A time-tested ratio for affordable housing is total costs amounting to 30% (max.) of a household’s pre-tax income. For the one-third of Canadian households that rent, rent and utilities are a ‘severely unaffordable’ 50%+ of household income in all ten Canadian provinces today. Also see the Visual Capitalist graphics in Countries with the highest housing bubble risks, at this link.

For the two-thirds of Canadian housholds that have bought homes, all-in shelter costs (financing, taxes and utilities, as shown below) are also more than 50% nationally, and more than 75% in t he most populous cities–Toronto and Vancouver. See Housing affordability to worsen in 2019.

he most populous cities–Toronto and Vancouver. See Housing affordability to worsen in 2019.

These extreme shelter prices extinguish funds available for all other forms of consumption, saving and investment, and the costs are multigenerational.

A new study from Financial Planning Canada finds half (48%) of parents with children under age 18 say they intend to assist their children with the purchase of their first home, and four-in-ten (39%) expect that assisting their children with the purchase of their own home will postpone their retirement. Parents living in an urban area (compared to those in suburban or rural areas) are significantly more likely to say they would dip into retirement savings or their own home equity to do so.

One-quarter (24%) of those surveyed say they have already assisted their children (18 and older) with the purchase of their first home. One-third (35%) have also assisted their older children with the cost of rent. Older parents (55 or older) are more likely to agree they have assisted their children with the purchase of a home (27% vs. 15% of those younger than 55).

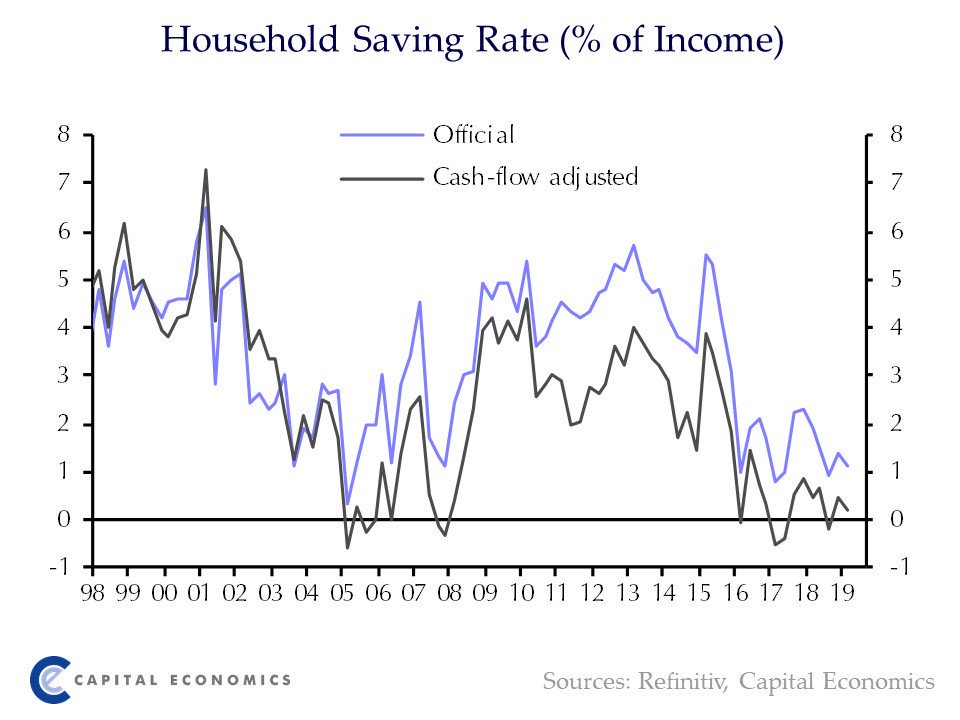

In the process, (as graphed below by Capital Economics) the official Canadian household saving rate was just 1.1% of incomes in Q1, and near-zero after making cash flow adjustment for repayment of principal, rather than just interest. Canada hit a similar household savings low just before the 2008 recession started.

