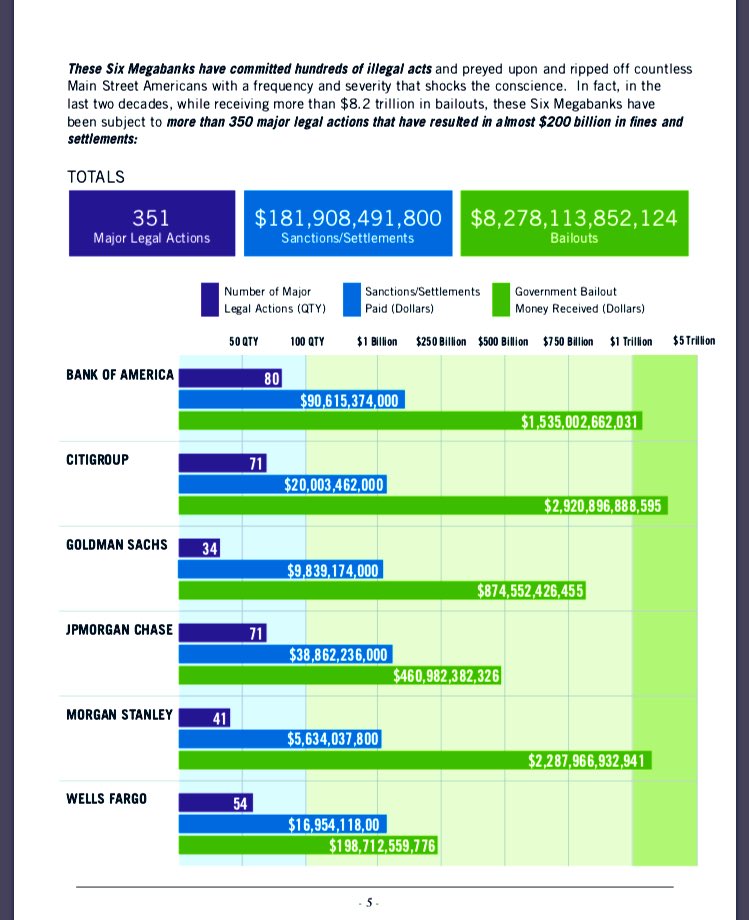

Better Markets (BM) describes itself as a “non-profit, non-partisan, and independent organization founded in the wake of the 2008 financial crisis to promote the public interest in the financial markets, support the financial reform of Wall Street and make our financial system work for all Americans again”. Eleven years in, BM continues to catalogue ongoing illegal activities within the largest US financial institution s. This week it released a detailed 39-page report entitled Wall Street’s Six Biggest Banks: Their rap sheets & their ongoing crime spree which includes the table on left summarizing the 351 major legal actions taken against these banks in the past 20 years, as well as the $200 billion in corporate fines and settlements (with no directing minds or executives personally penalized), and $8.2 trillion in bailout funds given to them courtesy of taxpayers. All of this has enabled investment banks to continue inflicting harm, confident that their profits will be subsidized by everyone else, everywhere.

s. This week it released a detailed 39-page report entitled Wall Street’s Six Biggest Banks: Their rap sheets & their ongoing crime spree which includes the table on left summarizing the 351 major legal actions taken against these banks in the past 20 years, as well as the $200 billion in corporate fines and settlements (with no directing minds or executives personally penalized), and $8.2 trillion in bailout funds given to them courtesy of taxpayers. All of this has enabled investment banks to continue inflicting harm, confident that their profits will be subsidized by everyone else, everywhere.

While the US banks have been world-leaders in this business model, big bank/investment sales franchises have followed the same playbook in varying degrees all over the world; hence why we now have similar problems of financial instability everywhere. Here’s Better Markets’:

In short, these institutions have continued to commit frequent and serious violations of law, spanning an extraordinary variety of civil and criminal misconduct and resulting in tens of billions of dollars in penalties, civil judgments, and other monetary sanctions. The Six Megabanks have not skipped a beat when it comes to committing fraud, market manipulation, and other abuses against their clients, investors, and the financial markets themselves. They continue to violate the law and to generate massive profits and huge compensation packages for their executives, without facing any meaningful punishment, deterrence, or accountability.

The break up of financial conglomerates and the return of Glass-Steagall style divisions between government-insured deposit-taking banks and firms that underwrite investment products is coming because it is essential. The next bear market will make the need painfully obvious once more.