In a report last week, Societe Generale analysts warned that a historically reliable indicator suggests a US recession is probably close at hand with commensurate declines in corporate security prices.

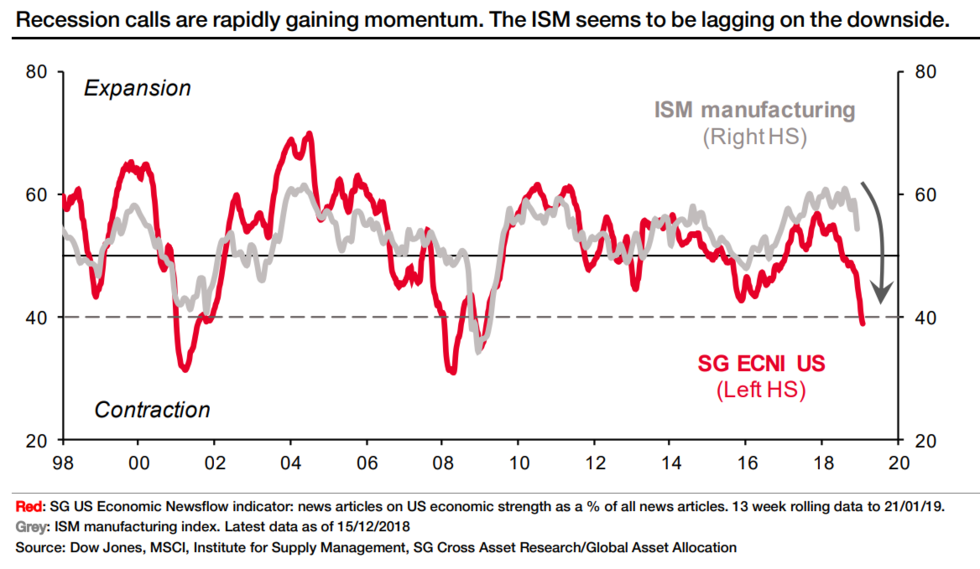

News articles on US economic strength as a percentage of all news articles (in red below) has led the US ISM manufacturing index (in grey) over the last 20 years. When the percentage of economic strength articles fell below 40% in 2008 and 2001, manufacturing followed, and the US economy was in recession within a few months. After falling throughout 2018, Soc Gen’s Newsflow indicator fell below 40% for a third time since 1998 on December 15, 2018.

This on top of an ongoing contraction in US corporate earnings growth into 2019, is likely to drive inflows into government treasuries and out of corporate securities as profit warnings, defaults, and volatility increase. See: An ‘earnings recession’ has arrived and the market’s not ready for it, Morgan Stanley and U.S. recession increasingly credible to top-ranked strategy team:

“The next recession could come sooner than expected,” the SocGen strategists wrote. “As there are no signs of an end to the sharp drop over the past few months in our indicators, hopes for improvement in the growth outlook seem purely speculative for now.”