India’s nearly 1.3 billion population is running a close second to China’s nearly 1.4 billion in terms of the world’s largest. Both economies averaged a fast 7% in annual GDP growth over the past decade and both are now weakening.

Even before rising trade tariffs however, lax lending, excessive domestic debt and ‘hot’ investor flows into the country’s property and financial markets since 2008, have left it vulnerable as flows are now retreating. Meanwhile, a higher US dollar and interest rates have weakened the rupee, ratcheting up commodity prices and debt service costs, which reduces funds available for domestic spending and investment. A cash crunch is now spreading. While India’s stock market has outpaced other global markets since 2008, it is now falling with the rest thanks to over-valuation, falling growth and retreating liquidity globally.

The below is an interesting discussion from an Indian perspective on the social and economic challenges facing India which its former central bank chief defines as agrarian distress, the ailing power sector and crisis in the banking system.

Former Reserve Bank of India Governor Raghuram Rajan spoke to NDTV’s Prannoy Roy on a range of challenges in front of the Indian economy today. Dr Rajan said the three biggest problems for the Indian economy today are the agrarian distress, the ailing power sector and the crisis in the banking system. The 55-year-old economist, who was the first RBI governor to not seek a second term in nearly two decades after his tenure ended in 2016, said government interference in institutions could affect both global and domestic investment. Mr Rajan’s comments come amid a row between the central bank and the government over its autonomy. Here is a direct video link.

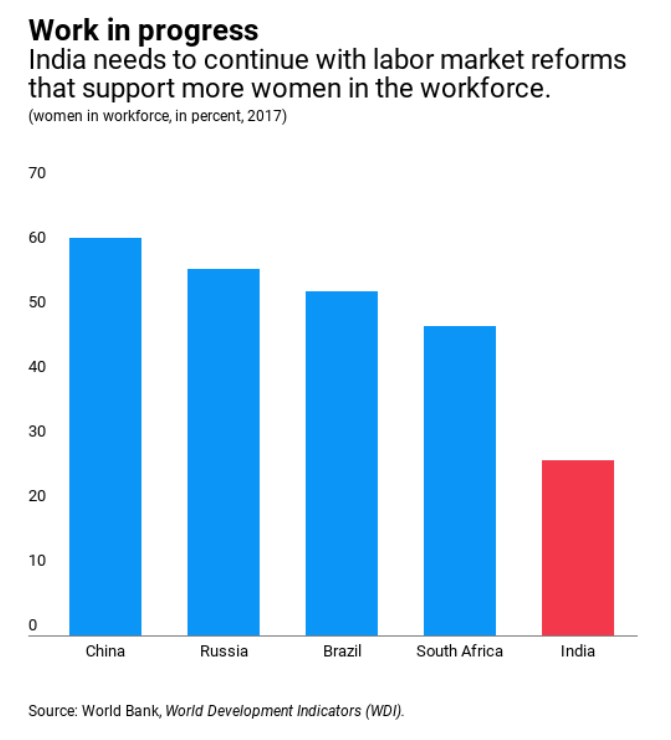

This chart showing low female workforce participation rates speaks volumes on the progress yet to be done in order to lift up household incomes and productivity in India and other developing economies.