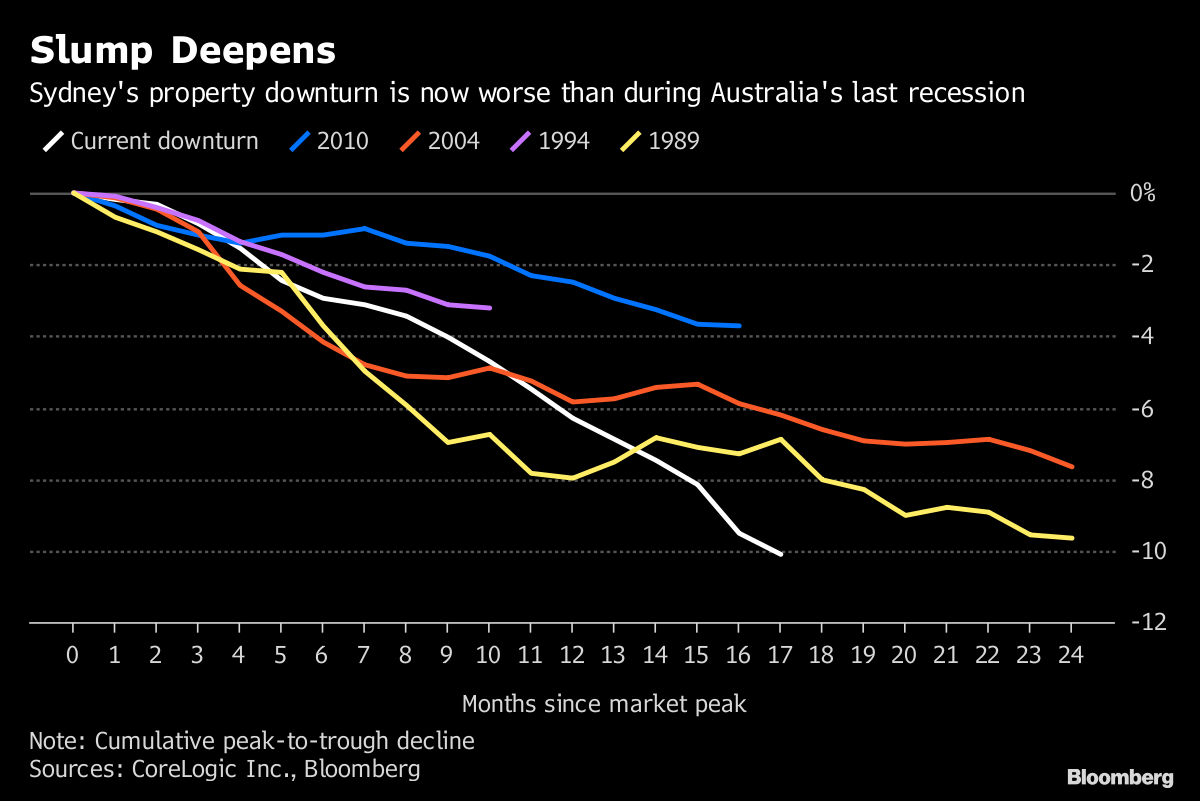

As shown in this chart, price declines over the past year have now been about 10%. This is larger than the previous four declines since 1989 but still less than the 18% decline seen in the 1982 recession.

Given the rise and run of the most recent boom, further downside is likely for Australian property prices this cycle. This is a healthy and needed correction to help restore affordability in shelter.

Given the rise and run of the most recent boom, further downside is likely for Australian property prices this cycle. This is a healthy and needed correction to help restore affordability in shelter.

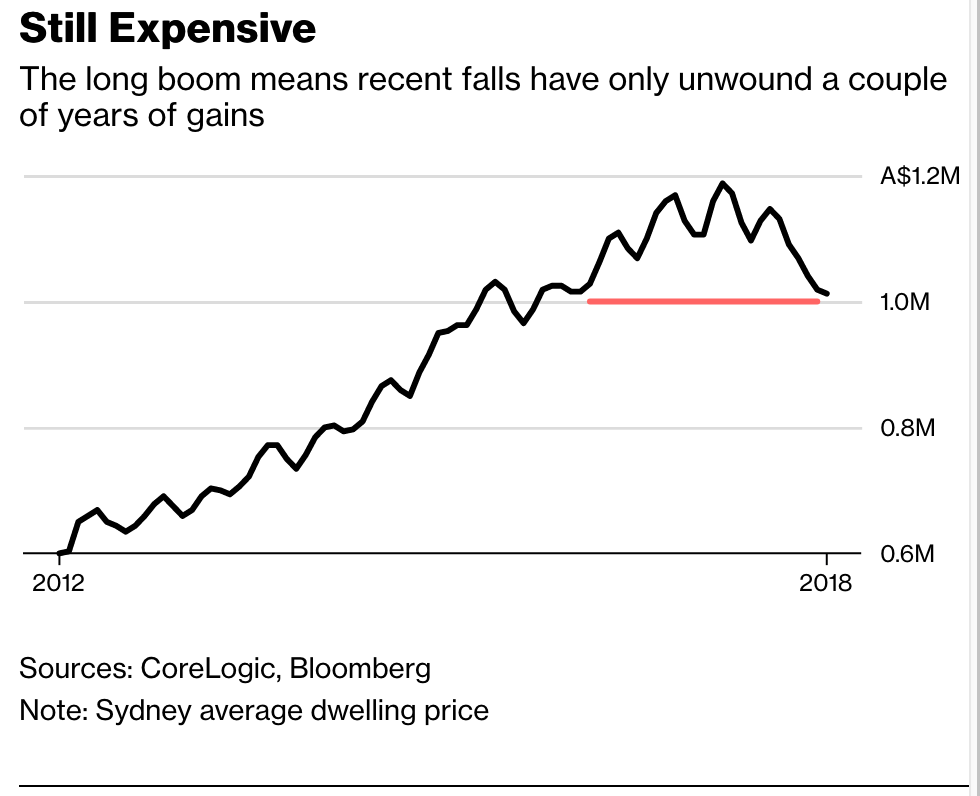

That said, the downside to date has only retraced prices to 2016 levels, as shown here.

Further retracement is likely and necessary but threatens the highly levered owners, lenders and investors presently exposed in the space. It’s also a broad negative for the larger Australian economy, which, like Canada, became precariously dependent on the realty sector and debt-enabled related spending since 2008. See: Australian house prices fall most since global financial crisis.

Further retracement is likely and necessary but threatens the highly levered owners, lenders and investors presently exposed in the space. It’s also a broad negative for the larger Australian economy, which, like Canada, became precariously dependent on the realty sector and debt-enabled related spending since 2008. See: Australian house prices fall most since global financial crisis.

Higher-end properties have the most price to lose in this process, as credit growth recedes and an aging population looks to raise cash and reduce living expenses.

What’s causing the property bust? The levered boom before it, of course. This segment discusses recent numbers further. Here is a direct video link.