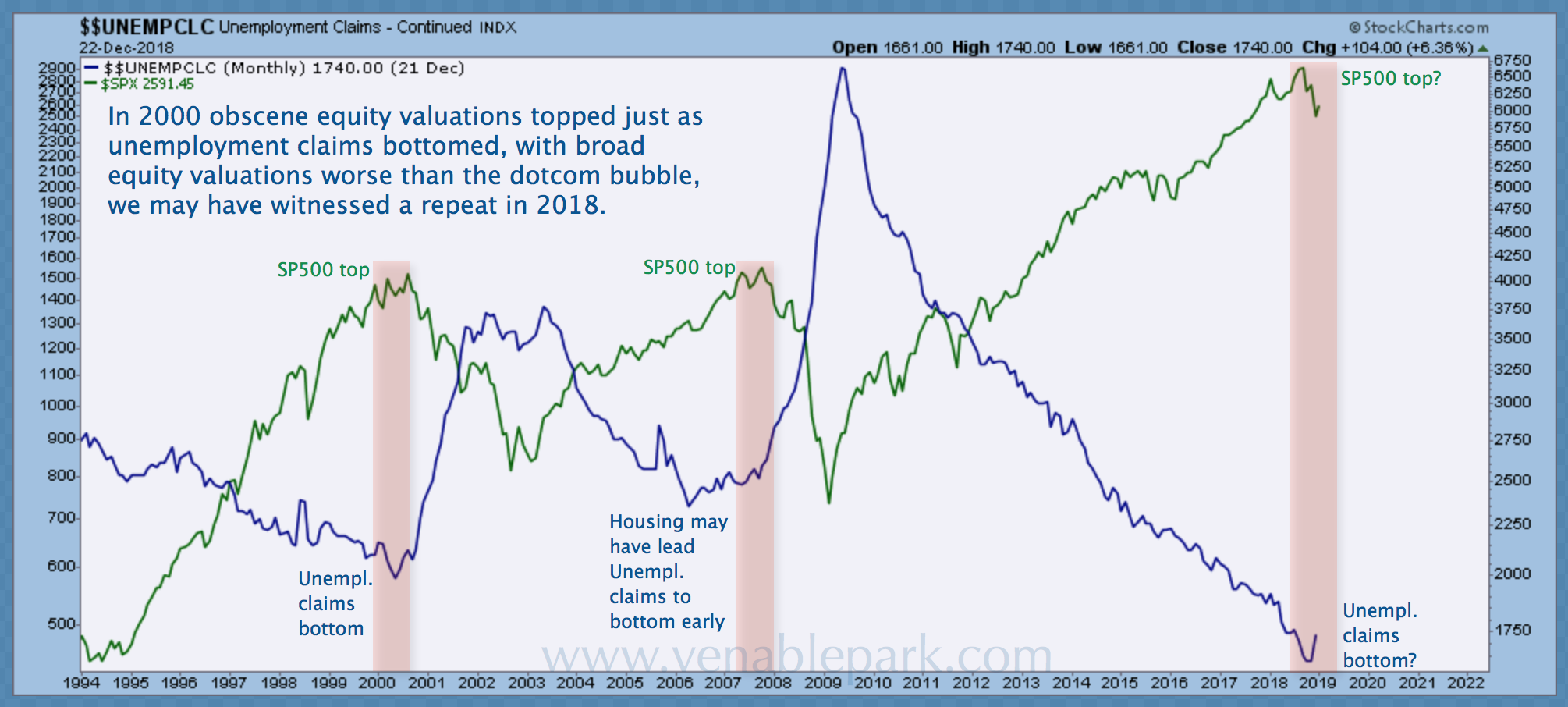

While the financial sales force likes to declare low unemployment as bullish for the economy and stocks, my partner Cory Venable offers the below chart to remind of the negative correlation between US unemployment cycles (in blue) and S&P 500 price cycles (in green) since 1994. Word to the wise: both lines are ripe for mean reversion, as they did in the last two recessions (pink bands); i.e., unemployment headed up and stocks down.

Thanks to destructive incentives that encourage people to save little and borrow and spend too much, along with harmful advice from the financial industry, most workers have debt and little savings to fall back on when unemployment moves back up. What savings most do have is generally funnelled into baskets of stocks and corporate bonds that tank in value just as their owners need cash to pay their bills. Forced liquidations during the downturns then amplify financial turbulence and loss for individuals and the economy.

Thanks to destructive incentives that encourage people to save little and borrow and spend too much, along with harmful advice from the financial industry, most workers have debt and little savings to fall back on when unemployment moves back up. What savings most do have is generally funnelled into baskets of stocks and corporate bonds that tank in value just as their owners need cash to pay their bills. Forced liquidations during the downturns then amplify financial turbulence and loss for individuals and the economy.

It doesn’t have to be this way. Market cycles are a regular recurring part of human life. Proactive planning and risk management are critical if we are to thrive through the cycles of our finite lifespans.