This morning, the Bank of Canada maintained its overnight rate at 1.75%, below what it deems the neutral range, on broad-based evidence that the Canadian economy will weaken further from its lacklustre 2018 growth rate (1.8%) during the first half of 2019. Although the BOC’s decision was widely anticipated, the loonie is selling off against the U$ after the announcement.

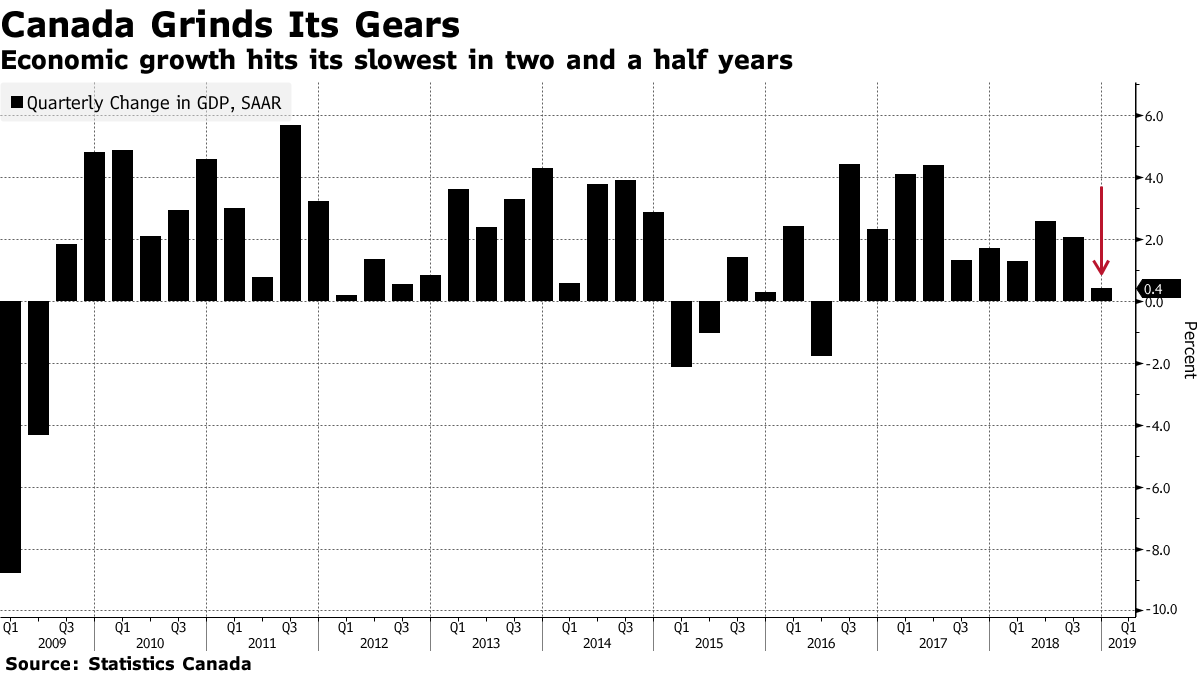

According to Statcan’s latest estimate last week, the Canadian economy grew by just 0.1% in the last quarter of 2018–an annualized rate of 0.4% well below the Bank of Canada’s expectations. Weakness  was across the board: consumer spending expanded at the slowest pace in nearly 4 years (0.7% annualized), housing investment fell 14.7% (the most in 10 years), business spending 10.9%, and real final domestic demand fell 1.5%, after a 0.5% contraction in Q3. As Economist David Rosenberg pointed out this week, back-to-back quarterly declines in this measure have always been associated with official recessions.

was across the board: consumer spending expanded at the slowest pace in nearly 4 years (0.7% annualized), housing investment fell 14.7% (the most in 10 years), business spending 10.9%, and real final domestic demand fell 1.5%, after a 0.5% contraction in Q3. As Economist David Rosenberg pointed out this week, back-to-back quarterly declines in this measure have always been associated with official recessions.

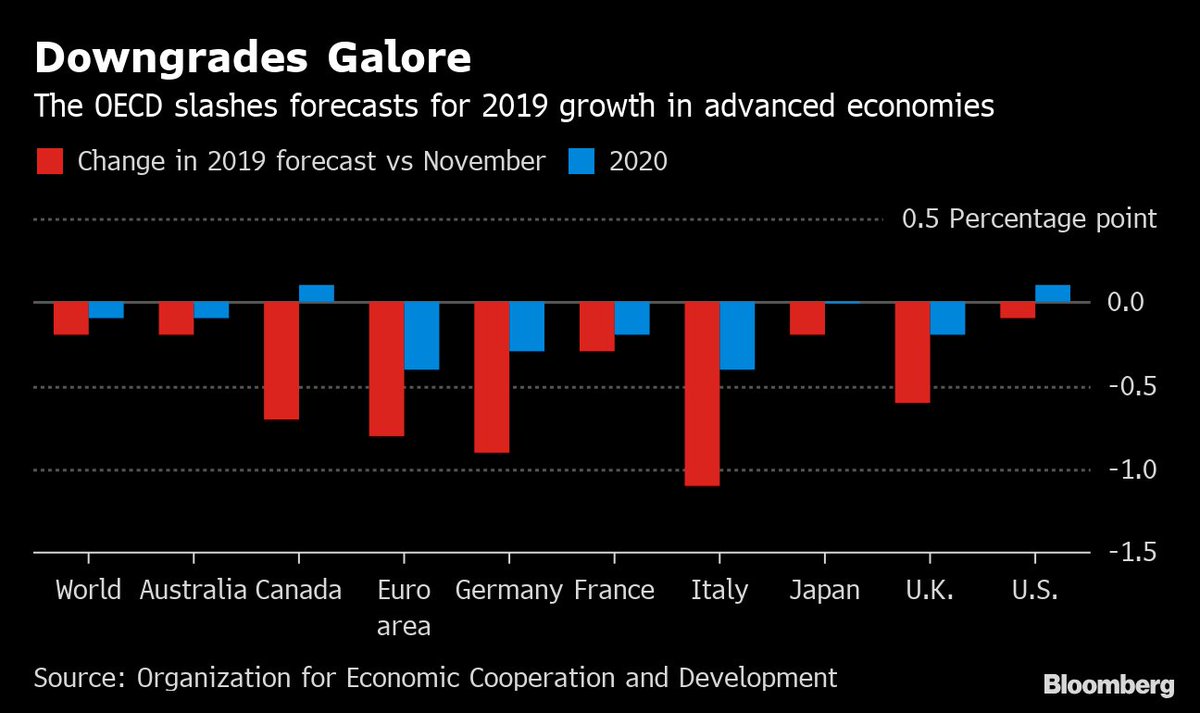

Of course, economic weakness is not just showing up in Canada; the OECD downgraded its growth forecasts for advanced economies further this week for 2019 (below in red) and 2020 (in blue).

Downturns are a normal recurring part of every economic cycle, and a decade since the last recession no one should be shocked that weakness has returned. Unfortunately, with households and corporations holding record debt and low liquid savings, along with falling oil and realty prices, Canada has never been less prepared to weather the financial challenges now spreading.

Downturns are a normal recurring part of every economic cycle, and a decade since the last recession no one should be shocked that weakness has returned. Unfortunately, with households and corporations holding record debt and low liquid savings, along with falling oil and realty prices, Canada has never been less prepared to weather the financial challenges now spreading.