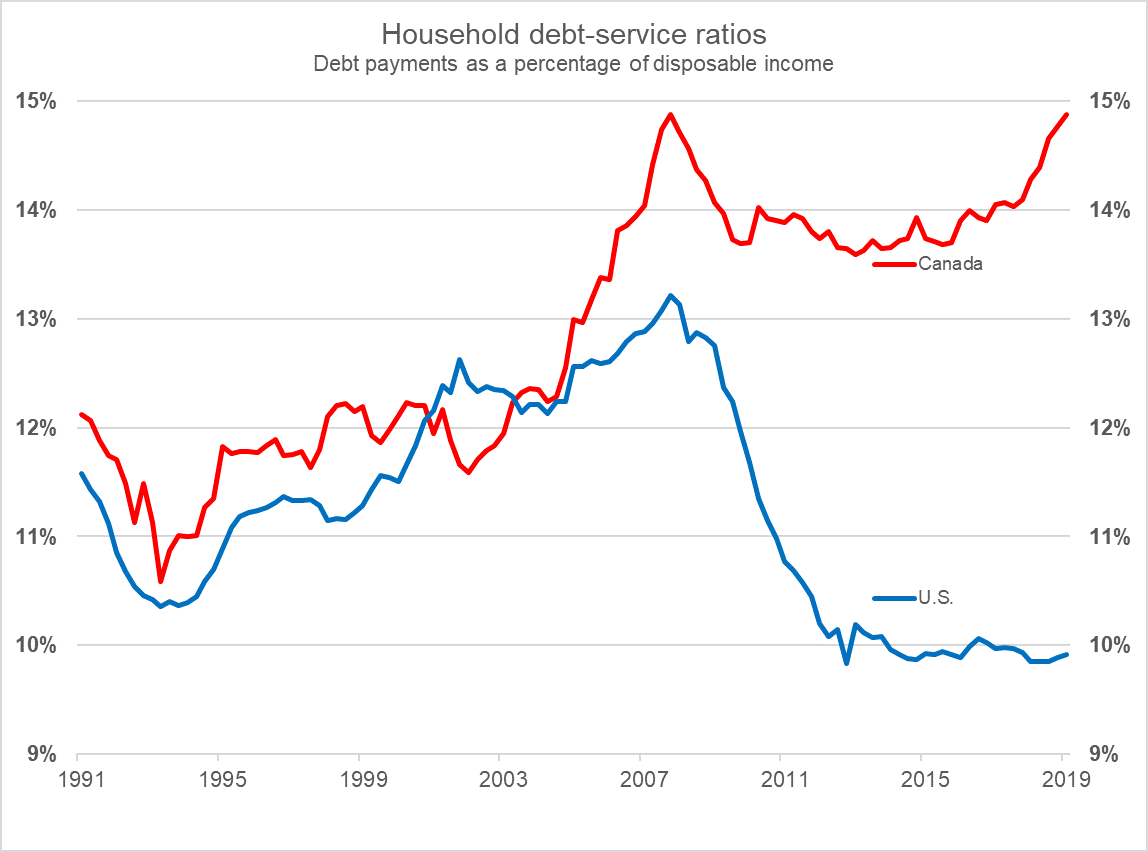

A key factor that softened the economic blow to Canada in 2008, was that our households were less indebted than the US at that time, and our home prices had not yet succumb to bubble pricing.

A key factor that softened the economic blow to Canada in 2008, was that our households were less indebted than the US at that time, and our home prices had not yet succumb to bubble pricing.

We no longer have such advantages to buffer us. Today, household debt payments as a percentage of disposable income are at an all time high in Canada (red line below) and much higher than in the US (in blue) both today and at the peak of the last US housing price bubble in 2006. Two thirds of the household debt oustanding in Canada is mortgage debt.

Wishful thinkers hope that building more housing will make affordable shelter more available to the masses without property prices having to decline. The truth is that more supply alone cannot sufficiently remedy the strains at hand. Significanly lower property prices are essential and apparently now in process. As shown below, over the past year, new home prices in Canada saw their first yearly decline since 2009.

A much deeper, longer price correction is needed and likely in order to restore home affordability, and allow households to work down stifling debt burdens and rebuild healthy savings for other goals and needs. Property price declines of 50%, that only recover slowily over many years thereafter, would be in line with experiences in other countries after similar debt-fueled price expansions.

Helping people to lever themselves into unaffordable homes is not help, and two decades of diverting funds from retirement, education and emergency savings has left large pot holes in Canada’s financial road ahead. Those that are looking to rent or buy in the next couple of years can benefit as prices mean revert. Those holding highly levered real estate now, as well as those under-saved and hoping to cash out funds for retirement going forward, are likely to be disappointed.