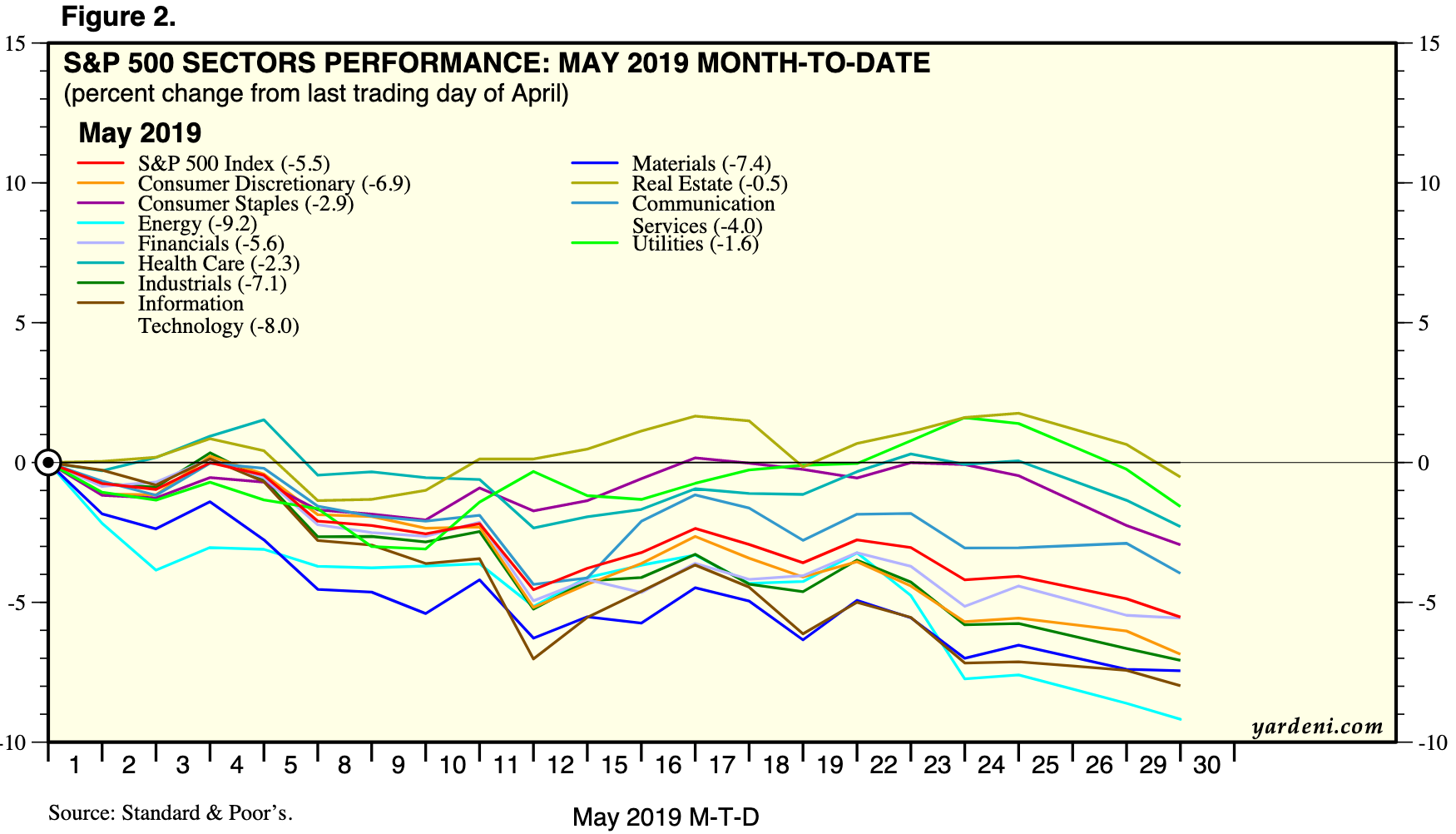

Risk assets have taken a fresh thumping in May. As of last night, the S&P 500 index was down 5.5% on the month, with energy (-9.2%), technology (-8%), materials (-7.4%), industrials  (-7.1%) and financials (-5.6%) faring worst, and so-called ‘defensives’: real estate (-.05%), utilities (-1.6%),

(-7.1%) and financials (-5.6%) faring worst, and so-called ‘defensives’: real estate (-.05%), utilities (-1.6%), health sick care (-2.3%) and consumer staples (-2.9%) faring less bad, as shown above from Yardeni Research.

