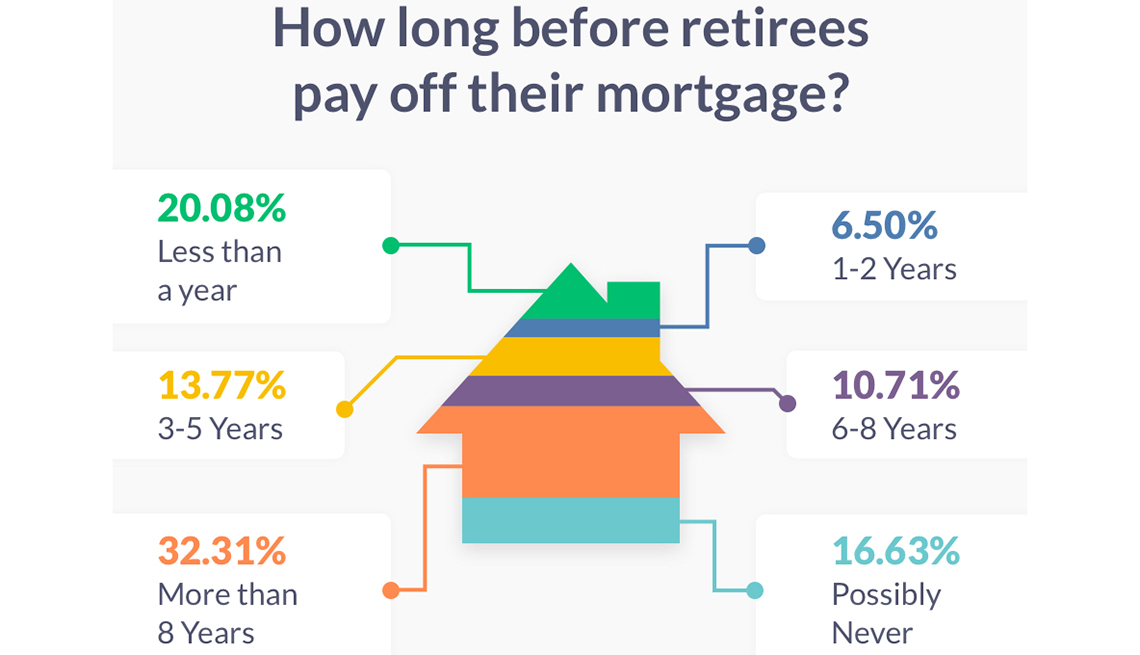

Two decades of flat income growth and excessive inflation in shelter and education costs have helped bury adults age 18 to 40 with more debt than any generation before them. At the same time, 44% of those aged 60 to 70 are still carrying mortgage debt–up from 25% in 2001–and their median loan amortization has 17 years remaining (US Federal Reserve).

On the income side, just ten percent of those age 50+ have a defined benefit pension plan today; half have zero retirement savings, and those that do, have a median amount of $104,000. (2015 GAO report to Congress). At the same time, according to research by the AARP, about 90% of seniors say that they wish to ‘age in place’ in their own homes.

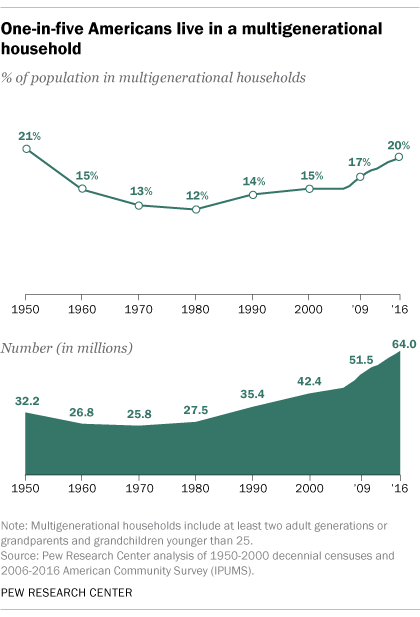

For all these reasons and more, cash flow is tight for households and cost reduction is a dominant preoccupation for all ages. This is driving interest in multi-dwelling homes and inter-generational sharing that was common up to the 1960s when trends shifted toward individualism and familial independence. Bottoming at 12% in 1980, 20%, or 64 million Americans, are now liv ing with two or more adult generations in a single household (Pew research chart on the left), and some 41% looking to buy a home report they are considering accommodating an elderly parent or an adult child.

ing with two or more adult generations in a single household (Pew research chart on the left), and some 41% looking to buy a home report they are considering accommodating an elderly parent or an adult child.

This is a huge change affecting many sectors of the economy as antiquated models falter and new opportunities in the ‘sharing economy’ unfold. Less is the new more. See an excellent update on these trends in The future of housing looks nothing like todays:

“We really think that there’s a policy piece in the future with that that will tie student debt reduction with supports for aging in place, but it’s not there yet,” Butts says. Cities like Boston are already piloting the idea, offering affordable housing to grad students in exchange for help with chores.

…Living with your parents (or your adult children) has plenty of potential benefits–everyone tends to save money, it can potentially benefit health outcomes, and you get to spend more time together.

Just one problem: American housing stock, dominated by single-family homes and connected by cars, isn’t really designed for it.

…“We’re seeing the golf course as less of an amenity these days for senior housing,” says Porter, who has worked with several developers to redevelop golf courses as housing. “The real amenity for seniors is being near their kids and grandkids. I think that comes back to that connection between the boomers and their kids.”