It is critical to keep in mind that monetary policy changes impact the real economy at a lag of several quarters. So the tightening cycle that ran from December 2015 to December 2018 will continue to dampen global demand over the next several quarters, even if central banks tighten no further and move to more stimulative efforts in the months ahead.

will continue to dampen global demand over the next several quarters, even if central banks tighten no further and move to more stimulative efforts in the months ahead.

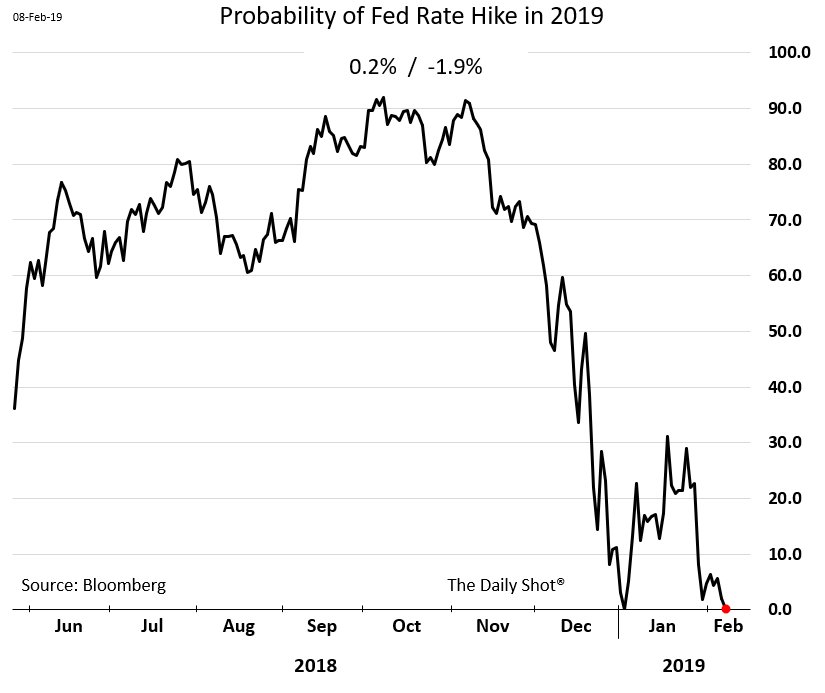

The speed and spread of global slowing in the last few months have alarmed the consensus so much that the futures market has now moved from pricing a 90% probability of US rate hikes in 2019 to zero percent today, as shown on left courtesy of The Daily Shot.

This Hedgeye cartoon sums the recent change in thinking well.

The segment below offers a good summary of spreading global weakness and how little monetary easing room suggests the incoming downturn may be longer/deeper than average.

Joachim Fels, global economic advisor at Pacific Investment Management Co., talks about the global economy, monetary and fiscal policies. Here is a direct video link.