At their peak last October, the six largest Canadian banks traded at an average price of 1.9x book value. This was similar to the cycle high in U.S. bank shares in 2007 just before an 83%+ price plunge (XLF) returned them to an average of 0.7 x book value.

Canadian banks went into the 2007-09 downturn with better fundamentals, little exposure to subprime loans and just a mild housing correction, and still, the Canadian bank index (XFN) lost 58% of its value.

In the most recent sell-off between October and December 2018, the US bank index fell 26% and the Canadian 14%. Both have bounced sharply over the last two weeks, but remain negative now since October 2017, and there is a reason to believe the worst is yet to come.

One of the best performing US hedge funds in 2018 gained by shorting Canadian banks, ie, betting they would decline in value. They’re betting on more of the same in 2019, noting the banks’ exposure to cash-strapped corporations and households.

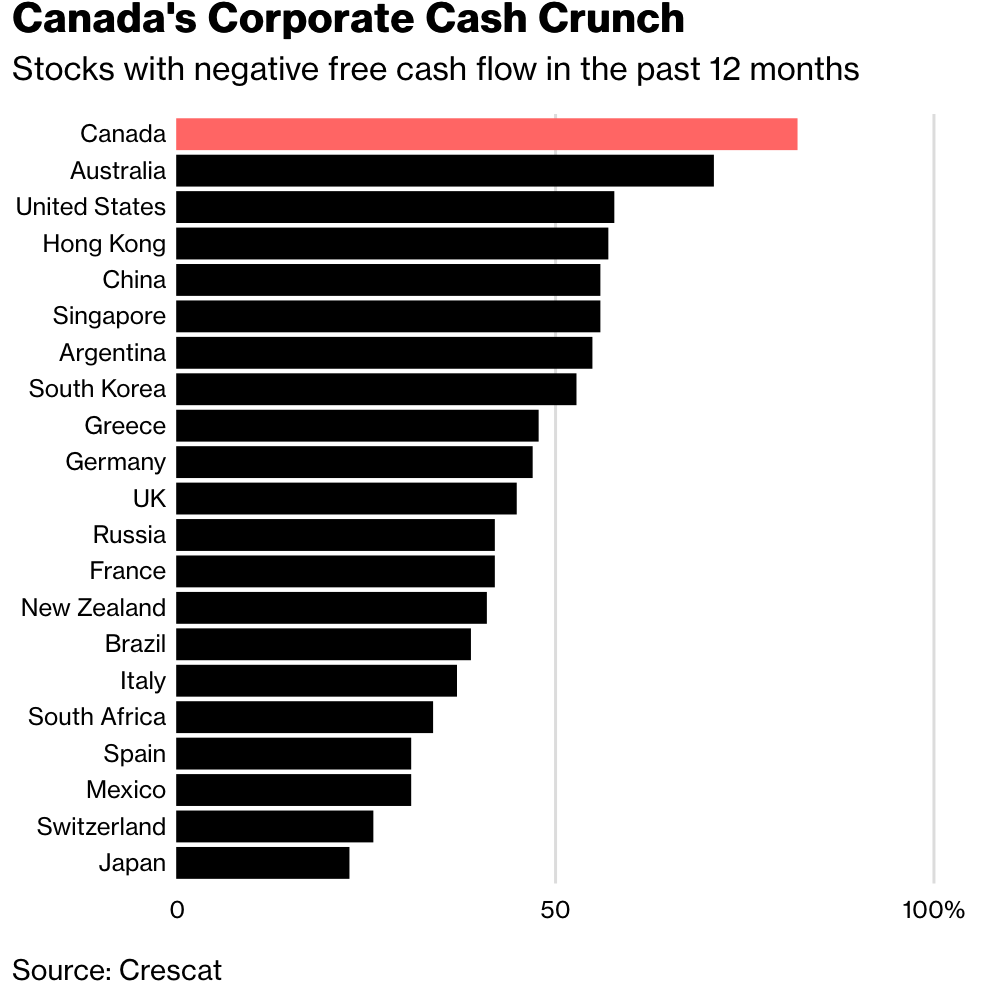

Crescat Capital has determined that some 80% of Canadian companies were cash-flow negative in 2018, and that’s before the country even enters a recession. See Top-performing hedge fund is shorting Canadian banks:

Crescat Capital sees the Canadian economy heading for recession as the housing market buckles. That might be bad enough for the banks, but they face an added strain: outside the financial sector, more  than 80 percent of Canadian companies aren’t generating enough cash to support their businesses, the highest percentage in the world, according to Crescat.

than 80 percent of Canadian companies aren’t generating enough cash to support their businesses, the highest percentage in the world, according to Crescat.

“Canadian banks will be left holding the bag and the ones to suffer from what is likely to be a major economic recession,” Tavi Costa, a global macro analyst at Denver-based Crescat, said by phone.

Weakness in financials has broad implications for Canadian investors. The TSX 60 Index which most Canadian equity funds and managers seek to replicate has nearly a 40% weight in Canadian financial shares as shown here.

High concentration to highly levered banks heading into a recession has historically been a toxic exposure for capital. This time is unlikely to prove different.