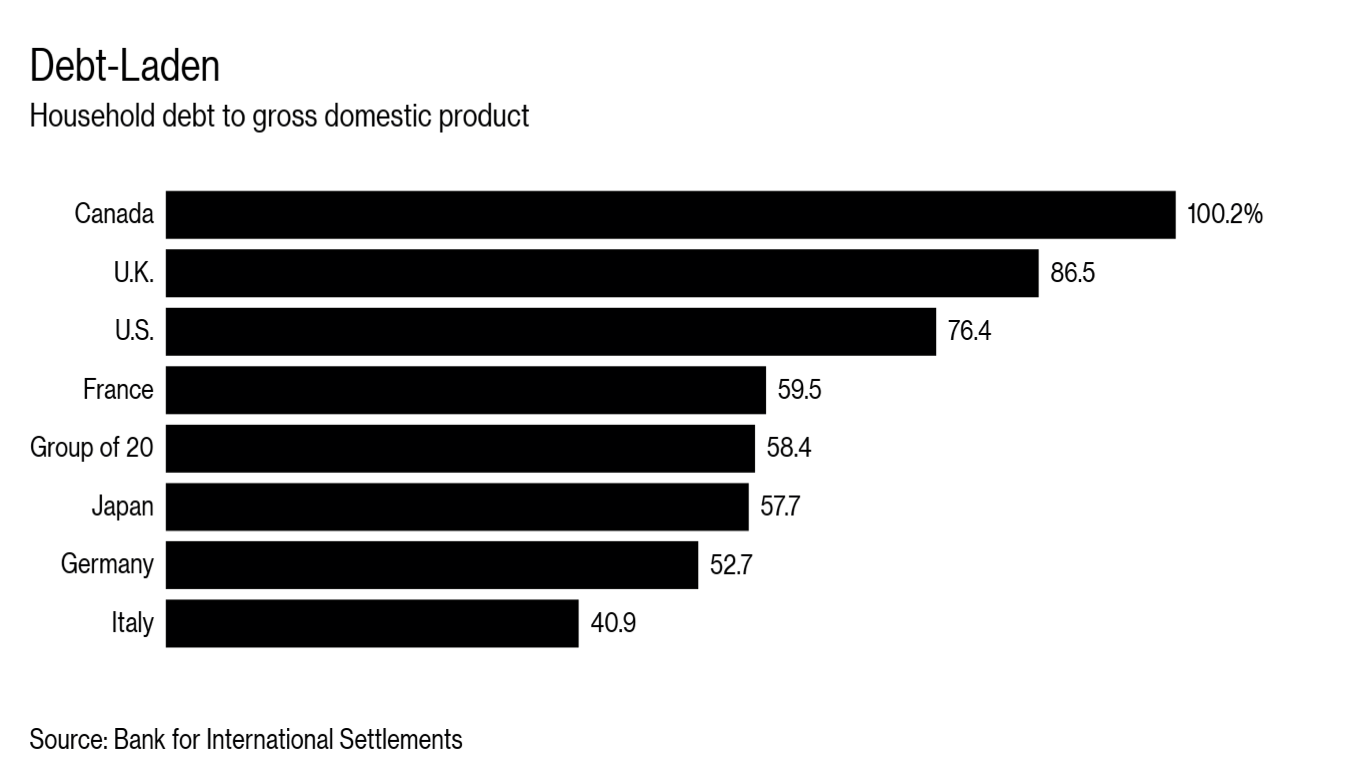

In terms of relative household debt levels, Canadians measured as more financially prudent than US households heading into the 2008 recessi on–that was then.

on–that was then.

