Easy money and speculative inflows enabled the Greater Toronto (GTA) and Greater Vancouver (GVA) areas to notoriously become some of the most unaffordable property markets in the world over the last decade.

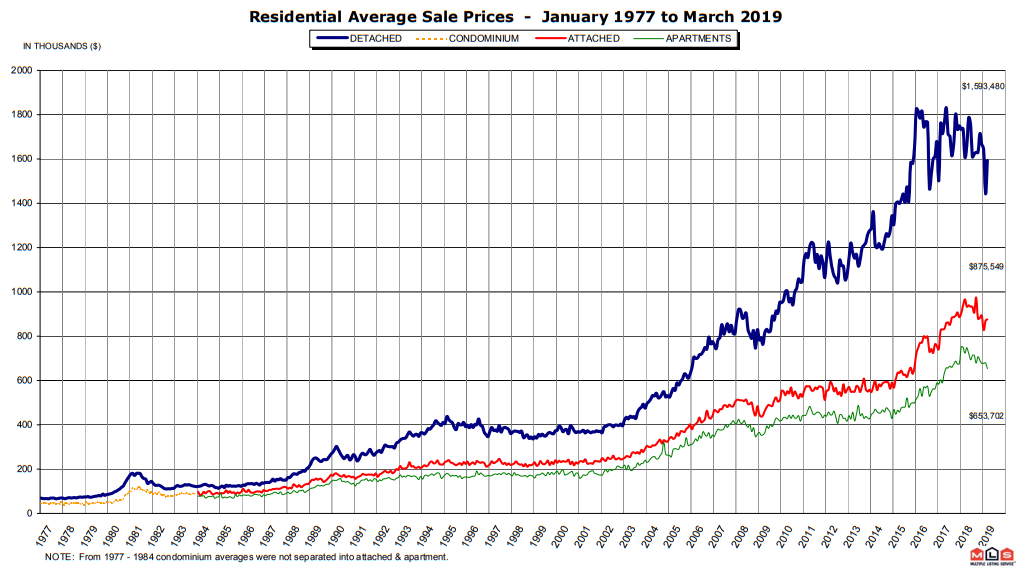

The latest data from the Real Estate Board showed that home sales in the GVA plunged to their lowest l evel in more than three decades in March – down more than 31% from a year ago with an average detached-home price of $1.4 million down 22% from $1.8million in 2017 (see chart).

evel in more than three decades in March – down more than 31% from a year ago with an average detached-home price of $1.4 million down 22% from $1.8million in 2017 (see chart).

In comparison, the average detached home price in Toronto was $1,050,000 at the end of April down 16% from a peak of $1.2m in May 2017. Home sales in the Toronto region are down 37% from their peak in 2016. See Mansions languish, condos pop as Toronto homes sales face spring test.

Common most everywhere is that more expensive properties are seeing the largest drop in both sales and price. This is not only in Canada; across America, home sales have fallen nearly 15% in the last month the average price of a ‘luxury’ home–defined as the top 5% in each of 1,000 cities–is down 1.6% to $1.55 million. Nonluxury homes, on the other hand, saw their average price rise 2.7% annually to $300,000. See Luxury home sales see the biggest slump in nearly a decade:

“The nation’s priciest properties are in far less demand this year, and that is taking a toll on their values. Sales of homes listed at $2 million and above fell 16% in the first quarter, the sharpest annual decline since 2010, according to Redfin, a real estate brokerage. This as the supply of those homes rose 14%, marking four straight quarters of annual increases in inventory”.

The most expensive markets are where the highest amount of mortgage debt is outstanding, and are disproportionately owned by the 50+ age group that is moving near and into retirement. This intensifies the consequences of falling prices. These markets have also been the largest drivers of price-based commissions and fees in finance and related services as well as realty-related tax revenues. Ongoing weakness is real estate is therefore broadly negative for net worth, consumer spending, lenders and the overall economy.