The fact that the US Fed has determined that real rates above 0.5% are a threat to both economic growth and 2% inflation, suggests the economy is not ‘in a good place’ but extremely fragile. Here is a direct video link.

Fed Chairman Jerome Powell said in prepared remarks that the central bank would use its monetary policy tools to keep the U.S. economy in a good place. Mr. Powell spoke at a news conference following the bank’s decision to keep its benchmark interest rate steady.

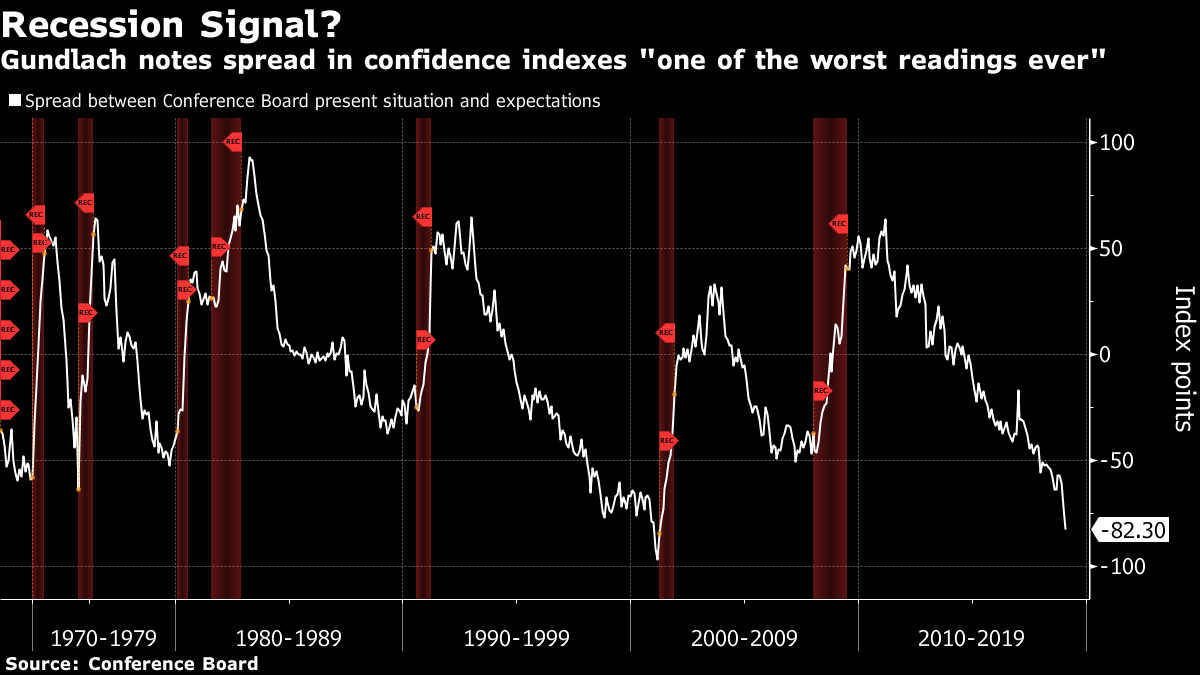

Perhaps the steady stream of historically informative indicators (such as the below spread between present situation consumer confidence and future expectations), suggesting recession and financial market shocks on deck, have caught their attention.

