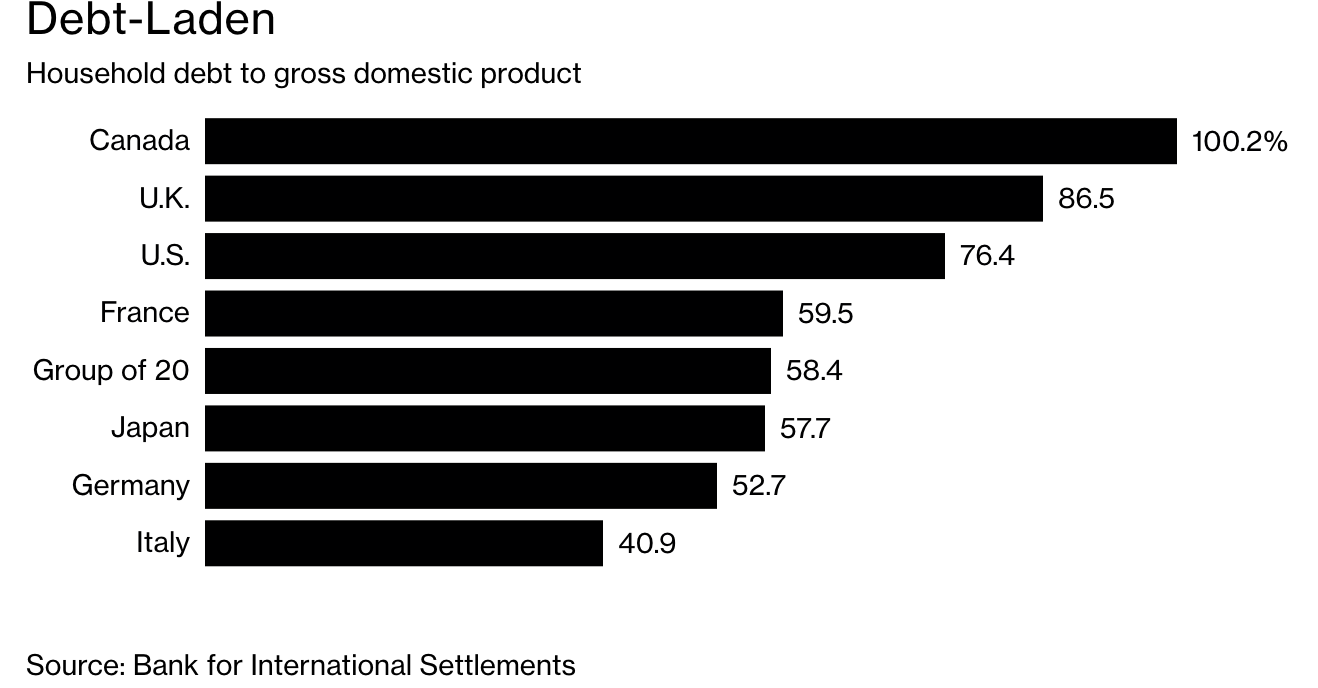

Canada is attracting international attention for our garish household debt levels. Not a good thing to be famous for! What a difference a decade of lax lending and low rates makes. In 2008, we were one of the countries that looked relatively prudent in our finances. That was then. See: Canadians are Feeling the Debt Burn.

Meanwhile inverted yield curves squeeze the bread and butter spread of banks and other lenders who rely on borrowing short at lower rates and lending long at higher. This means they tend to make fewer loans (and fewer profits) and refinancing is harder for homewowners to find even as mortgage rates move lower. Not surprisingly, trustees in bankruptcy have entered a boom phase.

Canadians are increasingly feeling the pinch from rising rates, with insolvencies back on the rise. For more on how consumers can avoid falling into dire straits, BNN Bloomberg spoke with Scott Terrio, manager of consumer insolvency at Hoyes, Michalos and Associates. Here is a direct video link.