John Hussman does an excellent job this month in highlighting how richly-valued stock prices compare with the central bank’s much smaller ‘put’ power in Ground Rules of Existence:

One has to remember that the current market capitalization of U.S. corporate equities now stands at $40 trillion, twice the level of U.S. Gross Domestic Product – the highest multiple in history (the multiple peaked at 1.9 in 2000). Investors are vastly overestimating the effectiveness of monetary policy if they believe that the Federal Reserve buying a few trillion in Treasury bonds can reliably stop “sudden efforts at escape” among investors holding $40 trillion in securities that the Fed cannot buy, and that even the U.S. government could not buy without a vote by Congress to effectively nationalize U.S. corporations.

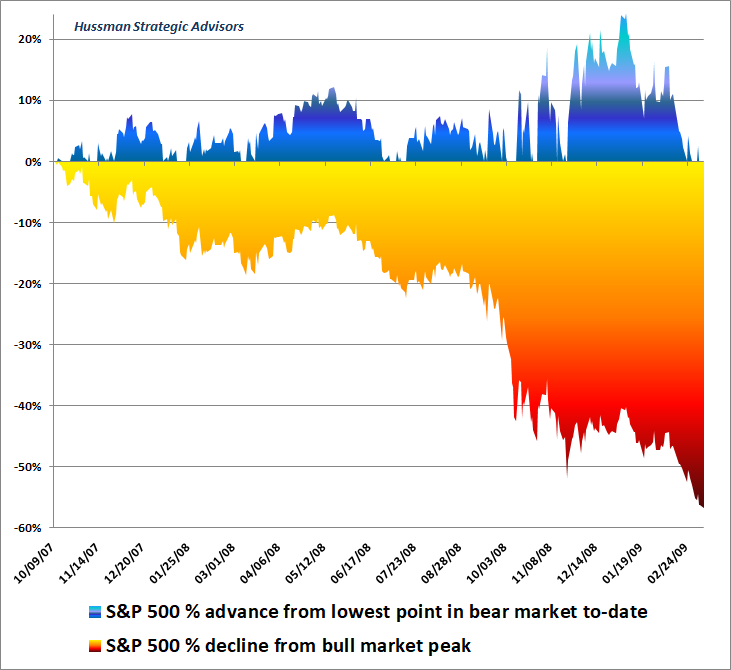

He also includes three vivid charts showing the intermittent rallies (in blue) within the overall bear market declines (yellow to red) of the 2007-09, 2000-03 and 1929-32 cycles, which are our present cycle’s closest historical relatives. Below is the 2007-09 chart along with Hussman’s reminder of the upside coming for value-conscious buyers who can stand clear of falling assets and then buy once the bear market restores investment-worthy prices in the months ahead.

“In summary…we expect dismal consequences for the U.S. stock market over the completion of this cycle, and over the coming 10-12 years [for those holding stocks at present levels]. Yet the historical reality is that once speculation shifts to risk-aversion, a period of just 18-30 months is typically required for valuations to revert to average or below-average levels, creating fresh opportunity for value-conscious long-term investors.”

“In summary…we expect dismal consequences for the U.S. stock market over the completion of this cycle, and over the coming 10-12 years [for those holding stocks at present levels]. Yet the historical reality is that once speculation shifts to risk-aversion, a period of just 18-30 months is typically required for valuations to revert to average or below-average levels, creating fresh opportunity for value-conscious long-term investors.”