In the first two credit-tightening cycles of the last 27 years, the US central bank hiked its base interest rate 108% from August 1992 to May 2000 (3 to 6.5), and 425% from June 2003 to June 2006 (1 to 5.25).

While household savings were higher coming into those cycles and total debt levels much lower than present, both ended in recession and a 50%+ average loss in stock prices. Going back much further, recessions have followed 93%–13 of 14– credit tightening efforts since the second world war. (See this link for a good summary of rate history and accompanying events).

Lest anyone misdiagnose the disease here though, the catalyst for recessions and financial market dislocations is not the ‘normalizing’ of lending rates and standards, but rather the years of low standards, excessive spending and poor risk mismanagement that proceeded them. And in this, the 2008 to 2018 cycle will go down as an all-star for the history books.

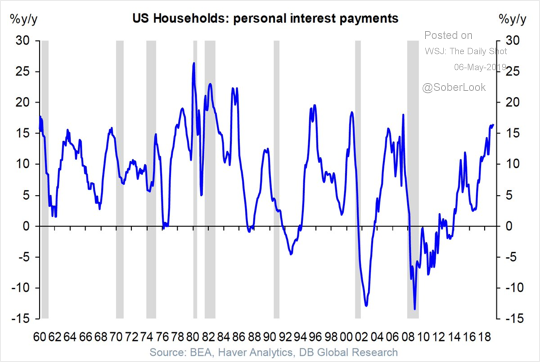

In the chart below, Deutsche Bank notes that the 15% year-on-year increase in household interest payments to date has already matched the pace that proceeded the last two recessions. Thus even though base rates remain less than 43% of previous cycle highs today, no one should be surprised that consumption-based economies are faltering and The Mighty US Consumer is Struggling. (Canadians too!).

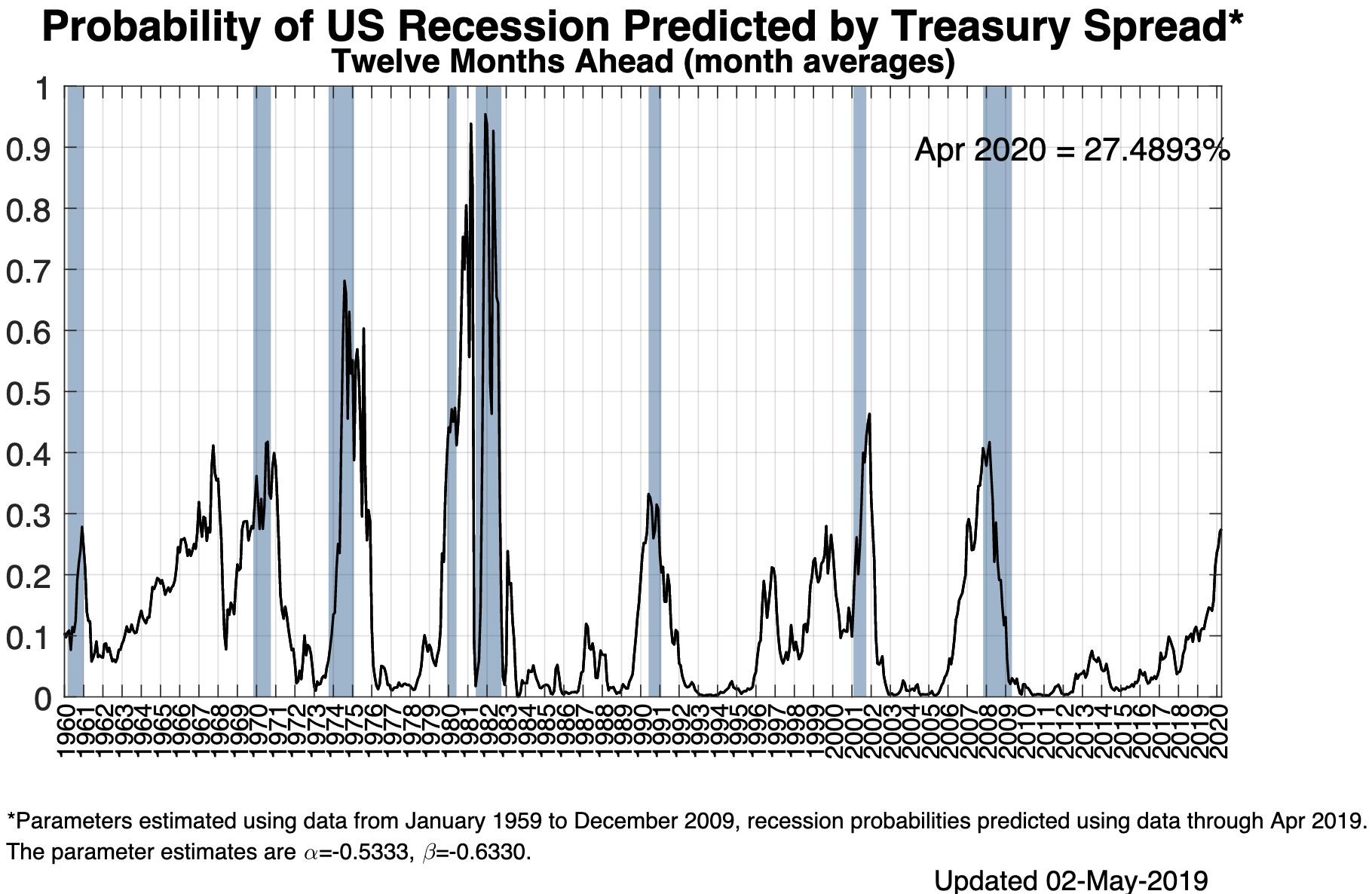

Similarly, the New York Fed’s indicator showing recession probability twelve months ahead (black line below), and the last eight recessions in blue, has also touched its highest level since 2007.

Similarly, the New York Fed’s indicator showing recession probability twelve months ahead (black line below), and the last eight recessions in blue, has also touched its highest level since 2007.

Economist David Rosenberg explained this historically relevant indicator along with others in an appearance on Bloomberg this morning. Here is a direct video link.

This epic credit cycle is mean-reverting whether we are ready or not. Individuals and businesses need a plan to help shield life savings from end of cycle losses (hold and hope are not good), while maintaining liquidity and a discipline to buy assets on deep discount once cycle lows return once more.