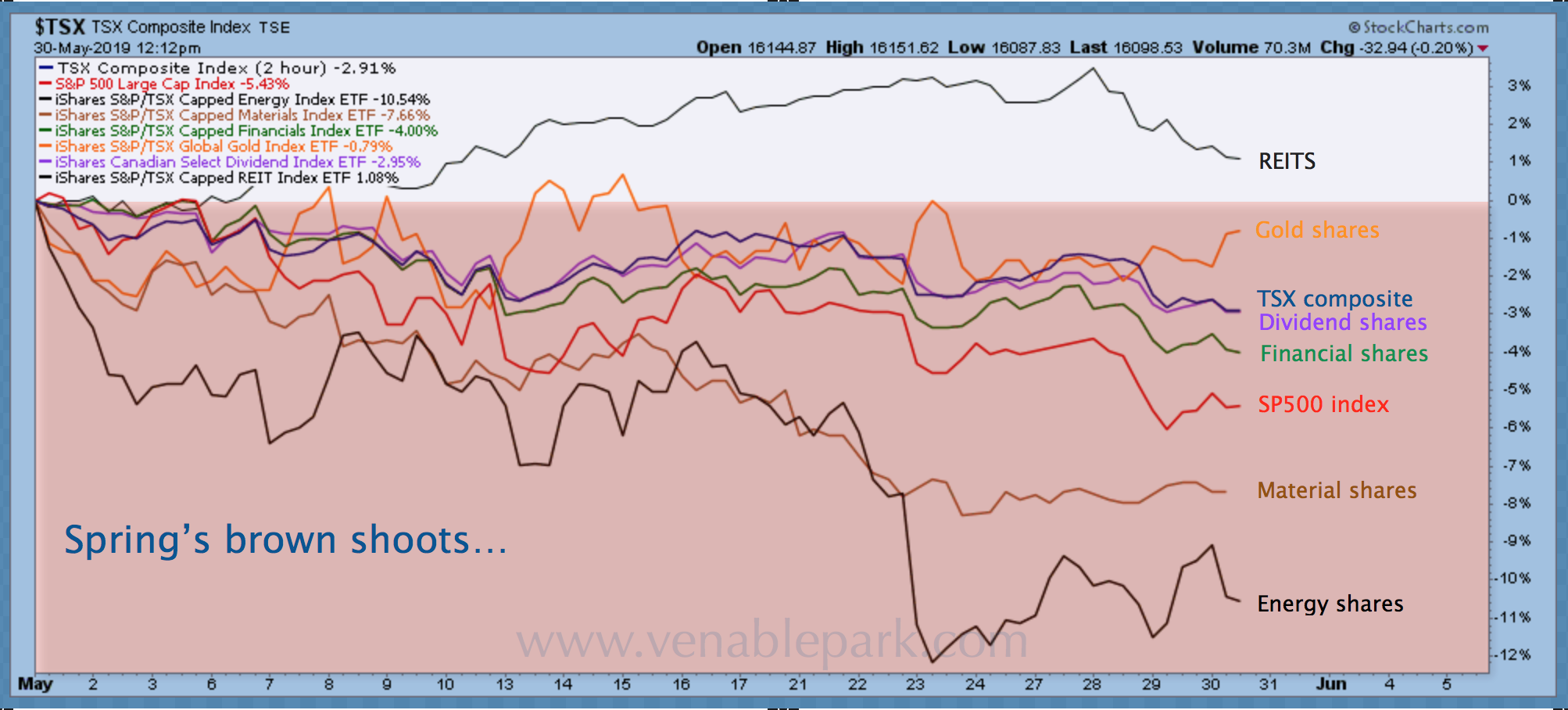

Canada’s TSX stock index lost about half as much as the S&P 500 this month, but still -2.7%, again with economic ally sensitive energy stocks (-9.77%), materials (-7.66%) and financials (-3.43%) faring worst, real estate (1.5%) best; gold producers (-1.4%), and dividend-paying stocks (-2.33%) less bad, as shown above from my partner Cory Venable.

ally sensitive energy stocks (-9.77%), materials (-7.66%) and financials (-3.43%) faring worst, real estate (1.5%) best; gold producers (-1.4%), and dividend-paying stocks (-2.33%) less bad, as shown above from my partner Cory Venable.

Copper (-8.6% on the month) has tumbled with global sentiment, along with oil (WTI -9.6%) while gold is just flat (.55%).

The most sketchy credits have followed equities lower (as they normally do) with US Junk bonds (-1.19%) and high yield (-1.13%). Investment grade corporate bonds are higher by a percent.

Traditional safe havens–government treasuries and the US dollar (vs. loonie)–have gained on bets that weakening demand and stock markets will prompt central bank rate cuts in 2019 (80% probability of US cuts now priced in). Yesterday, Bank of Canada head Stephen Poloz said the BOC remains on hold, but with a tiny 1.2% 2019 GDP growth forecast, rate cuts loom likely in the second half of the year.