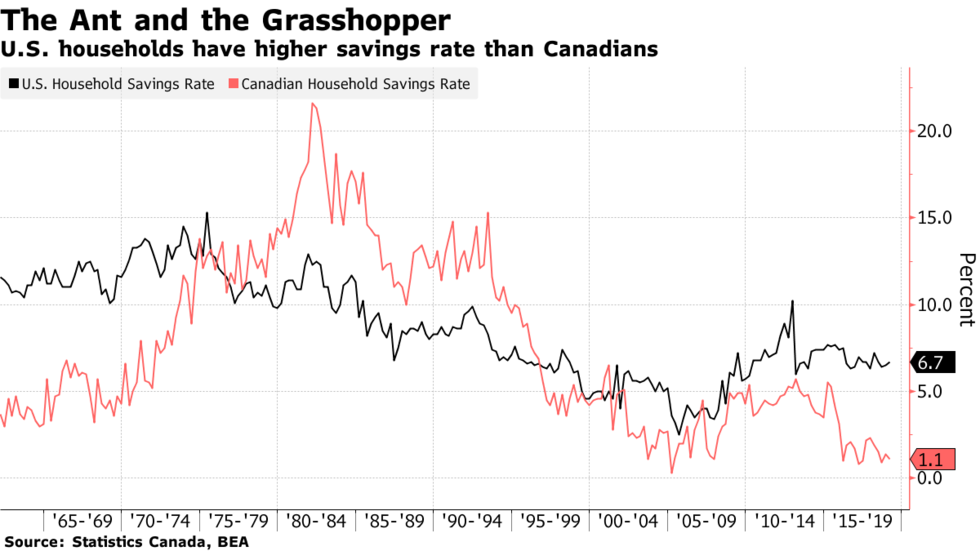

Today, as shown beside, Canadians are world leaders in financial imprudence with both record high debt and near-zero saving rates (in red below, versus US savings rate in black).

Being worse money managers than Americans is saying something because Americans have been notoriously profligate. (See: Why the next recession will hit Canadians harder than Americans.)

As shown below, in the early 1980s, when interest rates were in the teens and the economy struggling through a double-dip recession, Canadians were saving more than 15% of their disposable income. Today, after 20 years of saving less than 5%, we are plagued by capital deficits in most institutions and households.

double-dip recession, Canadians were saving more than 15% of their disposable income. Today, after 20 years of saving less than 5%, we are plagued by capital deficits in most institutions and households.

Getting saving rates back above 10% is an essential part of rebuilding financial strength and resilience. But to achieve this we need to spend less than we earn and get out of debt via less consumption and higher efficiency. Excersise cannot outrun destructive food choices, and large incomes or lump sums cannot outrun destructive financial management. The facts speak volumes: 70% of people who  receive large amounts of money go through it all in just a few years (National Endowment for Financial Education).

receive large amounts of money go through it all in just a few years (National Endowment for Financial Education).

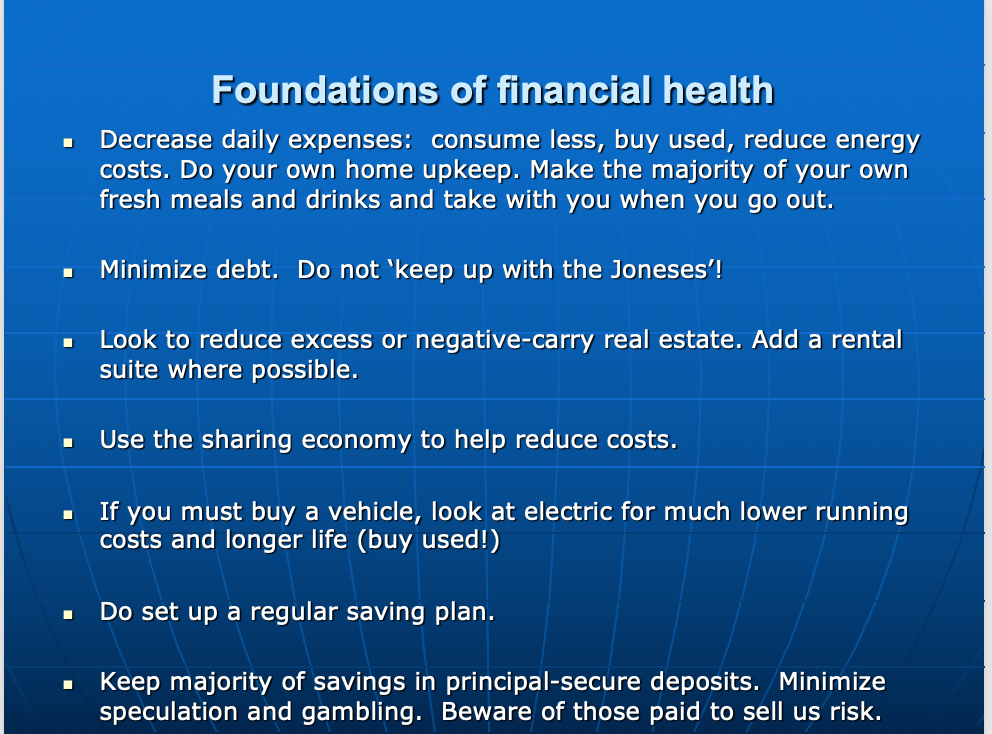

In a conference speech last week I summarized the ‘tricks’ or foundations of financial health in the slide above. Definitely not rocket science, and yet, evidently little understood or implemented.