The Bank of Canada (BOC) last week flagged the fragile nature of highly indebted Canadian households and said 42% of households would struggle to refinance their mortgage if home prices fall 20%. While mortgage and real estate brokers are calling for a re-softening of lending standards in the face of housing weakness, BOC head Stephen Poloz said he does not support such ideas. Since record debt is already plaguing Canadian households (and businesses), making it easier to add more, is not an idea that rational minds can endorse. See: ‘I would frown upon it’: Poloz on calls to loosen mortgage rules.

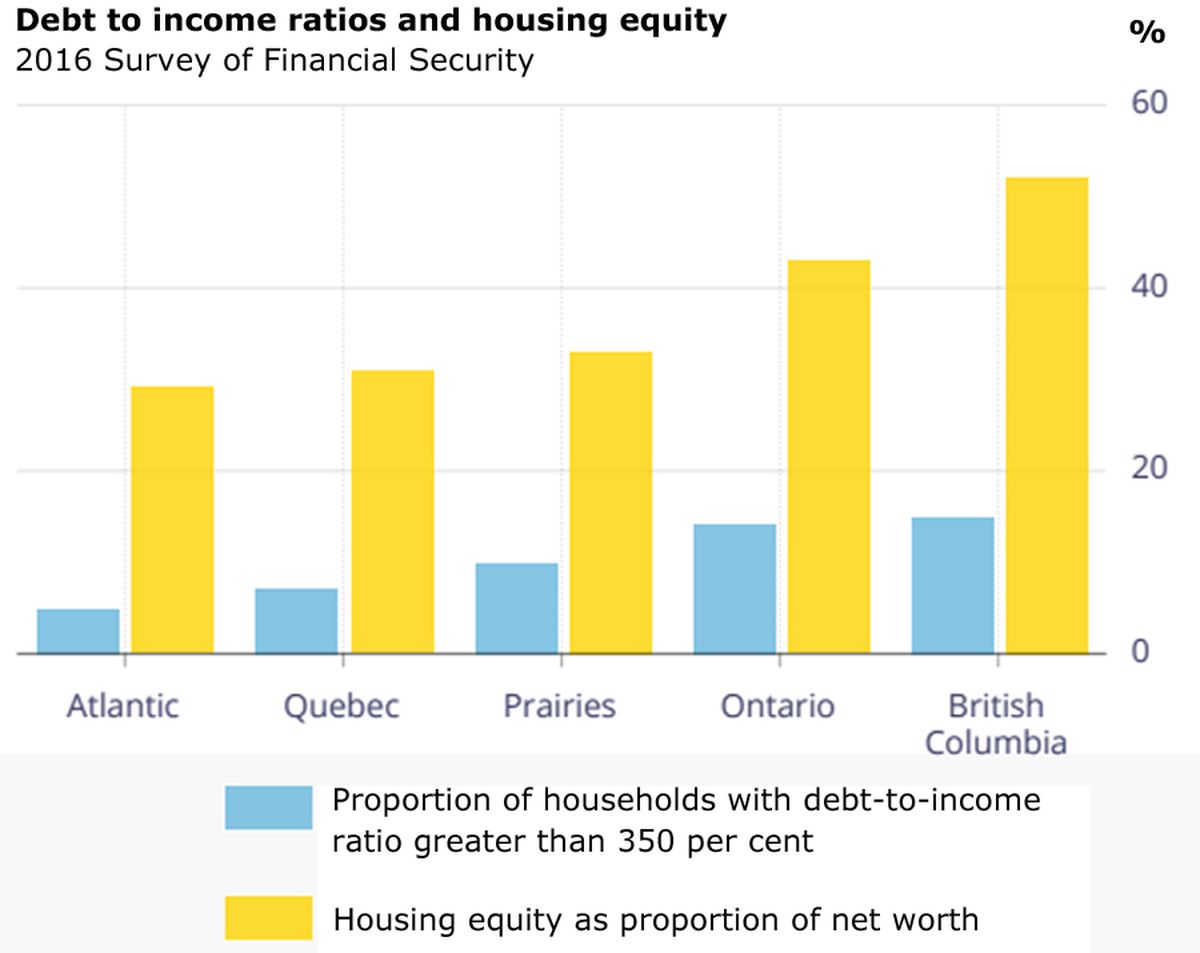

A chart of the BOC data below, confirms, as I have mentioned for some time, that the percentage of households with debt above a precarious 350% of income (blue bars) is highest in the most populous provin ces–Ontario and BC–where shelter prices rose the most over the past decade. See: Why so many Canadians could be in so much trouble in an economic shock.

ces–Ontario and BC–where shelter prices rose the most over the past decade. See: Why so many Canadians could be in so much trouble in an economic shock.

For the same reasons, housing equity makes up 40% and 50%+ of net worth in both provinces (gold bars). As home prices and related costs leapt, households have funded them at the expense of other savings and investment. This balance sheet–and economy–concentration in real estate serves to intensify negative shocks as property prices can quickly and dramatically retreat and debt levels do not. There is no quick fix; deleveraging cycles have their own timeline and take back capital from speculators and the unprepared as they go.