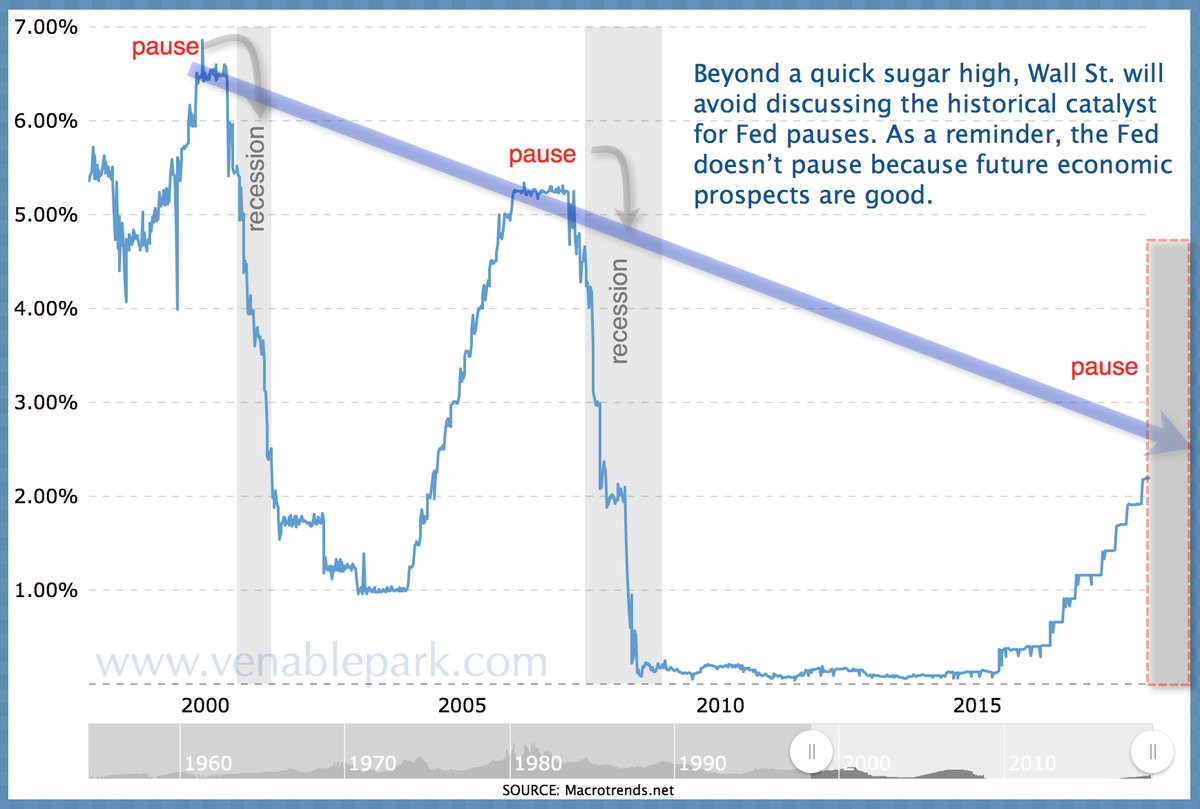

Lest anyone think the Fed’s pause yesterday is a bullish sign, this chart of the Fed funds rate since 1995, highlights that past pauses have preceded recessions not expansions.

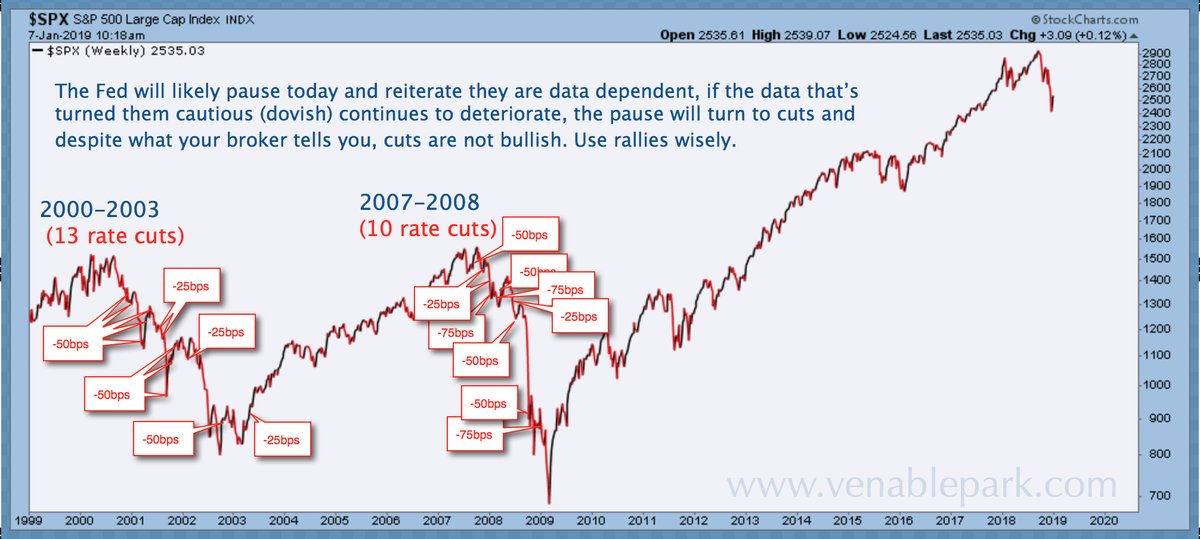

And yes, as shown below with the S&P 500, central banks switch to cutting rates and injecting liquidity as downturns worsen, and they will do the same this cycle, no doubt. However, this has never stopped bear markets and recessions from happening, and this time they meet the correction phase already holding several trillion in assets from the last crisis, and with 2 not 5% of rate-cutting room to deploy. Banking on miracles is not an investment strategy.