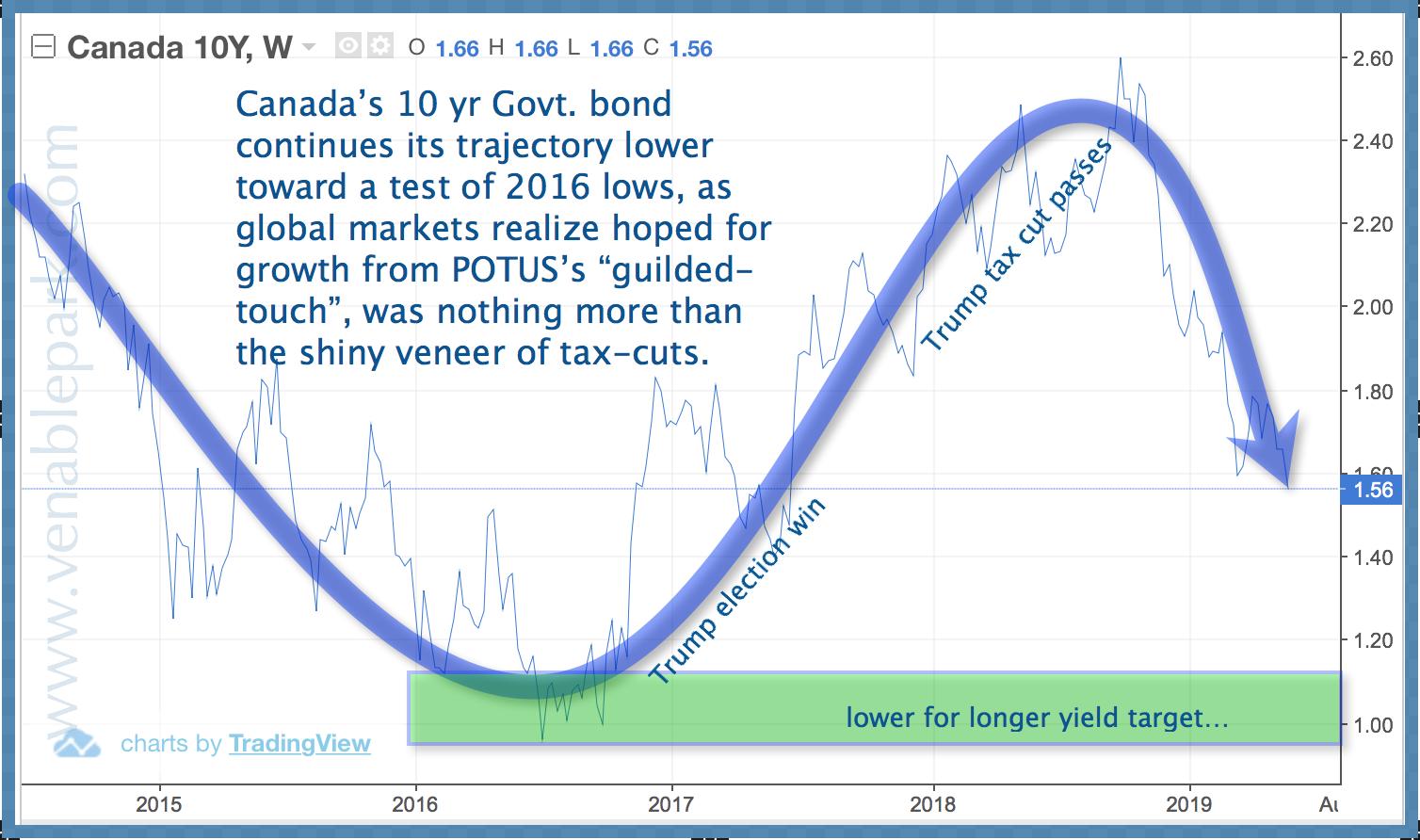

Acknowledging that the BOC is probably done hiking this cycle, Canada’s 10-year treasury price rose this month, and its yield has fallen from 1.73% on April 30 to 1.56 today. This is back at the level it was just before the Trump election when tax  cut promises drove dreams of inflation and a rising rate cycle that never came, (shown beside from Cory Venable).

cut promises drove dreams of inflation and a rising rate cycle that never came, (shown beside from Cory Venable).

Further warning of recession risk, some 40% of Canada’s treasury curve is already inverted (near-term rates above long), and the spread between 10 and 2 year yields has fallen to a cycle low of less than .049%; .156% in the US.

Many other countries already have negative spreads between their 30-year treasury and fed funds rate as shown below from Crescat Capital. Similar inversions preceded the 2001 and 2008 recessions and bear markets.

It’s important to understand that in past cyclical downturns, once central banks started cutting policy rates, they did so several percent over many months before any ‘recovery’ launched.

It’s important to understand that in past cyclical downturns, once central banks started cutting policy rates, they did so several percent over many months before any ‘recovery’ launched.

This cycle–starting from just 1.75 and 2.5%–North American policy rates will be back near zero in no time. The cavalry is running old playbooks but brings a fraction of its former force. This means the battle may well run longer with more casualties than the past two downturns. It’s wise for individuals to understand and take self-defensive measures accordingly.