The government bonds in our portfolios have appreciated for many months now as economic data disappoints and central bank rate cuts come to fruition once more.

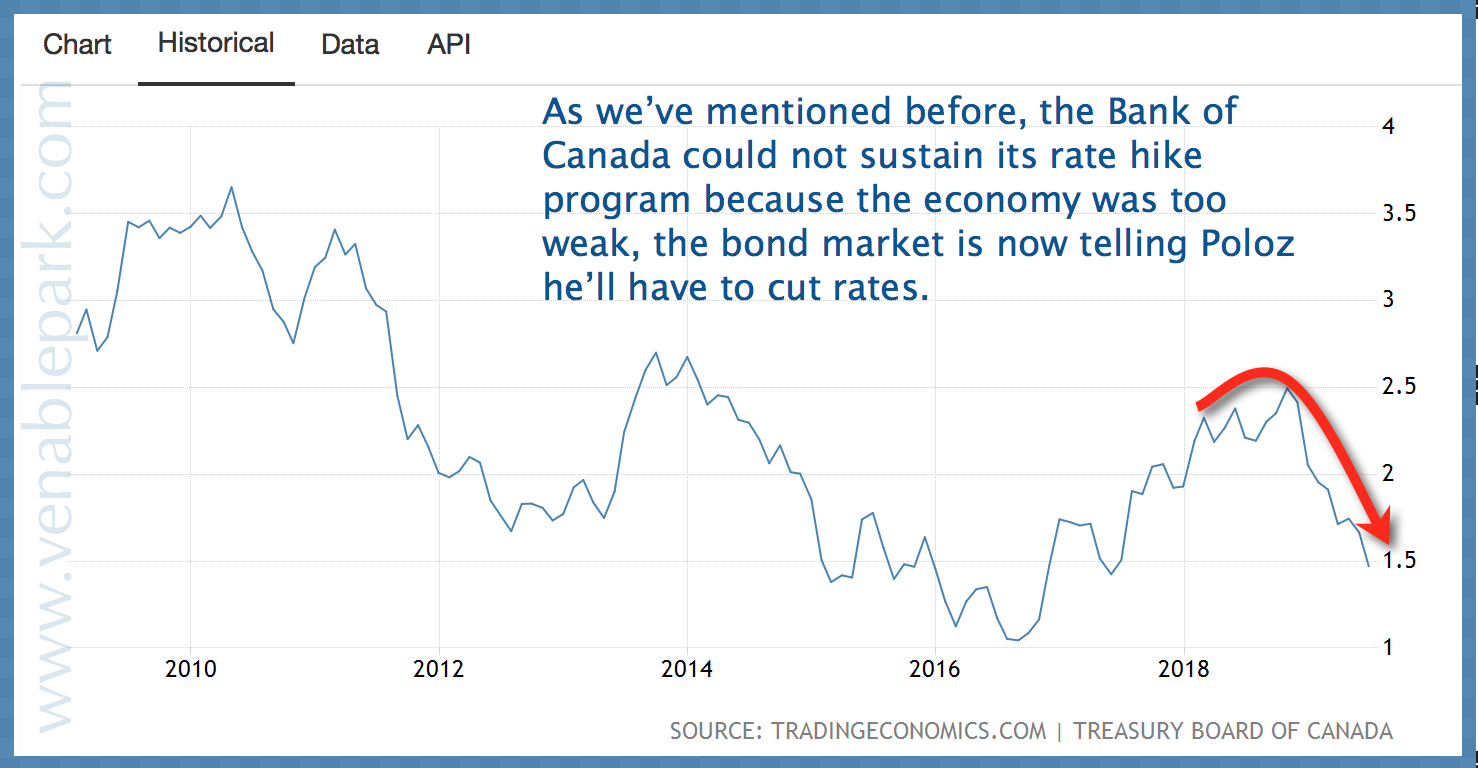

Although the Bank of Canada (BOC) is presently on hold, rate cuts by the US Fed will force the BOC to follow suit. The rally in government bonds is likely to continue as Canada’s ten-year treasury yield (shown below) falls from 1.54% today towards 1% in the months ahead.

On a risk-adjusted basis, now very late in this credit cycle, North American treasuries are a far more prudent allocation than stock markets near cycle highs. But since government bonds and funds pay relatively little in commissions and fees to financial advisors and product sales firms, most portfolios hold little to none of them. Sad fact.