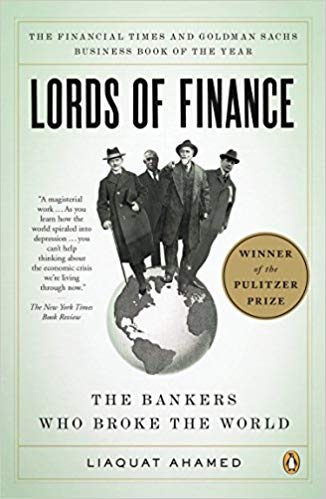

I recently finished reading Lords of Finance by Liaquat Ahamed.

I recently finished reading Lords of Finance by Liaquat Ahamed.

Published in 2009, the book details the rise and fall of central banks in the western world from the early 1900s through the end of the Second World War. More than 500 pages, it offers a detailed account of the personal relationships and policies which have shaped modern history.

To understand where we are, it is helpful to understand from whence we have come.

Exceptionally well-written and engaging, this work offers important context for our present era of monetary policy run to the end of its efficacy.

This quote offers a hint at the book’s warning to present times:

“The quartet of central bankers did in fact succeed in keeping the world economy going but they were only able to do so by holding U.S. interest rates down and by keeping Germany afloat on borrowed money. It was a system that was bound to come to a crashing end. Indeed, it held the seeds of its own destruction. Eventually the policy of keeping U.S. interest rates low to shore up the international exchanges precipitated a bubble in the U.S. stock market. By 1927, the Fed was thus torn between two conflicting objectives: to keep propping up Europe or to control speculation on Wall Street. It tired to do both and achieved neither. Its attempts to curb speculation were too halfhearted to bring stocks back to earth but powerful enough to cause a collapse in lending to Germany, driving most of central Europe into depression and setting in train deflationary forces throughout the rest of the world. Eventually in the last week of October 1929, the bubble burst, plunging the United States into its own recession. The U.S. stock market bubble thus had a double effect. On the way up, it created a squeeze in international credit that drove Germany and other parts of the world into recession. And on the way down, it shook the U.S. economy.”

For further insight on some similar parallels over the last decade, watch Panic: The Untold Story of the 2008 financial crisis. This story is not over yet.

HBO looks at factors that led to the 2008 financial crisis and the efforts made by then-Treasury Secretary Henry Paulson, Federal Reserve Bank of New York President Timothy Geithner, and Federal Reserve Chair Ben Bernanke to save the United States from an economic collapse. The feature-length documentary explores the challenges these men faced, as well as the consequences of their decisions. Here is a direct video link.